Although most investors dislike market corrections, they offer great opportunities to add solid stocks to your portfolio for the long term. With the Nasdaq Composite index down roughly 27% this year as of this writing, several growth stocks have also seen significant correction. Let's discuss five such top stocks that look very attractive right now.

Rivian

Stock of electric vehicle (EV) maker Rivian (RIVN 2.84%) has corrected roughly 77% this year and is 86% off its all-time high price of $172. The stock's market capitalization, which crossed $150 billion days after its listing, has fallen to $22 billion.

Rivian fared well in the first quarter, when it produced 2,553 vehicles. As of May 9, the number of vehicles produced rose to roughly 5,000. Importantly, the company expects to meet its target of 25,000 vehicles for 2022. With more than 90,000 pre-orders for its R1 truck and SUV, along with an initial order of 100,000 electric delivery vans from Amazon, Rivian has some demand visibility.

Image source: Getty Images.

Because Rivian is a loss-making young EV maker the stock entails risks, but the company's progress so far seems to be very encouraging. If you've been considering buying the stock, now could be a great time to do so.

ChargePoint

The stock of leading EV charging provider ChargePoint (CHPT -1.47%) has fallen roughly 50% year to date. ChargePoint is the largest public level-2 charging provider for EVs in North America, capturing roughly 70% of the market.

Its land-and-expand model and diverse revenue sources have allowed ChargePoint to grow its revenue significantly in recent quarters. As a leading payer in an industry with a long growth runway, ChargePoint looks well-placed to grow. The year-to-date fall in the stock's price provides a more attractive entry point for long-term investors.

Tesla

A large section of investors regret not buying Tesla (TSLA 1.85%) stock three years back, when it was trading near $35. Then, an investment of $10,000 three years ago would have risen more than 15 times to $152,000 today. If you've been considering buying the high-flying stock back then but didn't, now could be a good time.

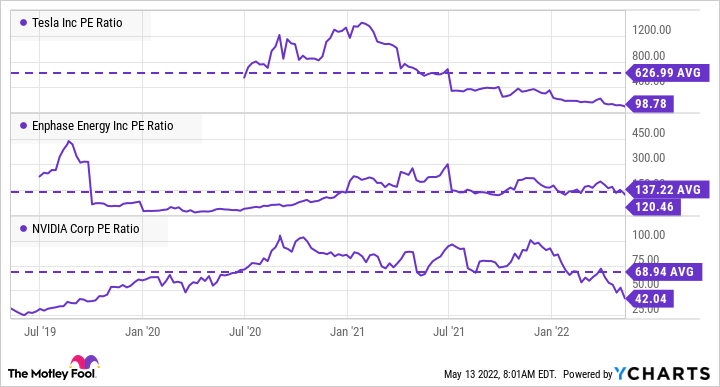

TSLA PE Ratio data by YCharts

Tesla stock has dropped roughly 30% this year, even though it posted solid performance in the first quarter. As the above chart shows, the stock's price-to-earnings (P/E) ratio of nearly 99 is well below its historical average level. Its forward P/E ratio, which is based on expected earnings for 2022, has also fallen to more attractive levels.

TSLA PE Ratio (Forward) data by YCharts

Tesla's forward P/E ratio has fallen to around 58, from 86 at the start of the year. Overall, Tesla stock is looking far more attractive now than it was in January.

Enphase Energy

Stock of solar microinverter manufacturer Enphase Energy (ENPH 2.69%) is down nearly 23% so far this year. The solar component specialist is growing its quarterly sales at an average year-over-year rate of 46% for five years. At the same time, its profit has also been rising. Enphase's microinverters are in huge demand as they offer several benefits over other inverter options in the market.

Given the expected growth in the use of solar energy, Enphase has a long growth runway. The stock's P/E ratio of 120 looks high but is still lower than its five-year average level. Further, Enphase Energy stock's forward P/E of around 41 is well below 53, where it stood at the start of the year.

Nvidia

Nvidia's (NVDA 3.65%) graphics cards find an ever-growing demand thanks to their widespread use, including in emerging areas such as artificial intelligence, autonomous vehicles, robotics, and virtual reality. What's more, the demand from these segments is expected to grow in the coming years. Nvidia believes that it has $1 trillion worth of opportunity across its various offerings.

Nvidia's stock has fallen 45% so far this year, partly due to overvaluation concerns. The stock's P/E of 42 is well below its five-year average P/E ratio of nearly 69. Its forward P/E multiple of nearly 29 looks very attractive compared to a ratio of 68 at the start of the year. In short, now could be a great time to add Nvidia to your portfolio.