Did you know that over the past 10 years, the Nasdaq has been a much better place to invest in than the S&P 500? With over 300% gains, it's dwarfed the broader index, which has increased by less than 200% during the same time frame. And that's with factoring in this year's downturn in the markets.

The Nasdaq is home to some of the best growth stocks in the world. And a drop in valuations could create a fantastic buying opportunity for investors willing to buy and hold. A couple of the best stocks you can buy on the Nasdaq today are Align Technology (ALGN 0.40%) and Netflix (NFLX -0.51%).

1. Align Technology

Align Technology, the company behind the popular Invisalign clear aligners for teeth, has been experiencing tremendous growth over the years. While there have been some recent fluctuations due to the pandemic, over the past five years, the company has averaged a growth rate of more than 33%:

ALGN Revenue (Quarterly YoY Growth) data by YCharts.

The company's growth rate has stalled of late due to challenging economic situations across the globe. COVID-19 lockdowns in China have also had a negative impact on the company's business. It may still be a challenging road ahead for Align as its aligners can cost close to $2,000 or more -- a big cost to take on amid soaring inflation. While patients can pay over multiple years, it may limit demand for the aligners in the near term.

As a result of the slowing sales growth and the challenges that lay ahead for the business, the stock is down a whopping 62% this year, while the Nasdaq is down a more modest 26%. However, the company, showing confidence in its business, decided that this downturn is a great time to buy up shares. In May, Align announced an accelerated stock repurchase agreement where it will buy back $200 million worth of common stock before the end of July. CEO Joe Hogan also plans to buy $2 million worth of stock.

Investors may want to follow suit as analysts from Grand View Research expect huge growth from this sector. They anticipate that the global clear aligners market to expand at a compound annual growth rate of 29.5% until 2030. As a leader in the industry, Align could make for an excellent buy-and-forget investment.

2. Netflix

Streaming-giant Netflix is also down big this year. At close to 70%, its losses have sent the stock back to 2017 levels. Last year, most investors likely would have jumped at the chance to buy Netflix at 2017 prices. Now, it has suddenly become a horrible buy because of a slowdown in subscriber numbers. The company has laid off hundreds of employees this year in an effort to curb costs as its revenue growth slows.

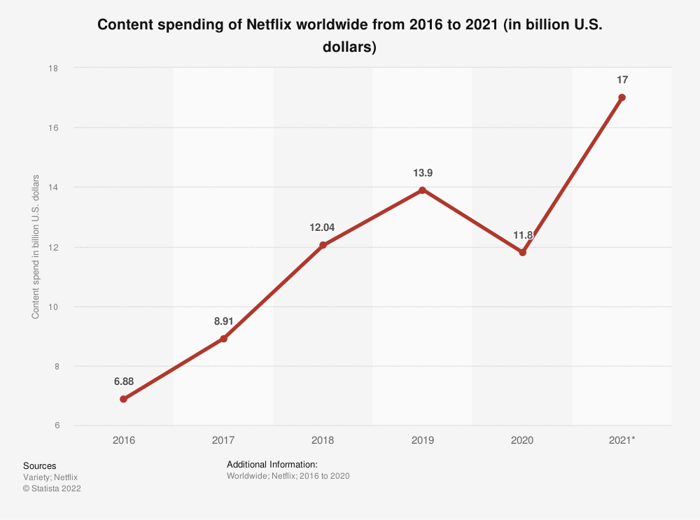

However, I'd argue this is a good thing for long-term investors. For far too long, Netflix knew about password sharing and piled on more content than was likely necessary. The company has tons of content that it probably doesn't need, and there could be significant cost savings out there just by being more diligent. Meanwhile, cracking down on password sharing could help it add more revenue, and so could adding an ad-supported tier.

By focusing more on costs, the business may be better off in the long run. When a business is growing fast and sales are soaring, everything is great and no one slows down to think about expenses because the company is beating expectations. But once that stops, suddenly those costs become a concern.

However, Netflix's business isn't broken by any means. The sell-off has been extreme and the stock could be one heck of an investment if the business can trim some unneeded expenses. This is still a remarkable company that over the trailing 12 months has reported a profit of more than $5 billion on revenue of $30 billion, for an impressive profit margin of 16%.

Investors should consider buying the stock and not the fear. Netflix may be one of the best bargains out there today, trading at just 17 times its profits.