The Nasdaq Composite briefly collapsed to 30% off its high on Thursday before rebounding at the end of the day and staging an epic rally on Friday. But so far this year, investors have seen the broader indexes come back, only to give up those gains and then fall even further to set fresh 52-week lows.

One of the worst feelings during a bear market is to get faked out. As much as we wish we can control short-term price action, we can't. The better strategy is to simply accept short-term unpredictability by positioning your portfolio for years of compounding growth.

However, retirees and investors who are nearing the capital preservation stage of their investment cycle may be more interested in safeguarding assets than reaching for outsize returns. For folks worried about a prolonged bear market, NextEra Energy Partners (NEP 0.26%), WM (WM 0.97%), and Hubbell (HUBB -1.08%) are three dividend stocks that can let you sleep well at night. Here's what makes each a great buy now.

Image source: Getty Images.

A powerful partner for prodigious passive income

Scott Levine (NextEra Energy Partners): When bears run rampant through the markets, it can be quite unnerving. It's not easy to repeatedly see red stock charts and, at the same time, keep faith that they'll recover in time. While history proves that the markets will eventually recover, fortifying your portfolio with reliable dividend stocks -- like NextEra Energy Partners -- is one way to help stave off the fear that a drawn-out bear market can induce. Offering investors a juicy 4.7% dividend yield, shares of NextEra Energy Partners provide the ability to pay investors the green while the company helps its customers go green, operating a portfolio of various clean-energy assets: 6,640 megawatts (MW) of wind, 1,310 MW of solar, and 50 MW of energy storage.

As a utility, NextEra Energy Partners provides investors with a conservative investment option. A prolonged bear market may indicate a challenging economic environment, but this company is unlikely to see customers dropping their electricity service as a way of scrimping and saving. The stock also represents an appealing option because the company's management is steadfastly committed to shareholders. Over the past seven years, for example, NextEra Energy Partners has consistently raised its payout to shareholders at a comparable rate to its growing earnings per share (EPS). While the company's EPS rose at a compound annual growth rate (CAGR) of about 41% from 2014 to 2021, the dividend rose at a CAGR of approximately 45% during the same period. There have certainly been a few downturns over the past seven years, so the fact that the company has consistently increased its dividend suggests that management is adept at managing capital to help the company prosper while also rewarding shareholders.

Further illustrating how the company's growing dividend hasn't jeopardized its financial health, consider that over the past five years, NextEra Energy Partners has returned, on average, an annual dividend of $2.00 per share -- a period during which the company has also generated annual average free cash flow (FCF) of $6.15.

Smells like opportunity

Daniel Foelber (WM): WM, formerly known as Waste Management, is the largest waste collection, transportation, and disposal company in North America. The company has continued to expand its operations while investing in new revenue sources, such as its recently announced $825 million commitment to renewable natural gas (RNG) between 2022 and 2026.

Natural gas is a nonrenewable fossil fuel. But methane that's emitted from a landfill can be captured and treated and turned into natural gas -- which is therefore considered renewable. It is WM's plan to produce RNG from its 200-plus landfills while using RNG, in the form of compressed natural gas, as a fuel source for its garbage trucks, instead of gasoline or diesel.

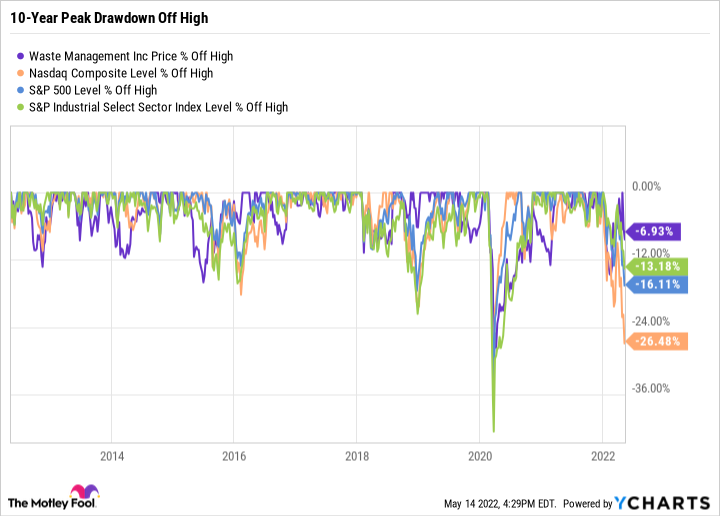

Aside from its diversified business that serves commercial, industrial, and residential customers, WM has been one of the most consistent industrial stock performers over the past decade. The worst peak-to-trough drawdown the stock has had over the past 10 years was just over 30% during the height of the spring 2020 COVID-19-induced sell-off.

