The COVID-19 pandemic, combined with the government and central bank response, has unchained inflation. The illnesses caused by the outbreak have required many workers to take time away from work. Additionally, fear of contracting a deadly virus has reduced their willingness to work at prevailing wages. Meanwhile, fiscal and monetary policies have boosted consumer demand. Unsurprisingly, with customer demand increasing and supply decreasing, prices are higher.

While that may be negative for many businesses and households, for now, it is providing an assist to Home Depot (HD 1.15%). Let's look closer.

Image source: Getty Images.

Rising prices led customers to spend more at Home Depot

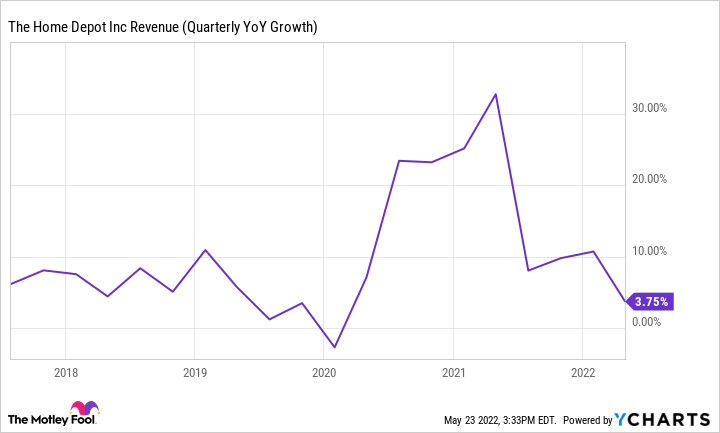

In its most recent quarter, which ended May 1, Home Depot noted that its sales increased by 3.8% from the same quarter of the prior year. That pleasantly surprised management, which expected flat revenue compared to the year before. The quarter last year was a time when consumers were more flush with cash after receiving stimulus checks from the government. Growing sales this year had more to do with rising prices than rising consumer demand.

HD Revenue (Quarterly YoY Growth) data by YCharts.

The average purchase at Home Depot increased by 11.4% in the first quarter of 2022 vs. Q1 2021; the vast majority of that increase was inflation-driven. In other words, folks were paying more for the items they bought rather than increasing the number of items. Indeed, total transactions decreased by 8.2% year over year. Inflation was entirely the cause for Home Depot's outperformance in Q1.

Management expects this trend to continue for the rest of 2022 and raised its target sales growth guidance to 3%, up from a previous forecast of no revenue growth.

The increase in revenue should boost the company's operating profit margin to 15.4% for the year. It will be the highest in a decade for the company if it hits that target. Besides inventory, most of Home Depot's expenses are fixed regardless of sales totals. For instance, Home Depot has to pay a certain sum for rent and lease, regardless of sales. Therefore, with sales rising, it leverages those fixed costs and delivers higher operating profits. Of course, that only works if Home Depot can pass along higher prices to consumers, which it has succeeded in doing so far.

HD Operating Margin (Annual) data by YCharts.

According to management, inflation is twice as high as they thought it would be, and they have raised product prices. Typically, when prices go up, consumers purchase fewer units, which Home Depot has observed. However, the decrease in the number of purchases is smaller than they expected. Home Depot has been around for decades, so it probably has robust data on how customers have responded to previous price hikes.

What this could mean for Home Depot investors

The response from Home Depot customers to price hikes is good news for Home Depot shareholders. The company has had to raise wages to attract sufficient staff, and the price hikes could help offset wage increases. It could also indicate that Home Depot may further boost prices if inflation remains stubbornly high or even rises. A few more quarters of Home Depot demonstrating its pricing power could assuage investor concerns about its sales and profits amid rising inflation. It won't remove all the risks from Home Depot, but it's one less thing to give investors worry.