Cathie Wood's fame as a star stock picker has taken a hard hit this year. Wood is an advocate of disruptive innovation, and therefore owns some of the highest-flying growth stocks in her ARK Invest group of exchange-traded funds (ETFs). With growth stocks plunging in this bear market, Wood's net worth has eroded as well.

But she seems unperturbed and is, in fact, using the market sell-off to double down on some of her highest-conviction stocks. Here are three that she is buying right now that you want to put on your list, too.

Cathie Wood sees 560% upside in this stock

Global sales of electric vehicles (EVs) doubled to a record 6.6 million units in 2021, and the momentum continues. EV sales climbed 75% year over year in the first quarter this year, according to the International Energy Agency.

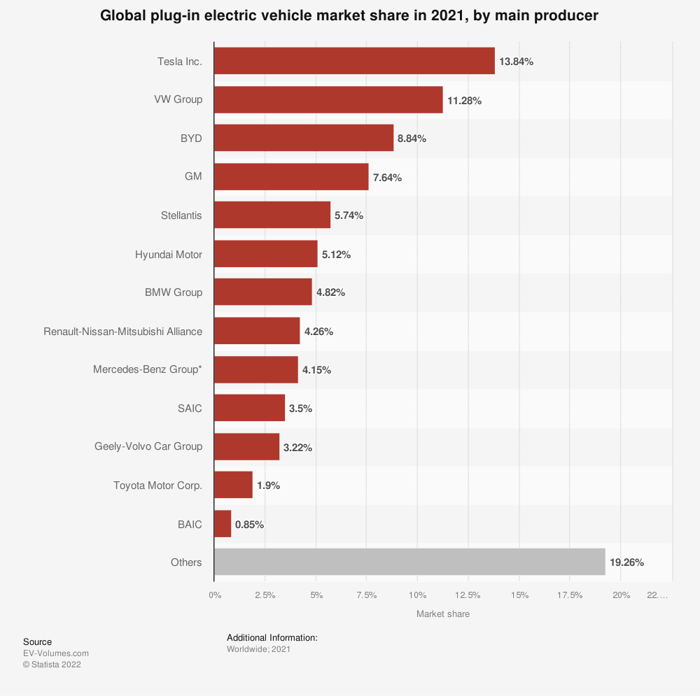

Guess which EV manufacturer is leading from the front: Elon Musk's Tesla (TSLA -1.92%). What you see in the chart below, though, is Tesla's global market share. In the U.S., Tesla cornered 75% of the EV market in the first quarter of 2022.

The first quarter, in fact, was a record sales quarter for Tesla, and its operating margin also jumped by more than 4 percentage points year over year despite surging raw material costs.

Wood is hugely bullish on EVs and (unsurprisingly) bullish about Tesla. ARK Invest's latest stock model, in fact, pegs Tesla to be worth a whopping $4,600 per share by 2026, up about 560% from today. With the company now proposing a 3-for-1 stock split, that target would imply a price of $1,533.33 if the stock splits and all else remains equal.

Wood is backing her optimism with regular purchases of the EV stock. It is, in fact, the largest holding across all ARK Invest ETFs combined, with a weighting of 7.23% across all of them as of June 21. If you're bullish about EVs, you simply can't ignore Tesla.

Wood believes this stock can be the next Amazon

Cathie Wood has owned Shopify (SHOP 0.23%) for several years now, and she's been buying the recent dip in the e-commerce stock. The shares, in fact, have plunged more than 70% in 2022 alone. The company is a victim of the sell-off in growth stocks this year, with fears of an economic slowdown exacerbating investors' worries.

Yet it continues to grow, even if it is at a slower pace compared with the past year or two. And it is making calculated moves like acquiring Deliverr to catch up with Amazon (AMZN -2.56%), which has a huge lead in the U.S. retail e-commerce market. But challenges to the giant's key competitive advantages like one-day and two-day delivery should help Shopify gain traction.

In an interview with BBN Bloomberg last year, Wood even projected Shopify to become the next Amazon, given the opportunities in social e-commerce, or the ability to buy and sell products through social media platforms. Shopify, for that matter, has tie-ups with every major social media company.

The stock's 10-for-1 split is coming up on June 28, and that has revived some bit of investor interest in the languishing stock. Wood, of course, is eyeing Shopify stock for its long-term potential and not the stock split. So should you.

The little-known stock Wood is buying in the market sell-off

TuSimple Holdings (TSP) is perhaps one of the least-known Cathie Wood stocks, but it's easy to see why ARK Invest is loading up on it: The fund family considers autonomous vehicles as one of the biggest innovations, and projects that revenue from autonomous logistics will grow from almost nil today to $900 billion in 2030.

A TuSimple autonomous truck. Image source: TuSimple.

TuSimple develops autonomous driving systems for semi trucks, and has partnered with Traton, owner of the Navistar and Scania truck brands, to build semi trucks with Level 4 (L-4) self-driving technology (true self-driving, but with limited capabilities). TuSimple currently has nearly 100 L-4 autonomous semi trucks in operation, with 75 in the U.S. and 25 in China. But the crux of TuSimple's growth lies in its autonomous freight network (AFN) launched in 2020.

AFN is a mapped network of routes and terminals within which autonomous trucks can move freight with real-time tracking and monitoring. TuSimple offers two options:

- The carrier-owned capacity model: Customers purchase L-4 autonomous trucks and pay TuSimple a per-mile subscription fee to move freight within its AFN.

- The TuSimple capacity model: Customers pay the company an access fee based on miles to use its trucks and AFN.

TuSimple says it expects to derive "substantially" all of its revenue from AFN. Right now, though, it generates revenue only under the second option and is growing -- its revenue shot up 140% to $2.3 million in the first quarter.

By 2026, TuSimple expects to generate its first meaningful revenue from carrier-owned capacity.

There's potential, but also risks, in a start-up stock. Yet Cathie Wood bought TuSimple shares in March before buying them again twice so far in June, perhaps to take advantage of the correction in the stock. At this price, you also might want to keep this stock on your radar.