Walmart (WMT -0.65%) is scheduled to report first-quarter results before the markets open on May 17. With close to $600 billion in annual sales, the world's biggest retailer will aim to keep costs under control as inflation hits economies worldwide.

The massive scale will give it some protection from rising costs. Walmart can use its purchasing power to negotiate concessions from suppliers and fight to keep increases limited. Investors hope to see that merchandising prowess on display when Walmart reports its results.

Image source: Getty Images.

Walmart is keeping a lid on costs

The coronavirus pandemic, in addition to causing tragic illnesses, is leading to supply-chain disruptions. An infection at a manufacturing plant could send workers home for several weeks and pause or reduce output. Furthermore, outbreaks at logistical facilities are causing delays in the shipment of goods. To make matters worse, fewer people are willing to work at prevailing wages because of a potentially deadly virus in circulation. It's all coming together to raise the price level of products and services.

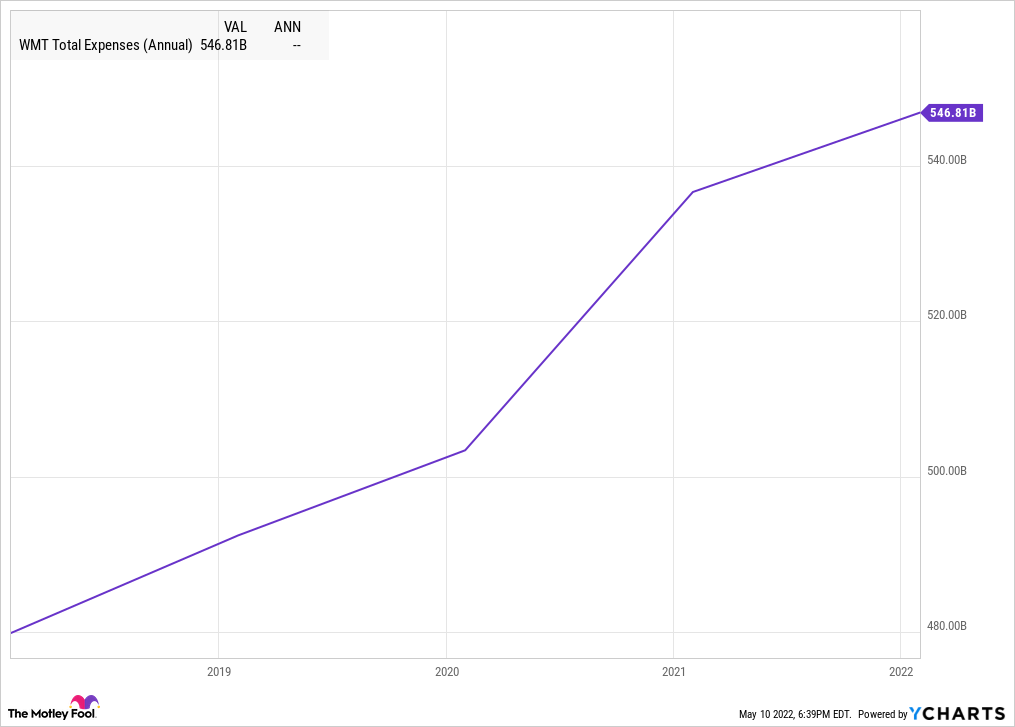

WMT Total Expenses (Annual) data by YCharts

Businesses have to pay more to secure labor, and they are passing those costs along to consumers, who are paying higher prices for everyday goods. Some companies are affected worse than others. With its massive size and buying power, Walmart is doing reasonably well. In its most recent quarter, which ended Jan. 31, it said that supply-chain costs were $400 million higher than expected in the U.S. But to put that figure into context, Walmart's overall expenses in the quarter were $147 billion.

Walmart's total operating costs grew by less than half a percent, year over year, even as total revenue increased by 0.5%. With inflation soaring worldwide, Walmart's ability to keep costs grounded demonstrates its remarkable skill as a merchandiser. Shareholders are hoping Walmart can keep this up for fiscal 2023.

Management forecasts revenue to grow by roughly 3% on the year and earnings per share to grow by mid-single digits.

What this could mean for Walmart investors

Analysts on Wall Street expect Walmart to report revenue of $138.81 billion and earnings per share (EPS) of $1.48. If the company meets those projections, it will represent an increase of less than 1% and a decrease of 12.43%, respectively, from the same period the year before. Note, however, that Walmart divested a meaningful piece of its international business in the last year, so these figures are not an apples-to-apples comparison.

WMT PE Ratio data by YCharts

More importantly, investors will want to listen to management's commentary on the evolving macroeconomic factors and how they are affecting Walmart's business. Rising inflation, the Russian invasion of Ukraine, and economic reopening are all potential headwinds for Walmart in fiscal 2023. Historically, the stock is already on the expensive side, so lowering targets for fiscal 2023 could bring shares down after the announcement.