Investing for passive income can be a rewarding strategy. Some companies pay their profits out to you as dividends, which can cover your living expenses, or you can reinvest them to buy more shares.

Dividends are a cash expense for businesses, so great dividend stocks come from profitable companies that steadily grow over time. Here are five dividend stocks with proven track records and dominant businesses that are simple to understand, making them perfect for the beginning dividend investor.

Image source: Getty Images.

1. Coca-Cola

Famed beverage giant Coca-Cola (KO 2.14%) is one of the most well-known stocks among retail investors, and for a good reason. Coca-Cola's product distribution across the world puts its sodas, water, teas, and coffees in so many stores and restaurants that most consumers have almost certainly enjoyed one of Coca-Cola's beverages.

KO Revenue (TTM) data by YCharts

You can see in the chart above how Coca-Cola's business has remained resilient over time, including restructuring in the 2010s. The company's dividend has been paid and raised for 60 consecutive years, giving investors a 2.8% dividend yield they can feel confident about. Its 71% dividend payout ratio means investors should have no problem counting on future dividends; annual revenue growth between 4% and 6% is management's long-term goal.

2. Procter & Gamble

Investing in the products you use daily can be a great investment strategy, which has proven true with Procter & Gamble (PG 0.54%). The company's household products include brands like Bounty, Old Spice, Febreze, and hundreds more. Like Coca-Cola, consumers buy Procter & Gamble's products regardless of the state of the economy because people generally won't cut hygiene or house cleaning from their budgets.

PG Revenue (TTM) data by YCharts

You can see this in the company's financials above: Procter & Gamble's 66-year dividend growth streak makes it one of the longest-running dividend payers on Wall Street. With a dividend payout ratio of just 62% and $8 billion in cash, the company's 2.5% yield is a dividend investors can rely on.

3. 3M

Notice a theme here? This list features companies whose products penetrate the daily lives of consumers everywhere. Industrial conglomerate 3M (MMM 0.86%) isn't as evident as the first two, but the same lesson applies. The company's products are used across industries worldwide, from adhesives for manufacturing products to Post-it notes used in the office to the N95 masks used during the COVID-19 pandemic.

MMM Revenue (TTM) data by YCharts

3M has raised its dividend for the past 64 years, enduring both good and bad economies as an industrial company. It sells more than 60,000 products, meaning it never lives or dies by any one piece of business. Investors can enjoy a dividend yield of 4.1%, and the dividend payout ratio is 67% of cash flow, which likely means the payout is safe for the foreseeable future.

4. Johnson & Johnson

Healthcare is one of the most critical aspects of society and an industry virtually guaranteed to grow as humanity strives to live longer and healthier. Johnson & Johnson (JNJ 1.49%) plays a role in that; from Tylenol to Band-Aids, its consumer products, medical devices, and pharmaceutical drugs are sold throughout the world.

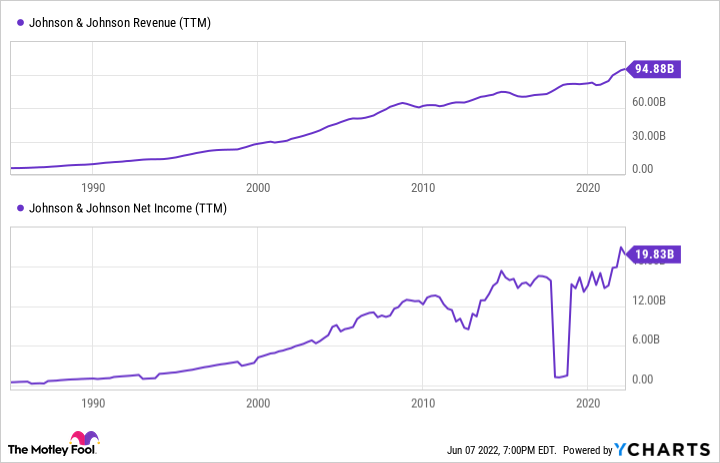

JNJ Revenue (TTM) data by YCharts

Johnson & Johnson is one of the only companies with a AAA credit rating from the major credit bureaus, which bolsters a dividend raised for 60 consecutive years. You'll struggle to find a stock that pays a more reliable dividend, and its 2.5% yield is nothing to sneeze at. The company will soon divest its consumer products into a new company, which could create additional value for shareholders.

5. McDonald's

Most people love a guilty pleasure, and restaurant chain McDonald's (MCD 0.37%) has been flipping cheap and delicious burgers since the 1950s. Today, the company is an international food giant with 38,000 locations across more than 100 countries. McDonald's is a franchise business that sells its branding rights to restaurant operators, who pay the company rent on the building and sales royalties.

MCD Revenue (TTM) data by YCharts

The franchise model keeps McDonald's cooking up profits, paying a legendary dividend raised for the past 47 years. The 2.2% dividend yield might not knock your socks off, but McDonald's is one of the most lucrative stocks of all time, with total lifetime returns of more than 93,000%, with dividends reinvested. As long as people enjoy a cheap guilty pleasure, the company might keep delivering.

One key takeaway

These companies certainly aren't offering shiny new technology, but their products are things you see in everyday life, are simple to understand, and have proven records of success that go back decades. For investors just starting on their journey for passive income, these stocks can be building blocks that you can count on.