Snap (SNAP -2.72%) CEO Evan Spiegel surprised the market with a cautionary statement warning the company would deliver worse-than-expected revenue growth in the current quarter. Macroeconomic factors are creating increasing uncertainty for businesses worldwide.

Snap derives nearly all its revenue from advertisers looking to influence buyers. The volatility in the market is causing marketers to pull back spending, hurting Snap. The stock tanked 43% on the day following the announcement.

Image source: Getty Images.

Snap's second-quarter is going worse than expected

Here's the complete statement delivered by Snap after the markets closed on Monday, May 23.

Since we issued guidance on April 21, 2022, the macroeconomic environment has deteriorated further and faster than anticipated. As a result, we believe it is likely that we will report revenue and adjusted EBITDA below the low end of our Q2 2022 guidance range. We remain excited about the long-term opportunity to grow our business. Our community continues to grow, and we continue to see strong engagement across Snapchat, and continue to see significant opportunities to grow our average revenue per user over the long term.

Before the statement on Monday, the company had forecast revenue would grow between 20% and 25% in the second quarter and adjusted earnings before interest, depreciation, taxes, and amortization (EBITDA) between breakeven and $50 million. This was the April 21 guidance the company alluded to in the above statement. It's now anyone's guess how far below that estimate Snap's revenue will grow in Q2. My hunch is that it will be considerably less than 20% -- perhaps 10% or lower. Otherwise, the company would not have issued the warning before the quarter was completed. This is, of course, subject to reversal if economic conditions improve.

A sudden end to the Russian invasion of Ukraine could unleash enthusiasm from businesses and the markets alike. Additionally, signs that supply chain constraints are easing and companies find it easier to secure the materials and inventory they need to run their businesses could turn Snap's quarter around. However, these scenarios are unlikely in the next month or so.

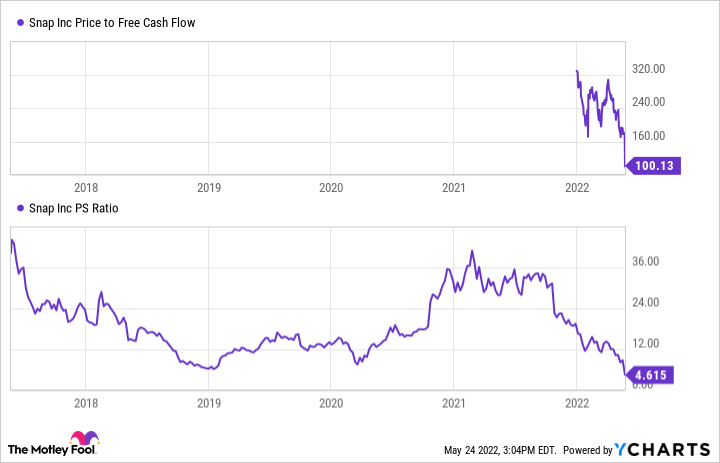

After crashing following this news, Snap's stock is down 84% off its high. Still, despite the dramatic fall, Snap's stock is not cheap when measured by its price-to-sales and price-to-free-cash-flow ratios (see chart below).

SNAP Price to Free Cash Flow data by YCharts.

What this could mean for Snap investors

When short-term volatility takes center stage, it's essential for investors to step back and look at the bigger picture. Snap has grown its revenue from $59 million in 2015 to $4.1 billion in 2021. Admittedly, growth will slow meaningfully this year, but Snap, over several years, has proven it can boost sales. Advertisers spent $763 billion globally in 2021, 22.5% higher than the prior year. Even if that spending stays flat or falls in 2022, it is still a massive sum.

SNAP Revenue (Annual) data by YCharts.

Enterprises will always be looking to influence individuals through advertising. Throughout history, any contractions in advertising have been followed by a return to growth. Investors can keep this in mind to prevent panic in selling their Snap shares.