Considering the broader market's decline and the tech stocks leading the ride down, it may not surprise investors to see that Nasdaq (NDAQ -0.03%), the parent company of the tech-heavy Nasdaq Composite index, has stock trading down about 24.8% year to date.

However, after browsing through the 2022 first-quarter results for the company, two specific numbers jumped off the earnings presentation at me, highlighting why Nasdaq may be a unique opportunity at today's prices.

Let's take a look at these two figures.

Image source: Getty Images.

1. First-quarter free cash flow of $570 million

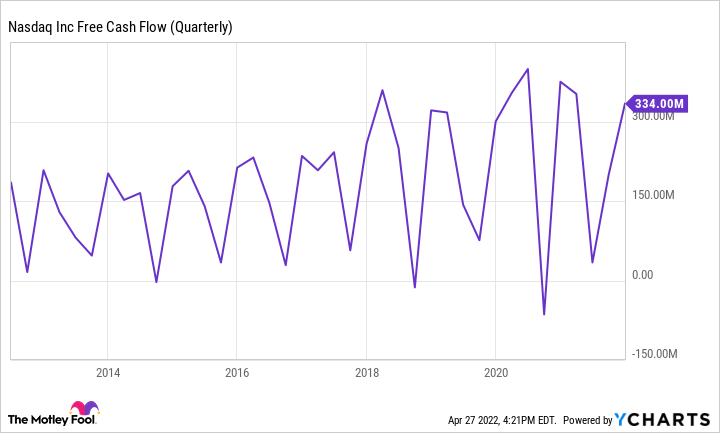

Setting a new all-time high, Nasdaq recorded $570 million in free cash flow (FCF) during its first quarter of 2022, well above any previous mark shown in the chart below.

NDAQ Free Cash Flow (Quarterly) data by YCharts.

To put this record-breaking figure into perspective, consider that in 2019 Nasdaq only generated $836 million in FCF for the entire year. Furthermore, compared to the first quarter in 2021, this $570 million marked 62% growth year over year.

Leading this impressive spike in cash generation is Nasdaq's ongoing transformation focusing on software-as-a-service (SaaS) and recurring revenue.

Since it is an amalgamation of four unique business segments, it can be tricky to value such a diverse company. However, these recurring sales generally lead to more stable and predictable cash flows, which is helpful when looking at Nasdaq's stock.

Therefore, this dramatic growth in FCF acts as an undeniable way for Nasdaq to show progress as it continues this transformation. As this FCF grows, look for its share price to move in lockstep, especially as it integrates its 2021 Verafin acquisition and sees its SaaS operations mature.

2. Market technology's operating margin of 3%

Posting a 3% operating margin from its market technology segment during Q1 in 2022, Nasdaq has now recorded four consecutive quarters of positive margins within the unit, despite still working on integrating Verafin's acquisition.

This market technology segment comprises its anti-financial-crime technology and its market infrastructure technology businesses and targets the $9.5 billion serviceable addressable market (SAM) for financial policing -- so to speak. Ranging from fraud and anti-money-laundering (FRAML) surveillance to supporting the broader financial framework in the markets, this segment leads Nasdaq's transformation, with 99% of new customers choosing SaaS.

As it generated $486 million in revenue over the last year, market technology has over 20 times upside compared to its SAM and projects to grow by 13% to 16% over the coming years, according to management.

Best yet for investors, this growth is just starting as the company looks to begin longer-term partnerships with its banking customers. Speaking to this point, CEO Adena Friedmann explained,

Since we closed on the acquisition, we have signed 10 new fintech clients and two new Tier 1 and Tier 2 banks with several ports of concepts currently underway at major Tier 1 banks."

On top of this, Nasdaq is also launching its first module for use with crypto exchanges, which they would use to combat FRAML through digital wallets made up of crypto and fiat currencies alike.

Why buy now?

As integral to both the financial and technology markets as Nasdaq is, I can't help but feel that its $26 billion market capitalization, or company price tag, is far too small considering its brand recognition alone.

NDAQ Market Cap data by YCharts.

While brand recognition means little by itself, Nasdaq's 86% initial public offering win rate highlights its enduring ability to attract the brightest young companies to list on its exchanges.

Having generated over $1.1 billion in FCF over the last 12 months, Nasdaq now trades at a price-to-FCF ratio of 23 -- well below the S&P 500's median ratio of 34.

Thanks to this attractive-looking valuation, accelerating FCF generation, and promising market technology growth potential, Nasdaq is at the top of my list of stocks to add to and hold for the long term.