Peloton Interactive (PTON -0.98%) is scheduled to report fiscal 2022 third-quarter earnings before the markets open on Tuesday, May 10. The company has been struggling to regain its footing as economies have started reopening.

Peloton thrived during the early stages of the pandemic when gyms were closed, and demand for at-home exercise equipment surged. Management overestimated the duration of the increase in demand and overinvested in manufacturing capacity. Peloton has since been trying to calibrate the business into equilibrium with several changes to pricing, leadership, and cost structure.

Image source: Getty Images.

Peloton surprised by sales decline

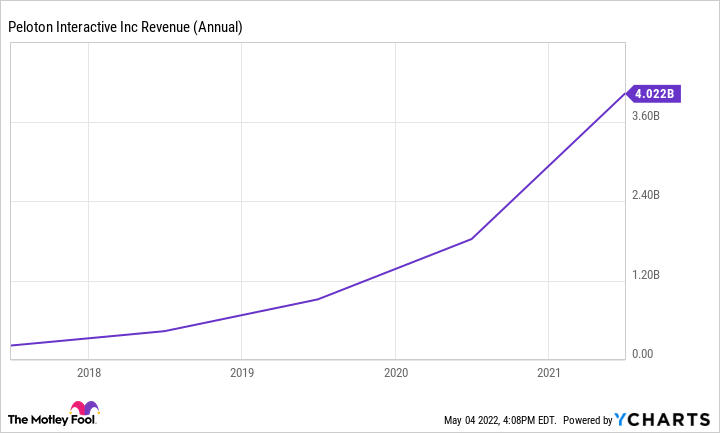

Interestingly, Peloton was nearly doubling sales two years before the outbreak of COVID-19. Revenue increased 99% to $435 million in 2018 and 110% in 2019 to $915 million. As demand for exercise equipment surged during the pandemic, Peloton's revenue increased by 99.6% in 2020 and 120% in 2021. The problem was that Peloton was not prepared for such a surge in demand.

PTON Revenue (Annual) data by YCharts

Customer orders exploded, but there was a backlog of up to 10 weeks. Commonly, orders were canceled or delayed for several weeks more, causing public complaints about the turtle-like speed from order to delivery. Management did what most businesses would do when demand is substantially outpacing supply -- they invested in boosting manufacturing capacity.

Peloton acquired manufacturing company Precor for $420 million and invested in creating its own facility in Ohio. Unfortunately, sales growth hit a wall. After they nearly doubled every year for four straight years, Peloton expects sales will fall in fiscal 2022. More specifically, management projects revenue of $3.75 billion in 2022 at the midpoint. To put that figure into context, it made $4 billion in revenue in fiscal 2021.

The sudden turnaround has forced Peloton to rethink its growth investments. Not long after it was evident that customer demand was decreasing, management went into crisis mode and made several adjustments to its cost structure. In all, Peloton said that the restructuring should save $800 million in annual expenses and reduce capital expenditure by $150 million in 2022.

PTON Operating Income (Quarterly) data by YCharts

As part of this recalibration, the company has changed prices several times on its products and services. It hardly allowed any time for investors to observe the effect of these changes on the financial statements before changing them again. Former CEO John Foley took responsibility for the missteps and stepped down as CEO.

What investors likely need now is some continuation of implemented plans. That way, the changes in prices and costs can show up in financial statements. As it is, investors are left guessing as to the effects these changes will have in the near term.

In the meantime, Peloton is considering selling a 15% to 20% stake in the business to shore up the balance sheet with much-needed cash. The move could buy it some time to implement efficiency improvements and get the business back on track.

What this could mean for Peloton investors

Analysts on Wall Street expect Peloton to report revenue of $972.88 million and a loss per share (EPS) of $0.83 in its fiscal third quarter. That loss would be a considerable increase from the loss of $0.03 per share it reported in the same quarter a year earlier.

If management notes a surprise increase in consumer demand, it could be the catalyst that lifts the stock higher. Down 89% off its high, Peloton stock has taken a beating from the missteps mentioned above. A burst in customer orders would alleviate some of the pain from the overinvestments.