Costco Wholesale (COST 0.06%) has been caught up in the broader market sell-off. The brick-and-mortar retailer has done an excellent job since the coronavirus outbreak, capitalizing on rising customer demand. It was deemed an essential retailer and allowed to stay open when non-essential businesses were forced to close their doors to in-person shoppers.

Given its solid growth in sales and profits, combined with a falling stock price, it's no surprise that some investors are asking if this is an excellent time to buy Costco stock. Let's evaluate below.

Costco is sustaining the momentum

In its most recent fiscal quarter, which ended on May 8, Costco's overall revenue increased to $52.6 billion. That was up from $45.3 billion in the same quarter of the prior year. Recall that this time last year consumers were flush with more cash after receiving stimulus checks from the government. Moreover, business restrictions on non-essential enterprises were more common, leaving consumers with fewer choices on where they could spend their money. Costco's sales growth on top of that difficult comparison to last year is impressive, to be sure.

The trend may continue for the next several quarters. Costco has developed a reputation among consumers for providing excellent quality at great prices. This is evident in Costco's relatively skinny operating profit margin over the last decade despite revenue rising by nearly $100 billion. Folks may look to Costco more often as soaring inflation pinches purchasing power. The consumer price index, which measures what folks pay for a basket of goods, jumped by 8.6% in May, a rate not seen in more than four decades.

US Consumer Price Index YoY data by YCharts.

Another clue to Costco's solid prospects is in its membership totals. People are so eager to shop at Costco's warehouses that they are willing to pay annual fees for the privilege. As of May 8, Costco boasted 64.4 million membership households, up 6% from the same time last year. Costco offers basic and executive memberships at $60 and $120 annually. Historically, it has raised the membership fee roughly every five years.

The last fee increase was in 2017, so the timing of an increase is approaching. Considering that it has over 60 million members and that membership fee income nearly all flows to the bottom line, even an increase of $5 and $10 could significantly boost profitability.

Costco's excellent prospects are no secret

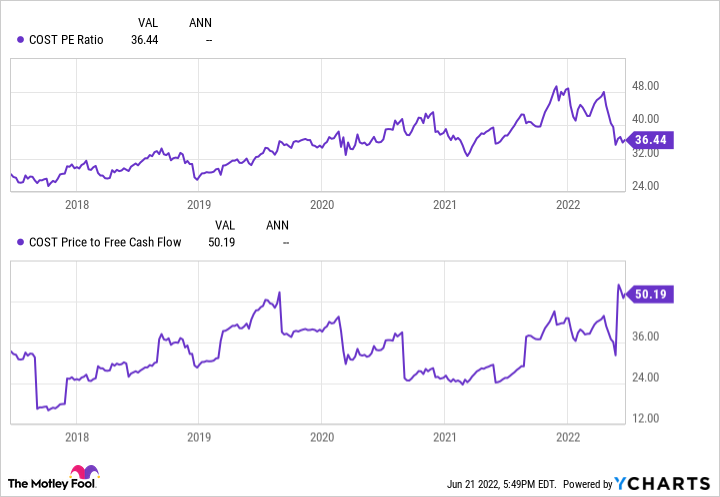

COST PE Ratio data by YCharts.

Costco is trading at a price-to-earnings (P/E) ratio of 36 and a price-to-free cash flow ratio of 50, suggesting a valuation near the higher end of its average over the last five years. Investors are undoubtedly aware of retailer's excellent prospects. Therefore, it may be prudent for those interested in buying Costco stock to wait for a pullback before starting a position. Given the volatile stock market of late, you may not have to wait very long.