One of the best ways to make money in stocks is to buy dividend stocks. When inflation is running high, dividend stocks are an even better investment.

According to Fidelity, dividends have accounted for 40% of the S&P 500's total returns since 1930. During high-inflation decades like the 1940s and 1970s, dividends have accounted for as much as 71% of the market's total returns.

Companies that pay dividends need to have growing businesses that generate cash flows. With the recent market sell-off, many of these companies are trading at a discount to their historical values. Here are three of those companies.

1. Walker & Dunlop

Walker & Dunlop (WD 1.18%) provides financing in the multifamily housing market, including apartment buildings and multi-unit houses.

The lender stands out because of its impressive growth over the last decade. From 2011 to 2021, Walker & Dunlop grew the total amount of financing for multifamily and other property lending at an impressive 32% compound annual growth rate (CAGR) -- making it the largest multifamily lender in the U.S. through loans from the Federal National Mortgage Association, or Fannie Mae. This translates into stellar growth on the top and bottom lines, with revenue growing at a 24% CAGR and diluted earnings per share (EPS) growing at an 18% CAGR.

The lender's growth is impressive, but it's not stopping there. Walker & Dunlop has ambitious goals to expand its investment banking capabilities, focusing on helping real estate companies.

To accomplish this, the lender acquired Zelman & Associates, a provider of research and analytics in the housing market. Zelman advised on the initial public offerings (IPOs) of Rocket Mortgage and Invitation Homes in recent years.

Walker & Dunlop is scaling the business through acquisitions and has other tailwinds working in its favor, including a wave of refinancings that should help it add to its market share.

The stock has taken a hit along with the rest of the market, and is down 38% since the start of the year. Today it trades at a cheap price-to-earnings ratio (P/E) of 11, slightly below its 10-year average, and yields investors a solid dividend that now checks in at 2.6%.

WD PE Ratio data by YCharts

2. Assurant

If you've ever purchased extended warranties for your cellphone, appliance, or vehicle, there's a good chance you've done business with Assurant (AIZ 0.44%).

Assurant focuses on the "connected economy," covering 63 million cellphones with its protection plans, and is eyeing a global market of 300 million devices. It also offers vehicle-service contracts, which it believes will grow in popularity as the costs of used car prices and car repairs skyrocket. It currently covers 54 million vehicles, but there is a global market of 400 million vehicles that could require extended warranties.

Assurant has found a profitable niche, and since 2017 the company has increased its net earned premiums to $8.6 billion, for an 18% CAGR. Analysts have high expectations for the company, forecasting earnings per share (EPS) growth of 36% this year and another 14% next year.

Assurant now trades at a P/E of 7.5, far below its 10-year average of 15.4, and it also yields investors a 1.58% dividend.

AIZ PE Ratio data by YCharts

3. Cincinnati Financial

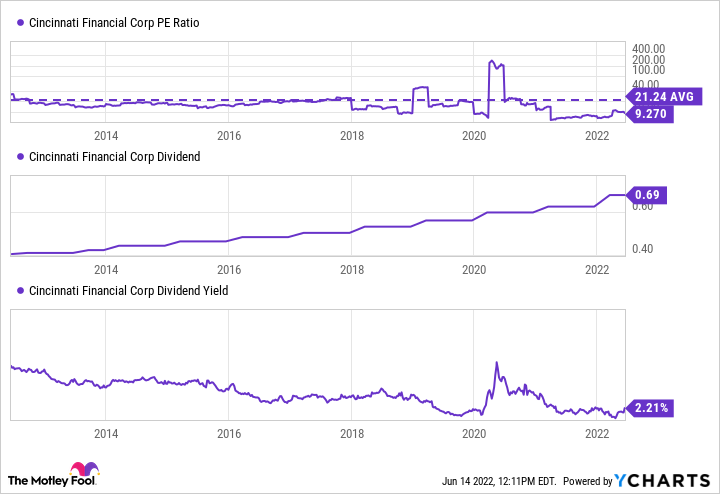

Cincinnati Financial (CINF 0.84%) writes insurance policies for individuals and businesses across the property, automotive, and homeowners insurance markets.

Cincinnati Financial is a top dividend stock, increasing its dividend payment for 62 consecutive years, making it a member of the exclusive Dividend Kings club. Only eight companies have increased dividends for a longer period.

Achieving Dividend King status is no easy feat. Insurers closely monitor the combined ratio, which measures claims paid out plus operating expenses divided by premiums written. A ratio under 100% is desirable because it means a company is taking in more premiums than it's paying in claims and expenses. Risk is the name of the game in insurance, and those who balance it well reap the rewards. Since 2011, Cincinnati Financial has managed risks skillfully, averaging a combined ratio of 94.6% -- below the industry average of 99%.

CINF PE Ratio data by YCharts

Cincinnati Financial trades at a P/E ratio of 9.3, below its 10-year average of 21.2, and yields investors a solid dividend of almost 2.4%.