Market corrections always present opportunistic investors with excellent deals. Downturns don't last forever, and those with the foresight to load up on shares of great companies while they are down are often well rewarded.

But before pulling the trigger on a beaten-down stock, it's essential to consider the company's prospects, among many other things. That brings us to Etsy (ETSY -0.86%), a leading tech company currently experiencing a particularly challenging year on the stock market.

After going down 63% year to date, is this e-commerce specialist worth investing in?

What the bears might say

During the worst of the COVID-19 pandemic, face masks on Etsy were selling like hotcakes. More generally, much of retail activity switched to online channels during the early days of the outbreak, which benefited companies like Etsy. Its revenue and earnings soared along with the number of buyers and sellers on its platform. In a now-familiar storyline on Wall Street, Etsy's pandemic tailwind is over. The company's growth rates have slowed down considerably as a result.

In the first quarter, the tech giant's top line grew by 5.2% year over year to $579.3 million. How does that compare to the quarterly year-over-year revenue growth rates Etsy recorded earlier in the pandemic? See for yourself.

ETSY Revenue (Quarterly YoY Growth) data by YCharts

Etsy's gross merchandise sales (the total value of the transactions conducted on its platform) increased by a meager 3.5% year over year to $3.3 billion. Net income fell by 40.1% year over year to $86.1 million. There's another worry. The economy isn't doing too well right now. With inflation out of control and a recession possibly on the way, retail activity might slow down considerably, thereby affecting Etsy's top line.

Let's not forget that the company specializes in unique, vintage, and handmade items, many of which people can afford to cut back on in difficult times without significant disruptions to their day-to-day lives. In other words, things could get worse for the e-commerce company before they get better.

Reasons for optimism

Even the most successful companies encounter some headwinds; there is no such thing as a risk-free investment. For long-term investors, the key is to figure out whether the potential upside outweighs the risk. Let's look at several factors that will work in Etsy's favor beyond the next 12 months and whatever other economic-related struggles they might bring.

First, the company's platform benefits from the network effect. Etsy is a leader in a niche segment of the e-commerce industry, and those looking for vintage, handmade, and other original goods know where to turn. The more consumers flock to its e-commerce website, the more they attract sellers of these rare goods. On the other hand, an increasing number of sellers and items on the platform attract more customers.

This powerful competitive advantage makes it difficult for direct competitors (especially new ones) to disrupt Etsy's business. It partly explains why Etsy has been successful even when going up against such e-commerce giants as Amazon.

Second, the e-commerce industry is still in growth mode. According to some estimates, the market will expand at a compound annual growth rate of 14.7% through 2027. Etsy sees a $2 trillion total addressable market, and it holds a tiny 2.6% slice of this pie. No single company will capture this entire space by itself, not even Etsy. Still, the point is, there is lots of room for the company's revenue and earnings to grow.

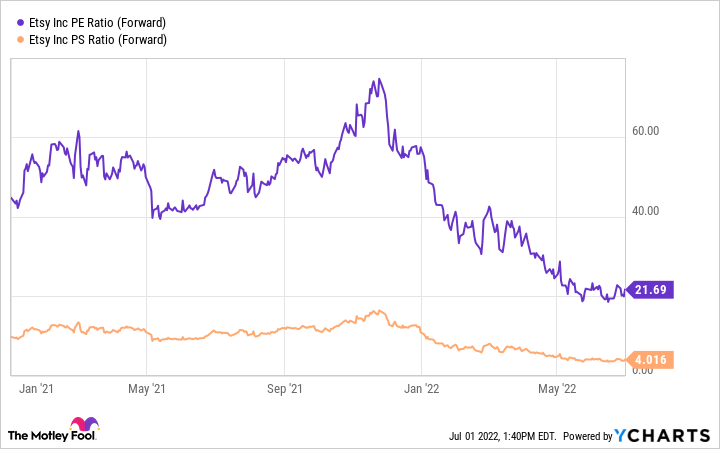

Third, Etsy looks cheaper than it has in more than a year.

ETSY PE Ratio (Forward) data by YCharts

The company's market cap is at $10 million, which seems awfully low, at least in my view. Etsy is a strong buy at these levels, especially for those planning on holding onto its shares for more than a year. Despite the company's struggles this year, Etsy's shares will be substantially up from their current levels by the end of the decade.