For context, the S&P 500 suffered around a 35% drawdown during that brief crash, and the industrial sector was down around 40%. However, fast-forward to today, and WM stock is only 7% off its high while the industrial sector is down 13%, the S&P 500 is down 16% from its all-time high, and the Nasdaq Composite is down more than 26%.

One of the reasons WM stock has been so consistent is the company's ability to generate sizable FCFs no matter what the economy is doing. In 2020, revenue fell less than 2% compared with 2019, and FCF was down just 14%. Strong FCF provided plenty of dry powder to fund dividend payments and even raise the dividend -- which WM has done for 19 consecutive years.

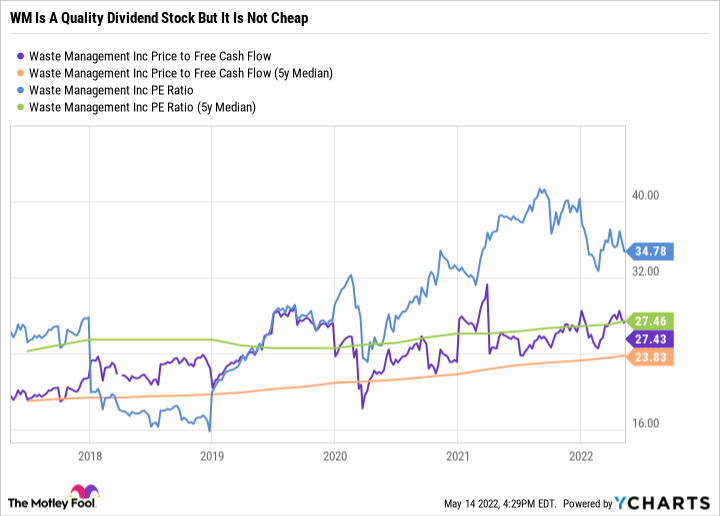

It's worth mentioning that WM's safety comes at a price. The company's price-to-FCF and price-to-earnings ratio are above five-year median levels -- suggesting that WM's stock price has outpaced its ability to grow earnings or FCF.

WM Price to Free Cash Flow data by YCharts

WM isn't a flashy company by any means. But it's the exact kind of investment that folks can rest easy with during a bear market, as long as it's understood that safe stocks like WM tend to fetch a premium price relative to their performance as investors dip out of riskier stocks and into safer stocks.

Invest in the electrification trend

Lee Samaha (Hubbell): The electrical products company known as Hubbell runs out of two segments. Utility solutions (56% of 2021 sales) sells electrical transmission and distribution products to electrical, gas, and water utilities. The other segment, electrical solutions (44%), sells electrical products to a range of industrial end markets, including non-residential construction, data centers, and light industrial end markets.

Hubbell is not going to be immune from an economic slowdown. After all, spending on electrical solutions is partly a function of healthy capital investment spending. However, there are three reasons Hubbell is likely to do better than most.

First, utility spending tends to be relatively recession-resistant and dependent on an underlying level of maintenance spending to keep networks running. Second, the trend toward electrification, driven by the move to the digital and clean energy economy, is a powerful one, and spending on automation, data centers, electric vehicles, automation, connected buildings, and the like is likely to hold up better because of the increase in productivity generated by these new technologies. Third, Hubbell's dividend, with a current yield of 2.1%, is very well covered by its earnings, and the company has a good history of raising dividends.

Data by YCharts

Hubbell stands well placed to grow even in a slowing economy, and combined with its excellent dividend coverage, it's reasonable to expect dividend growth in the coming years.