The stock market has been a circus show in recent history, due to record-high inflation levels, the Fed's decision to raise interest rates in response, and lingering concerns in connection to the war between Russia and Ukraine. Consequently, the S&P 500 and Nasdaq Composite have backtracked 15% and 24% year to date, respectively, with no end to the negativism in sight.

Even big tech has struggled, with premier companies Netflix and Meta Platforms posting weaker-than-anticipated financial reports in recent quarters. The panic has sent investors swarming to value stocks and safer assets for protection, leaving the technology sector drowning in the red. But as long-term investors, this doesn't mean that we should completely ignore tech stocks for the time being.

Image source: Getty Images.

In fact, there are several companies that continue to deliver strong financial results in spite of the challenges our current economy presents. One of those companies, Apple (AAPL -1.22%), is a world-beater that can provide investors with much-needed security in today's market environment. And since it's down almost 20% year to date, the technology juggernaut grants investors a handsome valuation at present levels.

A resilient business

In the past 12 quarters, Apple has beaten earnings estimates each time, and the company has only fallen short of Wall Street's revenue forecasts once. In the second quarter of 2022, the tech leader increased both total sales and earnings per share by 9% year over year, up to $97.3 billion and $1.52, respectively. While its product category -- which includes the iPhone, iPad, and Mac -- only grew a modest 7%, the company's services segment surged 17% to $19.8 billion.

For the full fiscal year 2022, analysts are forecasting Apple's top line to improve 8% to $394.2 billion and its earnings per share to increase 10% to $6.15. Investors should like where the iPhone maker is positioned today. Not only does its world-class core business offer stability on top of its persistent growth, but the company's services segment enjoys a long runway for expansion in the years ahead.

Fortunately for Apple and its shareholders, the company's elite balance sheet and cash generation will comfortably facilitate growth for the tech giant in the future. The company has $28.1 billion in cash on its balance sheet, and it continues to generate funds at a red-hot pace. In the past 12 months, Apple has produced $105.8 billion in free cash flow (FCF), and its three-year FCF compound annual growth rate (CAGR) is 13%. The company's robust balance sheet and consistent cash generation provide financial flexibility to increase its dividends, buy back shares, and grow its business in the years to follow.

A normalized valuation

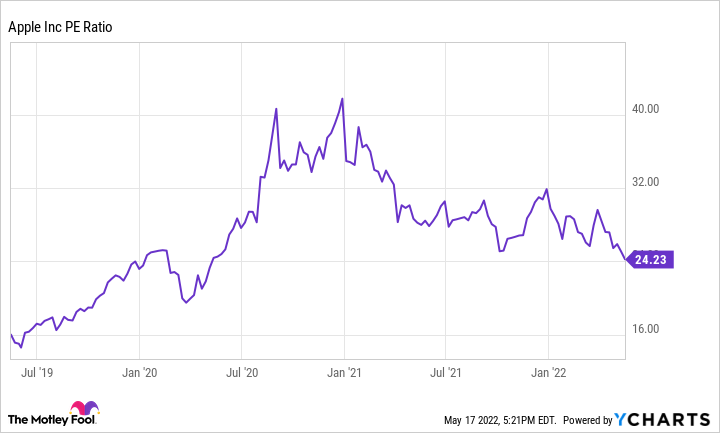

The recent stock price pullback year to date has made Apple stock a very tempting buy. The stock carries a price-to-earnings multiple of 24 today, representing its lowest trading level since the early summer of 2020.

AAPL PE Ratio data by YCharts

The tech company's current earnings multiple is also largely in line with its five-year historical average of 23. But given that Apple has been able to maintain solid growth in recent quarters -- especially compared to the rest of big tech -- investors should be thrilled about buying the stock at existing levels.

Apple is a good play on the turbulent stock market today

Apple is a wise investment today -- the world-leading technology company continues to expand its business at a steady rate in an economy where many of its peers are suffering from growing pains. The stock is also trading at its lowest valuation since mid-2020, supplying investors with a favorable margin of safety. If you're searching for a durable stock to combat the market's volatility today, Apple might be the choice for you.