The "world's richest man" Elon Musk famously occupies the CEO's chair of two very different businesses: Tesla (TSLA 12.06%), the world's leading electric-car company, and SpaceX, which is fast-becoming the world's leading space company.

Of the two businesses, Tesla has been the bigger factor in making Musk a mega-billionaire. Over the past 10 years, Tesla's market capitalization soared from $3.5 billion to just under $1 trillion today. And yet, by all appearances, Tesla is not Elon Musk's favorite company.

Image source: Getty Images.

Tesla or SpaceX?

According to historical data from S&P Global Market Intelligence, Tesla was founded in 2003 -- and Musk didn't become involved in the company until 2004 (or become CEO until 2008). But Musk sank his personal fortune into setting up SpaceX even earlier, in 2002.

Why was Musk's first instinct to set up a space company, with electric cars being an afterthought? Clearly, his long-standing desire to "occupy Mars" and make humans an "interplanetary species" were driving factors. But I also wonder if way back in 2002, Elon Musk saw something that the rest of us missed at the time -- the incredible growth ahead for space companies.

Consider the following:

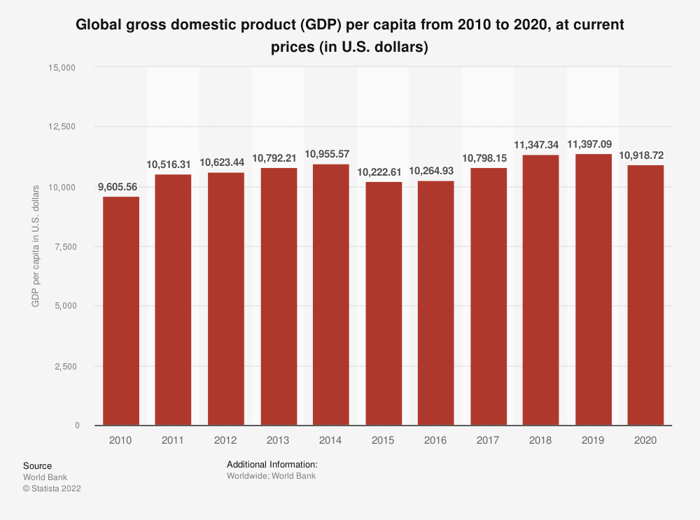

This chart above is pretty simple. It shows the total estimated gross domestic product (GDP) per capita of the entire Earth. Such "revenue per person" grew a grand total of 14% from 2010 to 2020. True, 2020 wasn't a great year for economic growth, thanks to the pandemic throwing the global economy into reverse. But even excluding that outlying year, from 2010 to 2019, global GDP grew less than 19% in total, or less than 2% annualized.

That's not very impressive, is it? But here's the good news: There's one segment of the stock market that's growing much faster than average.

Earth companies or space companies?

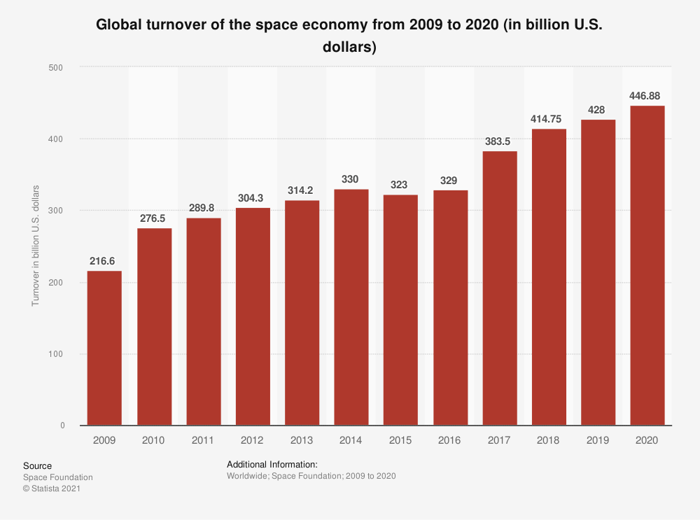

Now check out this next chart, which shows the growth in revenue of companies specifically involved in space. This includes:

- Rocket-engine builders like Aerospace Rocketdyne.

- Companies that use those engines to launch rockets and put satellites in orbit, such as Boeing, Lockheed Martin, and SpaceX.

- Companies that operate satellites, such as Earth imaging company Maxar Technologies.

- Companies down here on Earth that utilize services provided from space, like Amazon's trucks navigating by GPS, Netflix streaming TV with the help of communications satellites, and so on.

See that? From 2009 to 2020, the global space economy grew an astounding 106%. That's 7.5% annually, or nearly four times as fast as overall global GDP growth. And in contrast to the rest of the world economy, the space economy grew even during the pandemic -- rising 4.4%.

Admittedly, investors still face the tricky task of picking individual winners and losers among a plethora of "space stocks" (and here's help for that). But clearly, space stocks are a promising sector in which to find those winners -- just as Elon Musk foresaw back in 2002.