Believe it or not, Tesla (TSLA -3.40%) has been making electric cars for 10 years now. The electric vehicle (EV) trailblazer produced 2,600 vehicles in 2012, and its stock has returned more than 15,000% since then. Of course, it wasn't always smooth sailing, and the company flirted with bankruptcy along the way.

Tesla effectively created a market, making it easier for others to follow in its footsteps. There may not be another stock that matches those returns, but Rivian Automotive (RIVN 1.85%) is taking advantage of what Tesla created and is trying to mirror its results from a different approach. Rivian investors have heard nothing but bad news recently, but sometimes, that's the best time to buy into a stock.

Image source: Tesla.

Almost down and out

Tesla CEO Elon Musk has said that his company was within about a month from bankruptcy when it was ramping up its Model 3 mass production in 2017. He famously called the experience "production hell." But as this chart shows, once Tesla made it through manufacturing start-up struggles, its production and delivery rates soared.

In its recent first-quarter conference call with investors, Musk said he feels there is a "reasonable shot at a 60% increase over last year," implying potentially hitting about 1.5 million electric vehicle deliveries in 2022.

Different set of challenges

Rivian produced just over 2,550 vehicles in the first quarter of 2022 and believes it is on pace for 25,000 for the full year. That mirrors Tesla's volume in its early days, well before the production of the Model 3 in 2017 that prompted Musk's comments.

But Rivian is facing its own set of challenges at this early stage of its growth. Supply chain issues led it to reduce its projection for vehicle production in 2022 to 25,000, though it has the capacity to produce twice that many. In its first quarter letter to shareholders, the company said it has the equipment and processes in place to produce over 50,000 vehicles across its platform if it were able to get needed parts. It is also being forced to absorb rising costs as it works to deliver the more than 80,000 pickup trucks and SUVs reserved before raw material prices became more inflated. And there won't be a quick reversal for either supply chain constraints or rising prices.

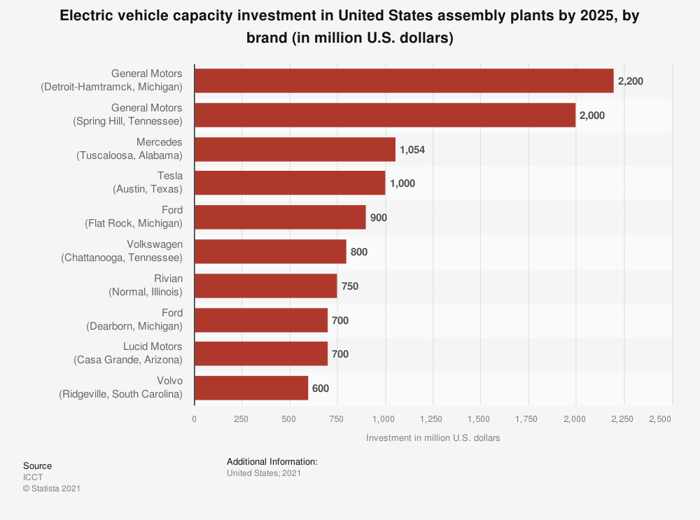

But that's not stopping Rivian from planning for the long term. In addition to those truck and SUV preorders, the company has an order from Amazon -- its largest shareholder -- for up to 100,000 electric delivery vans. That's a nice production base to have, and Rivian has already announced investments to secure the production capacity needed. A newly planned $5 billion plant in Georgia it hopes will be in production in 2024 would put it atop the list of largest single EV capacity investments in the U.S.

Rivian announced a $5 billion investment for its second production facility in Georgia.

Long-term planning

It's not just Rivian that should be planning for the long haul. Rivian investors should, too. There will likely be more pain in the short term as many challenges must be worked through.

Rivian shares may never have the phenomenal returns Tesla stock has provided. But the company has a good base of orders and plans to be able to ramp up to large-scale production with a total planned capacity of 600,000 annual units.

Like Tesla in its early years, it must overcome the early challenges. Therein lies the big risk for investors. But if it successfully manages through its growing pains, it could become a large-scale EV maker with pickup truck, SUV, and delivery van offerings that drive the company's growth over the next decade.