Bucking the trend of many pandemic-era stocks, Boston Beer Company (SAM 1.70%) was not a tech darling, but its revenue and earnings exploded higher in 2020. As a result, the stock boomed -- rising from $300 to over $1,000 in just nine months.

The good times haven't lasted for the maker of Samuel Adams, Angry Orchard, and Truly Hard Seltzer, as the stock has made a round-trip from its rise and sits now below $400. With such an epic rise followed by a rapid fall, is Boston Beer a buy?

Image source: Getty Images.

A beer company no longer?

Boston Beer Company was founded in 1984 and started with its Samuel Adams beer line. This brand did well for the company, but Boston Beer expanded when it purchased Dogfish Head Brewery in 2019. With brands like Angry Orchard, Twisted Tea, and Truly Hard Seltzer, this acquisition marked the company's transition from solely a beer maker to a beer and beer alternative producer.

Unknown to consumers at the time of the acquisition, seltzer was about to take the market by storm. In 2020 alone, seltzer took a 5% market share from standard beer. This rise propelled Boston Beer's stock higher but then significantly affected the company when demand began to subside.

Rough results

There are a few other metrics besides sales that help investors understand how beer companies are performing. Depletions are how much volume is sold by distributors, and shipment volume is how much volume is transferred to distributors. Along with sales, these two metrics paint a picture of how quickly the product is moving from the manufacturer to the distributor to the consumer.

Unfortunately for the Boston Beer Company, these numbers were horrendous in the first quarter. Shipment volume decreased 25% year over year and depletions decreased 7%. With such an imbalance, investors may be wondering what is going on. Per the company's management, distributors are keeping their inventory levels far below 2021's values.

Image source: Getty Images.

Product demand slowdown is not something any investor wants to hear. As a result, revenue fell 21% for the quarter and caused the company to report a net loss of $0.16 per share. Not only did sales fall, but its gross margin was also impacted, falling to 40.2% from 45.8% a year ago.

Decreasing gross margin means Boston Beer Company has relatively little pricing power, a bad sign for investors. Whether it cannot pass on price increases to the consumer, negotiate better terms with its suppliers, or a combination of the two, Boston Beer Company may be in for a rough 2022.

However, the company still believes it can increase its depletions and shipments between 4% and 10% for the year. It also believes it can produce between $11 and $16 in non-GAAP (generally accepted accounting principles) earnings per share. However, this assumption requires Boston Beer's gross margin to rise back to between 45% and 48%. These seem like rosy projections, and I'm unsure if Boston Beer can meet them.

A low-valued stock

One saving grace for Boston Beer's stock is its cheap valuation. Because of its recent unprofitability, any metric like free cash flow or earnings is skewed. As a result, pricing the company from a price-to-sales (P/S) standpoint allows investors to make the best apples-to-apples comparison possible.

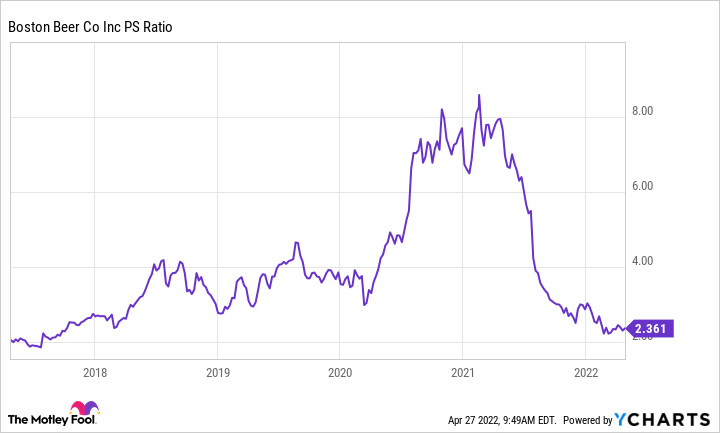

SAM PS Ratio data by YCharts.

According to its chart, Boston Beer's valuation has reached levels not seen since 2018. Furthermore, it is valued lower than its pandemic sell-off bottom. This low valuation isn't a buy recommendation but is an interesting proposition.

If you believe Boston Beer Company can turn its business around and post solid numbers for the rest of the year and throughout 2023, this valuation may provide a great chance to purchase the stock on sale for a slight discount.

However, there are just too many factors out of Boston Beer's control for me to invest in the stock. It relies upon consumer trends to boom or bust, which benefited the business in 2020 but is hurting it in 2022. With a lack of pricing power and rising shipping costs, Boston Beer could still have a problematic 2022. For my money, there are just too many better stocks available on the market than Boston Beer Company right now.