Bear markets can seem unfair: Once the selling starts, fundamentals tend to be ignored, and share prices move lower.

This has been the case for Airbnb (ABNB 2.77%). The stock is down 45% from last year's high and lower by 30% year to date. Nevertheless, its fundamentals are not only rock-solid -- they're downright impressive.

So is now the time to buy this proverbial baby that's being thrown out with the bathwater?

Image source: Getty Images.

Airbnb just crushed first-quarter earnings

Simply put, Airbnb announced stellar first-quarter results on May 3, beating expectations on both the top and bottom lines. Revenue of $1.51 billion topped estimates of $1.45 billion, and the first-quarter loss of $0.03 per share was well ahead of the $0.29-per-share consensus.

The company reported over 102 million nights and experiences booked, an all-time high. Airbnb's average daily rate, a vital leisure industry metric, rose to $168, up 5% from a year earlier. The company is expanding on multiple fronts -- not only are overall nights booked rising, but the average rate for those stays is rising too.

What's more, the company provided upbeat guidance. Management indicated second-quarter revenue should fall between $2.03 billion and $2.13 billion. Wall Street analysts have noticed and scrambled to adjust their full-year earnings estimates higher. In fact, full-year 2022 earnings estimates have nearly doubled since three months ago.

| Time of Estimate | Full-Year 2022 | Full-Year 2023 |

|---|---|---|

| Current | $1.92 | $2.49 |

| 7 days ago | $1.27 | $2.05 |

| 30 days ago | $1.33 | $2.04 |

| 60 days ago | $1.34 | $2.04 |

| 90 days ago | $0.97 | $1.67 |

Data source: YAHOO! Finance.

Airbnb is now the leading American travel site

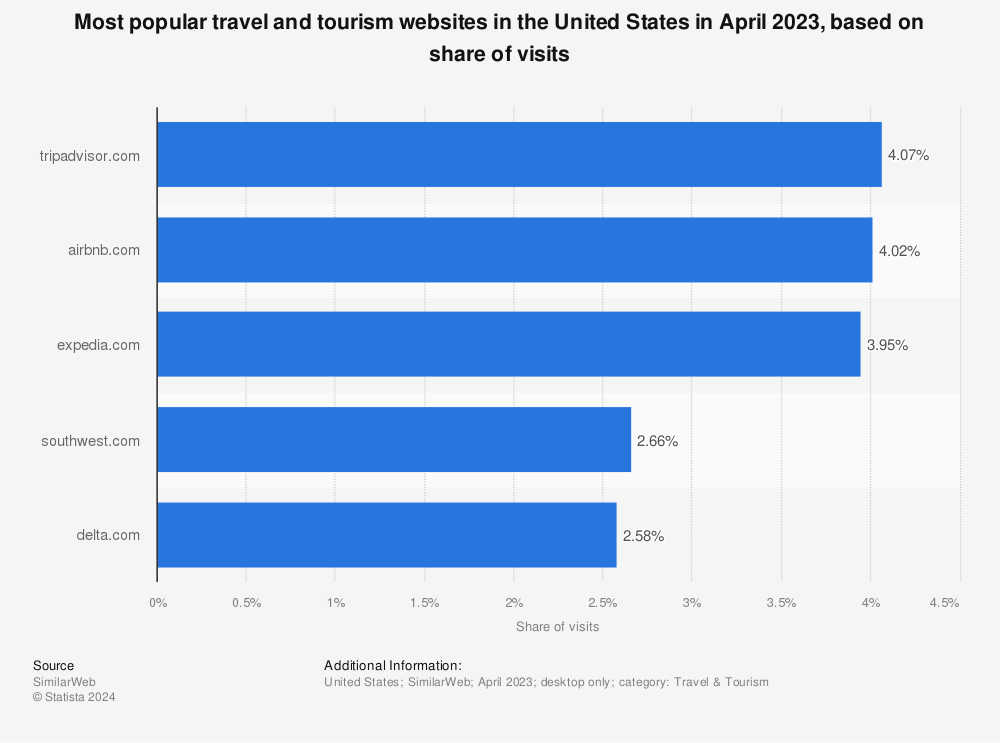

One driving force behind Airbnb's outstanding earnings results is that the company continues to take market share from its competitors. As this chart shows, Airbnb is now the leading U.S. travel site with close to 5% of overall traffic.

Moreover, the company's "I'm Flexible" feature seems to be a game changer. Airbnb reports it has been used over two billion times since its introduction last year. The feature drives traffic to less popular locations -- helping to match guests and hosts more evenly across the platform and increase conversion (i.e., booking) rates.

Why Airbnb looks like a screaming buy right now

Bear markets can be scary. Some stocks are losing 50% or more of their value literally overnight. But for long-term investors, bear markets are a great time to buy good companies when they're oversold. Airbnb certainly seems to fit that mold.

Despite reporting excellent first-quarter results, shares are at all-time lows. That's a great time to load up on a company with a great business model, solid fundamentals, and a strong management team.