The stock market has been under an immense amount of stress recently, and it's not hard to see why. Inflation has surged to 40-year highs, the Fed has begun boosting interest rates in response, and a host of macroeconomic issues have been exacerbated by Russia's invasion of Ukraine.

Even big tech has lost its mojo. Consider the FAANG stocks: Meta Platforms (aka Facebook), Amazon, Apple, Netflix, and Alphabet (GOOGL 1.27%) (GOOG 1.25%) (parent company of Google). These five premier U.S. technology companies are down by an average of more than 30% year to date.

Of the group, Alphabet wears the crown for best investment opportunity at the moment. Down 20% year to date, its valuation has become increasingly attractive, and it has maintained its success on the financial front. In a stock market that is rife with uncertainty, Alphabet grants investors an excellent combination of growth potential and security -- and a rare chance to acquire one of the world's top companies at a historically cheap valuation.

Image source: Getty Images.

Alphabet keeps growing

In the first quarter, Alphabet generated $68 billion in sales and earnings per share of $24.62, in line with analysts' consensus expectations. Given its massive market capitalization of $1.54 trillion, its top-line growth north of 20% is exceedingly impressive.

Revenues from its advertising segment, which represents 80% of total sales, climbed by 22% year over year to $54.7 billion. The Google Cloud unit continued to make headway as well, growing by 44% to $5.8 billion. One fantastic element about Alphabet is that it combines a dependable -- yet still growing -- core business with rapidly developing segments like Google Cloud. Still in its early innings, the global cloud computing market is forecast to expand at a compound annual rate of 16% through 2030 to a value of $1.6 trillion.

Beyond its unrelenting growth, the company is practically a money-printing machine. The tech giant boasts a cash position of $20.9 billion, and it generated $69 billion in free cash flow in the past 12 months. This degree of financial flexibility allows the company to reward its shareholders in a grand way. On April 20, its board of directors approved the repurchase of another $70 billion worth of Class A and Class C shares.

Historically cheap

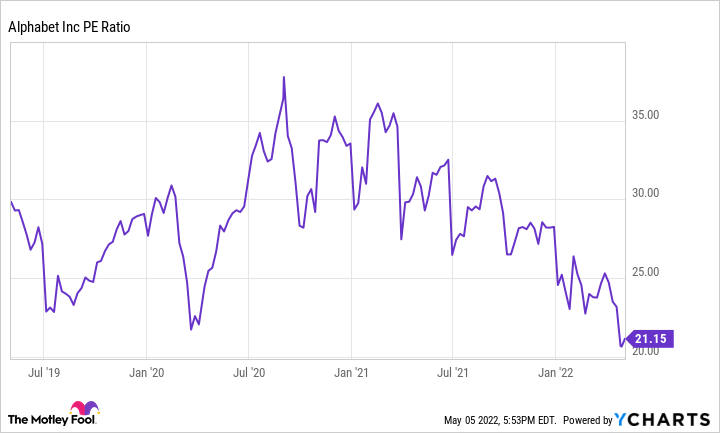

Not only is Alphabet performing exceptionally well financially, the stock is trading at a bargain price-to-earnings multiple of 21.2 today. That's a cheaper valuation than it held at the lowest point of the March 2020 pandemic sell-off. It's also 42% below Alphabet's 5-year average price-to-earnings ratio of 32.4.

GOOGL PE Ratio data by YCharts

Relative to its peers, the company seems attractively valued. Up until Netflix's recent share price collapse, the world's premier search engine operator was trading at a discount to all FAANG stocks besides Meta Platforms. Interestingly enough, Alphabet experienced the greatest earnings growth of the bunch over the past year. Typically, investors have to pay a premium for superior growth, but in this case, we're being offered a discount. Investors should interpret this as the ultimate buying signal.

The bottom line

Consumer sentiment is at a decade-low, and as a result, the market has lost its optimism. Many companies, Alphabet included, have seen their share prices get beaten down due to nothing more than the stock market's broader negative sentiment. I can't predict how stock prices will move in the short term, but I do think Alphabet possesses a wonderful investment profile given current economic conditions. Its business has continued to advance even as its valuation has moved in the opposite direction. Hence, investors should consider adding shares of Alphabet to their long-term portfolios today.