The technology sector is enduring one of the steepest sell-offs since the 2001 dot-com bust, with the Nasdaq-100 index officially in a bear market after plunging 29.4% from its all-time high. But while there are some similarities to the crash 21 years ago, there are also some comforting differences.

Most of the technology stocks down 50% or more from their all-time highs right now are real businesses with real revenue. Many are even profitable and, in some cases, their revenue is growing by triple-digit percentages. In the early 2000s, the majority of the companies that folded never were able to earn their first dollar.

That big difference makes a strong case that the sector will eventually enter a new bull market with most of the previously popular names pulling through this tough period. Here are two stocks to consider buying ahead of a potential resurgence, and one to steer clear of.

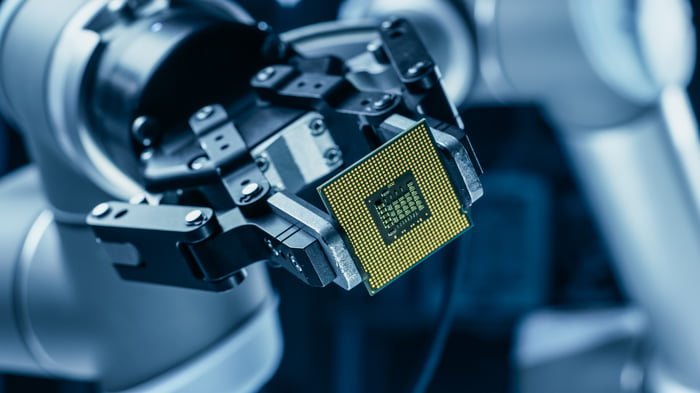

Image source: Getty Images.

The first stock to buy: Ultra Clean Holdings

Looking at in-demand industries is a great place to start when scouring the stock market for opportunities. The semiconductor sector is near the top of the list, with advanced computer chips becoming arguably the most important manufacturing component in the world. Ultra Clean Holdings (UCTT 1.28%) is a semiconductor service company growing at a strong pace, and it consistently generates earnings, which makes it a low-risk bet in this environment.

Computer chips are found in everything from smartphones to cars, and their breadth of use will only expand over time. Chipmakers are constantly innovating to make hardware faster, smaller, and more versatile, and Ultra Clean offers solutions to streamline efficiency and limit downtime. Automated production processes rely on speed and precision, and the company's mechatronics segment provides testing solutions to ensure systems, assemblies, and robots are up to the task.

Its QuantumClean processes also add longevity to manufacturing equipment, and its ChemTrace solution limits waste by identifying contamination risks inside clean rooms.

The company recently released its earnings report for the first quarter of 2022, and it grew revenue by a robust 35% to $564 million. Over the last 12 months, Ultra Clean has delivered over $2.2 billion in revenue and $4.23 in non-GAAP earnings per share, making it a highly profitable enterprise. The company has a 30-year track record in business, and its financial performance makes it a great stock to own in this market.

The second stock to buy: Fiserv

Investors can often find safety in diversity, and Fiserv (FI -2.02%) offers that through its innovative financial technology segments. The company has touchpoints with almost every household in America, yet most consumers have never heard of it because it mostly serves financial institutions and merchants.

Fiserv's merchant acceptance segment is led by its Clover point-of-sale systems, which allow businesses to accept in-store credit card payments. It's currently processing $197 billion in gross merchandise value on an annualized basis. The company's technology is also behind 1.4 billion customer accounts at over 10,000 financial institutions through its white-label software that allows banks to deliver digital banking services to their clients.

For those financial institutions, Fiserv is also responsible for processing 12,000 transactions per second.

The company is a cash-generating machine. Analysts expect it will deliver $16.5 billion in revenue in 2022 accompanied by $6.48 in earnings per share. That places its stock at a forward price to earnings multiple of just 15 -- a solid discount in comparison to the Nasdaq-100 index, which trades at a forward multiple of 21. Not only does that represent a good value, but Fiserv is also returning money to shareholders, buying back $3.8 billion of stock over the last two years, which has helped to buoy its share price.

In fact, Fiserv stock is only down 6.5% year to date, far outperforming the broader market that is toying with bear-market territory.

The stock to sell: DoorDash

DoorDash (DASH -2.01%) was a popular pandemic stock because lockdowns turned its on-demand food delivery service from a luxury into a near necessity. But the company's stock has suffered a spectacular fall from grace over the past six months, declining by 75% since hitting its all-time high price in November 2021. As society reopened, the appetite for food delivery faded and it led to a period of stagnant growth for the company.

Marketplace gross order value (GOV) is the total value of all the goods consumers purchased through DoorDash, and it's one of the best measures of demand. The metric resumed its climb higher in Q1 2022, but its growth rate has fallen off a cliff compared to just a year ago.

Make no mistake, a 25% year-over-year growth rate is still perfectly respectable. But here's the rub: DoorDash still isn't profitable, and if it couldn't generate a profit in early 2021 when it was growing by triple-digit percentage points, it's difficult to make the case for sustained profitability as its business slows. And in the current market environment, investors aren't fond of consistent loss-makers.

In Q1 2022, the company lost $167 million on $1.45 billion in revenue. Part of the reason is the significant level of competition in the food delivery industry, which forces DoorDash to spend hundreds of millions of dollars each quarter on marketing to acquire and retain customers. That figure topped $414 million in the first quarter alone.

DoorDash is expanding its business through the 2021 acquisition of Wolt, a local commerce delivery company that operates in food, groceries, and retail across Europe. While this is positive at face value, DoorDash will need to chart a path to profitability for the combined business if it wants to generate a meaningful stock-price recovery in this market. Until then, DoorDash is one to steer clear of.