Oil and gas stocks have provided a refuge for investors fleeing the turmoil of the wider markets in 2022. Generally speaking, oil and gas producers tend to be deep-value stocks -- boasting modest price-to-earnings valuations and paying above-average dividends to shareholders.

And this year -- after many years of figuratively wandering the stock market wilderness -- these largely forgotten stocks have come roaring back to life. One such name is Coterra Energy (CTRA 1.95%), an oil and gas exploration company based in Houston. So, with shares of Coterra up 57% this year, is it too late to buy?

Image source: Getty Images.

The company's recent earnings were excellent

Coterra's first-quarter earnings results, released on May 2, showed that the company continues to deliver outstanding returns for shareholders. Earnings per share for the quarter were $1.01, blowing away the consensus estimates of $0.83. Coterra generated $961 million in non-GAAP (adjusted) free cash flow, and what's more, it announced it was returning more than 69% of that cash to shareholders in the form of dividends and share buybacks. Management also raised guidance for its full-year free cash flow to $4.5 billion -- up from earlier estimates of $3.0 billion.

Henry Hub Natural Gas Futures Contract 1 data by YCharts.

Multi-year highs for natural gas are fueling Coterra's flood of cash. Earlier this month, natural gas futures broke the $8 level -- a price not seen since 2008. This is a boon to Coterra, which produces far more natural gas than oil (the company's production during the first quarter was 76% natural gas, 13% oil, and 11% natural gas liquids). Moreover, the tight supply of natural gas should keep a floor under natural gas prices.

Coterra remains cheap, but is it a buy?

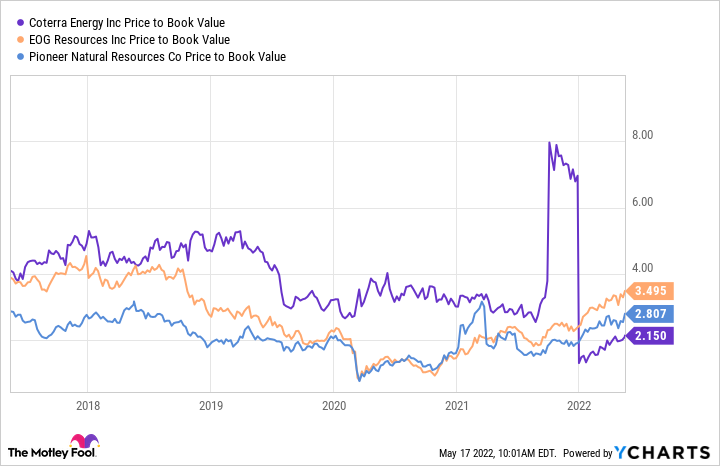

Turning to valuation, Coterra still looks attractive, even after rallying more than 50% this year. Its price-to-earnings (P/E) multiple is 13.9, below competitors like Pioneer Natural Resources (15.9) and EOG Resources (16.6). And while its price-to-book value has increased to 2.05, it remains in line with other domestic oil and gas producers.

CTRA Price to Book Value data by YCharts

Finally, the company's management has shown it can deliver on its two biggest priorities:

- Returning more than 50% of discretionary free cash flow to shareholders through dividends and share buybacks.

- Keeping capital spending under control.

On this last point, management reaffirmed its capital spending guidance for full-year 2022 at $1.4 to $1.5 billion. By sticking to its capital spending guidelines, Coterra management is building trust that costs will not balloon and threaten to eat into future dividend payments or share buybacks.

Even after its fantastic start to 2022, Coterra remains a must-know name for investors looking for value in the oil and gas sector.