The year is halfway over and there's still plenty of bearishness to go around. Good stocks, bad stocks, they're all falling in value. But entering July, Elanco Animal Health (ELAN 1.19%) and Mastercard (MA -1.19%) are two of the best and safest growth stocks to be loading up on for the long haul.

These companies possess significant potential, and are in sectors that could do well this year and beyond. Investing $5,000 into either one of these stocks may result in robust profits within the next year or two as they are likely overdue for a rally.

1. Elanco Animal Health

Elanco is one of the largest animal health companies in the world, and buying shares of the business can be a great way to gain exposure to the growing pet health market. The company produces medication and products that help people raise healthy pets and farm animals.

The healthcare stock is down 28%, however, performing worse than the S&P 500 (which has fallen by 18%). One reason investors may be selling it is due to underwhelming guidance. Although Elanco's revenue rose by 46% last year to $4.8 billion, the company is only forecasting revenue growth between 2% and 3% this year (that's after excluding the negative impact of foreign currency).

One problem for investors is that the bulk of Elanco's revenue (55% last year) comes from international markets, which can add volatility. The war in Ukraine and COVID-19 lockdowns in China are a couple of the headwinds that have been impacting the company's business in 2022.

But there's plenty of long-term growth on the horizon. Fortune Business Insights projects that the global animal health market will expand by a compound annual growth rate (CAGR) of 6.3% through 2026. And so while the short term may be concerning, the bigger picture is that Elanco still has much more room to grow.

Shares of Elanco have bounced back since hitting a new 52-week low earlier this month, but this could still make for an underrated growth stock to buy and hold right now.

2. Mastercard

One sector that's growing at a faster rate than pet health is the global credit card payments market. Allied Market Research estimates that it will expand at a CAGR of 8.5% until 2028. And in the short term, there could be some surprising tailwinds for Mastercard.

With inflation pushing prices up, consumers may need to dip into their credit cards more than in the past. Pent-up travel demand could make it difficult to resist booking a vacation even though now may not be an opportune time to do so given the rising prices.

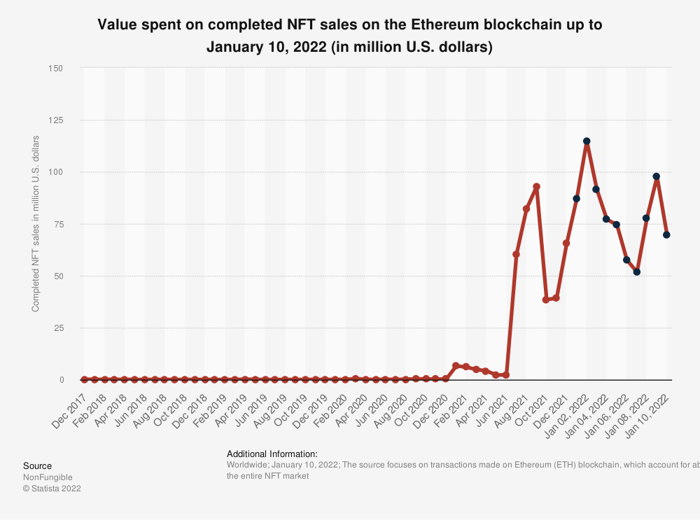

Yet another growth avenue for the business is through non-fungible tokens (NFTs). Mastercard is now making it possible for its cardholders to buy NFTs without even having to buy cryptocurrency first. And given the growth in NFTs over the past year, that could unlock significant potential for the credit card company:

Mastercard's sales fell by 9% in 2020 due to the pandemic and lockdowns and travel restrictions. Although they rose 12% this past year to $18.9 billion, that was still before there was a return to normal in the economy.

Despite inflation, the situation still looks better than it did a year ago for Mastercard. Unfortunately, its shares are down 8% year-to-date, and investors may still be overlooking the potential that it has to be a top recovery stock. And that's why now may be a prime time to buy it.