A stock market sell-off can be nerve-wracking, but it also makes dividend investing lucrative, given the higher yields as stock prices fall. That doesn't mean you should chase yields, but some dividend stocks deserve your attention in a market sell-off more than ever.

These are the ones that can back their yields with sustainable -- even growing -- dividends and generate passive income for you, usually even during a recession like the ones economists are predicting for 2023. Here are three such supercharged dividend stocks you can buy right now.

One of the safest energy dividend stocks now

Enterprise Products Partners (EPD -0.47%) stock is down more than 10% so far this month, as of this writing. Every dip is an opportunity to buy this massive 7.9%-yielding stock.

Although oil prices have skyrocketed in recent weeks, many believe the heated market could cool off just as quickly if the economy slows down or slips into a recession. Crystal-gazing doesn't work for the oil and gas markets, but you don't require a crystal ball to know that rock-solid dividends can hugely help investors ride out any volatility in the oil markets. That's what Enterprise Products stock can do for you.

Enterprise Products has increased dividends every year for 23 consecutive years and grown them at an impressive compound annual growth rate (CAGR) of 7% over the period. Fueling that dividend growth is the company's midstream business model, which generates stable cash flows, and prudent capital allocation prioritizing shareholder returns.

Right now, Enterprise Products' cash flows are more than sufficient to fund its growth projects and dividend payout. Its distributable cash flow covered its dividend 1.8 times in the first quarter.

No matter where oil and gas prices are headed, Enterprise Products should continue to transport crude oil, natural gas, natural gas liquids, and refined products under its long-term, fee-based contracts. Also, thanks to the company's $4.6 billion worth of projects under construction, you can bank on this high-yield dividend stock for years to come.

Want quarterly dividend raises? This stock's for you

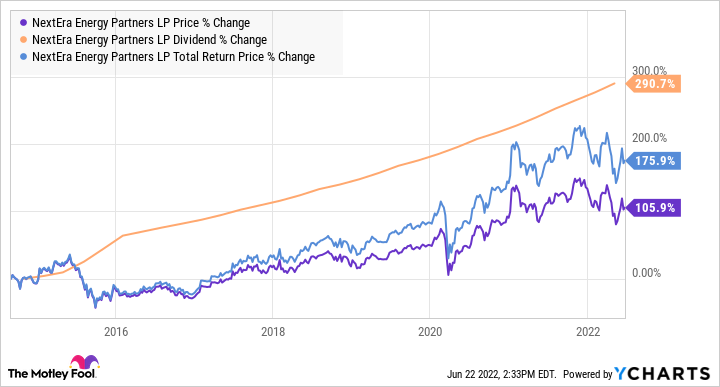

NextEra Energy Partners (NEP 1.50%) has turned out be a stupendous dividend growth stock since its initial public offering (IPO) in late 2014. It's also increased its dividend every quarter since.

The very premise for NextEra Energy Partners' dividend growth lies in its core business objective: The company acquires ownership interest in long-term, contracted clean energy assets from sponsor NextEra Energy or third parties with the sole purpose of generating stable cash flow and paying out high dividends to shareholders.

So far, NextEra Energy Partners hasn't disappointed investors. Its portfolio has grown from 1 gigawatt (GW) in 2014 to more than 8 GW in 2021, and dividends have risen alongside. So have shareholder returns over the period.

Backed by a world-class sponsor that expects to spend a whopping $85 billion to $95 billion on growth projects through 2025, there should be no dearth of growth opportunities for NextEra Energy Partners. That also means bigger dividends for you, likely in every quarter.

NextEra Energy Partners, in fact, aims to increase its annual dividend by 12% to 15% through 2025. If the dividend can grow by 15% annually, NextEra Energy Partners stock could be paying you an annual dividend of almost $4.95 per share by 2025. With the stock now almost 20% off its 52-week highs and yielding 4.2%, it's an attractive deal.

A dividend growth gem that'll pay you more even in a recession

Brookfield Infrastructure (BIP -1.06%) (BIPC -0.51%) is the kind of dividend stock that often flies under Wall Street's radar, despite its potential to make investors rich. It's also the kind of stock you can rely on for a steady stream of dividends, even in a recession.

That's because Brookfield Infrastructure owns and operates assets in highly regulated and contracted industries, which means stable cash flows. Think utilities, midstream oil and gas, railroads, and toll roads.

Image source: Brookfield Infrastructure's corporate profile presentation for May.

To put a number to that, 90% of Brookfield Infrastructure's cash flows are regulated or contracted. What's more, 70% of its cash flows are also indexed to inflation, so any periodic rate hikes as per contract terms are adjusted for inflation.

That makes its cash flows hugely reliable during periods of rising inflation and interest rates, and a looming recession. With cash flows so predictable, it's not surprising that Brookfield Infrastructure has been able to grow dividends at a 10% CAGR since inception in 2009.

Even if the economy slows down, you can expect at least 5% growth in Brookfield Infrastructure's dividend every year. The stock also yields a respectable 3.8% right now, making it a gem of a dividend stock that you may want to own.