At a time when inflation is skyrocketing, it's particularly hard for many people's salaries to keep up with their most basic costs. A great alternative approach to cover those costs, without having to work more or wait on tough-to-get raises, is to build a passive income stream through dividends.

With that in mind, we asked three investors to come up with top companies with a history of not only paying, but also raising their dividends. After all, if inflation continues unabated, the only thing better than a passive income stream would be a passive income stream that grows.

They came up with McDonald's (MCD 1.70%), AbbVie (ABBV 1.05%), and Genuine Parts (GPC -0.33%). Find out why, and determine for yourself if these stocks have what it takes to earn a spot in the part of your portfolio focused on income growth.

Image source: Getty Images.

This Dividend Aristocrat is delivering record earnings

Parkev Tatevosian (McDonald's): Investors looking for passive income should not ignore McDonald's. Its over 25 years of paying and increasing its dividend has qualified McDonald's as a Dividend Aristocrat. The iconic restaurant brand is emerging from the pandemic stronger than ever, which could give rise to faster dividend increases in the coming years. The Golden Arches reported record earnings per share in 2021.

Digital sales are fueling the increase, which could prove to be long-lasting. The coronavirus pandemic made meal delivery popular, and McDonald's was a prime beneficiary of that trend. Online sales totaled $18 billion for McDonald's in 2021, and orders for delivery undoubtedly helped it reach that impressive sum. Fortunately for investors, the benefits will last beyond the acute phases of the pandemic, as consumers have proven they appreciate the convenience of delivery.

Remember, dividends are paid out of earnings. Without enough profits, dividends will be paid out of saving or borrowing, which can sustain payments temporarily but will eventually be exhausted. Therefore, McDonald's record earnings per share is a good sign for long-term income investors. Already, McDonald's has increased its dividend payment from $2.87 per share in 2012 to $5.25 in 2021.

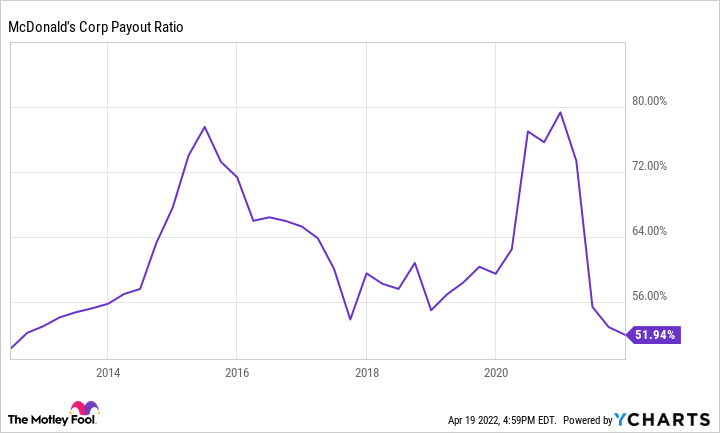

MCD Payout Ratio data by YCharts.

McDonald's dividend payout ratio, which is the percentage of earnings it pays out in dividends, was recently 52%. That's nearly its lowest in the last decade, further indicating there's room to boost the payout. Making the case for investing in McDonald's more compelling, the stock is not expensive. Trading at a price-to-earnings ratio (P/E) of 25, it's roughly on par with its average historical valuation according to that metric.

A healthy addition to any portfolio

Eric Volkman (AbbVie): The pharmaceutical sector is not loaded with high-yield dividend payers. Yet for sharp-eyed investors who like getting paid on the regular, there are a handful of generous plays in that typically miserly bunch. One of the best of these is longtime industry veteran AbbVie.

Despite a recent pullback in share price, AbbVie has been a justifiably popular stock. The company is the developer and seller of the powerful Humira, which happens to be the top-selling drug on the planet (at least for now; more on this in a moment).

Humira alone has added a great amount of value to AbbVie, but the company is far from a one-trick pony. Thanks to its own efforts and a series of well-considered acquisitions, it has a wide and deep pipeline that covers a broad range of treatment categories.

This will give AbbVie plenty of muscle to compensate for the loss of Humira, the U.S. patent for which will begin expiring next year. It's a given that the company will take a hit from this -- the drug was responsible for nearly 40% of total revenue in 2021, after all -- but not as much as you might suspect for such a pivotal product.

On average, analysts tracking AbbVie stock are estimating that 2023 revenue will decline by 9% year over year, with per-share net income sliding by 13%. Yet that still places next year's top line at comfortably over $56 billion, and profitability well in the black at $12.30 per share. Meanwhile, after that, hotly growing therapies like plaque-psoriasis treatment Skyrizi and arthritis drug Rinvoq alone could potentially make up for the loss of Humira.

As this transition occurs, AbbVie's free cash flow (FCF) should remain strong. It ballooned by almost 31% in 2021 to just under $22 billion. That was far more than enough to take care of the $9.3 billion in dividends this Dividend King paid during the year.

A Dividend King gets its status from constant annual dividend raises, so we can count on AbbVie continuing to add to its payout even if FCF sags in the immediate post-Humira period. And this is a stock that, even with that recent share-price appreciation, already had a comparatively high dividend yield north of 3.5%.

So in AbbVie we have not only a solid pharmaceutical company with strong fundamentals, but also an excellent dividend stock that will keep lining its shareholders' pockets for years to come.

An almost perfect situation for this company's business

Chuck Saletta (Genuine Parts): Best known for its NAPA Auto Parts stores, Genuine Parts is a true titan among businesses with a history of rewarding shareholders for the risks they take by investing. With a 66-year history of paying an increasing dividend every year, it stands in rarefied company based on its ability to deliver cold, hard cash to its shareholders.

Even more outstanding for a company with that long a streak of dividend increases, its 2022 raise was a whopping 10%, which was enough to keep pace with the elevated inflation we've seen recently. A key reason for this is that the company sells auto parts. With new cars in short supply, even used cars are at a premium these days. That provides an incredible incentive for people to keep their existing vehicles running longer -- and thus drives demand for Genuine Parts' goods and services.

Of course, we all want the supply chain challenges that are behind those car shortages to end. This is why it's important to recognize that Genuine Parts isn't just a current success story, but rather one that has managed to keep its annual dividend growth streak alive for over six decades. It has done so through recessions, bubbles, the financial crisis, and even wars. That's a sign of a business structured to last -- driven in no small part by a product line that people want even when times are tough.

That's one of the best aspects of the car-parts business. Cars are rarely something that consumers have to buy new. Often, it's possible to keep a vehicle limping along for quite some time with maintenance and repairs. In a tough economy, people are more likely to have to take care of their existing cars, and that's a key driver of Genuine Parts's ability to consistently raise its dividend, even during recessions.

Because of that reality, this dividend-growth titan has a great chance of continuing to reward its shareholders, even as this unique and almost perfect situation for its business passes.

Get started now

Whether or not you believe McDonald's, AbbVie, or Genuine Parts deserves a spot in your portfolio, a strong and growing passive income stream can be a great tool to have as you try to fight inflation. The sooner you begin building yours, the sooner your investments can give you back some much-needed cash. So get started now, and improve your chances of seeing at least part of your bills being covered by the money your portfolio pays back to you.