After a few years of blistering growth, Skillz (SKLZ -5.96%) has stalled in 2022. The unique gaming company, which allows players to bet real money on the outcome of contests, benefited at the pandemic's onset. Unsurprisingly, it found it easier to add customers and revenue when people were spending most of their time at home.

As economies have reopened and folks have returned closer to pre-pandemic behavior, Skillz's growth has slowed meaningfully. Fortunately for shareholders, the company has made progress on a few initiatives that could get the flywheel in motion again.

Image source: Getty Images.

Skillz secures deals with the UFC and NFL

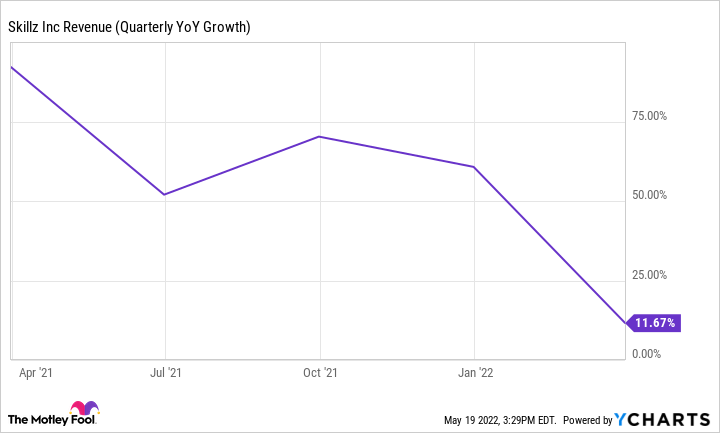

In its most recent quarter, which ended March 31, Skillz reported revenue of $93.4 million. That was a meager 12% increase from the same quarter of the prior year. To put that figure into context, Skillz boosted revenue by 136% in 2019, 92% in 2020, and 67% in 2021. Revenue growth of 12% is a considerable slowdown.

Management does not expect much improvement for the rest of the year -- it is forecasting revenue of $400 million for the year compared to the $384 million it earned in 2021.

SKLZ Revenue (Quarterly YoY Growth) data by YCharts

Skillz has chosen to outsource the games available on its platform. The asset-light business model aims to attract developers to create games on Skillz by promising them a percentage of the revenue they generate. In that way, developers have the chance at more upside if the game they create becomes a big hit. It also reduces the risk for Skillz because it does not spend the resources building games that could turn out to be flops.

However, it is not without downsides. For instance, Skillz cannot control the quantity or the type of games created. It can try to influence with incentives, but ultimately it's up to developers. Getting developers to create games is a critical element of Skillz's flywheel. More content will attract more players, which makes a bigger pool of revenue, which could attract more developers, and so on.

Skillz has secured a few excellent partnerships with the Ultimate Fighting Championship and the National Football League to spur this wheel in motion. The UFC has more than 625 million fans worldwide, and the NFL is so prolific it needs no description.

These deals could allow a few developers to use these famous brands to enhance the fighting and football games they produce for the Skillz platform. The hope is that when fans see these branded games, they will be more likely to sign up and engage with the Skillz platform. Management noted that NFL-branded games will start appearing on the platform before the 2022 NFL season and the UFC games in 2023.

What this could mean for Skillz investors

SKLZ Net Income (Quarterly) data by YCharts

So far, Skillz has relied on spending aggressively on sales and marketing to boost its flywheel. Skillz has invested more than 100% of revenue on marketing and has generated massive losses on the bottom line with limited success in attracting new players. That strategy has repelled investors, and Skillz stock is down 96% off its highs in early 2021.

It could be a welcome sign for shareholders to see management succeeding in fresh ideas to spur growth. Admittedly, it is too early to determine if these sponsored games will work to promote profitable growth. Still, considering the massive fan base boasted by these sports leagues, the potential is there.