The coronavirus vaccine race might be over, but that doesn't make BioNTech (BNTX -2.16%) any less relevant. With its shares coasting in the aftermath of a decline of more than 15% in the last 12 months, the biotech's next act is already in motion, and it can't arrive soon enough for investors.

But is the stock as good of a buy in 2022 as it was in 2020, or would it be better to wait for it to gain a bit more momentum once again? To answer those questions, let's examine three key things that'll determine the company's future.

Image source: Getty Images.

1. Demand for Comirnaty is ebbing

With more than 2.6 billion doses delivered in 2021 and more than $20.2 billion in sales, the Comirnaty COVID-19 vaccine it developed jointly with Pfizer is BioNTech's only source of revenue. But management expects 2022's sales to drop to as low as $13.8 billion, perhaps as a result of a global pandemic that's becoming more under control than previously.

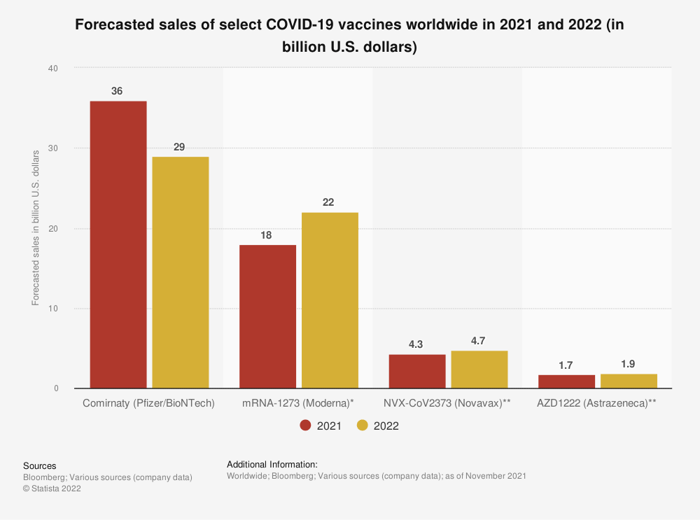

Still, competitors like Moderna and Novavax aren't necessarily going to be facing the same struggle, as shown below:

In a nutshell, investors should expect the company's revenue to contract sharply in the near term. Though some of this drop is likely already priced into the valuation, there's always room for a worse-than-expected quarter.

And without any other pipeline programs approaching completion and commercialization, BioNTech might face shrinking revenue for quite some time before turning things around.

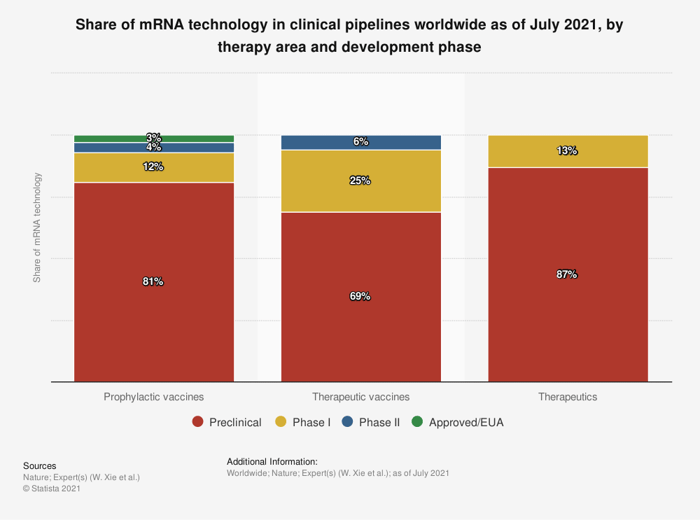

But investors should also be aware that most of the other companies working on mRNA medicines are in the same position as BioNTech regarding the relative immaturity of their pipelines.

Take a look:

So even if the company's peers in the coronavirus vaccine market might one-up its sales in 2022, it's still competitive in the mRNA space more generally, which is a good sign for the long-term view.

2. It can whiff in clinical trials just like any other biotech

Though it might seem obvious, biotechs like BioNTech have tons of programs in their pipelines because sometimes clinical trials don't go exactly as planned. And simply having a best-selling medicine on the market offers no protection against mishaps or weaker-than-expected results.

In this vein, the company announced on April 11 some preliminary data from the phase 1/2 trial of its BNT211 project, a novel therapy for advanced solid tumors. While management cast the results as positive, its stock barely budged in response to the news, and a closer inspection shows things to be far more ambiguous.

The overall response rate to the treatment was 43%, and responding was limited to the six patients in the trial who had ovarian or testicular cancer out of 14 in total. The patients with endometrial cancer, fallopian tube cancer, sarcoma, and gastric cancer didn't respond to treatment, so it's a toss-up whether BNT211 will continue to be advanced for those indications.

The moral of the story is that BioNTech is still going to keep facing the same clinical development risks and potential upsides as other biotechs. And as revenue from Comirnaty continues to drop, those risks could have significant consequences for its share price.

3. A new collaboration could pave the way for even better vaccines

The third thing for investors to consider before buying BioNTech stock is that it recently started work on what might be a big improvement to its coronavirus vaccine program.

As part of a new collaboration announced on April 11, it'll be teaming up with Matinas BioPharma to get access to Matinas' lipid nanocrystal (LNC) drug delivery platform. With the help of the LNC technology, it could eventually make an oral formulation of its coronavirus vaccine, which is similar to what competitors like Vaxart are trying to do.

Though details are currently sketchy, the appeal of an oral coronavirus vaccine is quite appealing as it would reduce the burden on healthcare providers to administer shots. It's also possible that the orally formulated doses will be more effective than jabs at creating immunity in the tissues of the mouth and nose, which are the most likely to be exposed to the virus.

If such benefits could be realized, it would make BioNTech all the more relevant to the pandemic response, and the windfall to shareholders could be considerable.

For now, the collaboration is in the early stages, so it's worth keeping an eye on how it proceeds if you're on the fence about buying the stock.