When COVID-19 first struck in March 2020, the stock market crashed, economic uncertainty was rampant, and we plunged into a health crisis. It also spurred something else: the rise of "pandemic stocks."

Companies like Roblox (RBLX -1.54%), Zoom Video Communications, and Peloton Interactive were seen as big winners as the way we lived, worked, and played suddenly changed. As life has returned to normal (relatively), investors confront the reality that short-term momentum stocks often fizzle. Zoom has fallen more than 70% from its high, and Peloton has seen an astounding 90% loss.

Roblox stock has fallen more than 70% from its highs, and investors wonder if it has touched bottom. These charts offer clues.

Is Roblox still growing revenue?

Roblox's gaming platform was one of the biggest beneficiaries of the pandemic. With people stuck indoors, lonely and bored, this metaverse company's interactive games offered an escape, and revenue exploded.

In Q1 2020, the company earned $161.6 million. Sales skyrocketed 250% to over $568.8 million by Q4 2021. But even during its banner year of 2021, the company lost $495 million from operations.

Clearly, growth must continue for Roblox to scale to profits. The company's growth rate has been slowing since Q1 2021, but this can be misleading. After all, going from $1 to $2 is a 100% gain, while going from $100 to $150 is only a 50% gain. I don't know about you, but an extra $50 in my pocket sounds better than $1. Instead, we can look at the actual increase (or decrease) in sales dollars for each quarter, as shown in the chart.

Data source: Roblox. Chart by author.

Revenue declined in Q1 2022, showing the pandemic momentum is hard to sustain.

Bookings and losses are concerning

In the world of software-as-a-service (SaaS), bookings are perhaps more important than sales. Simply put, bookings represent revenue the company expects to record in the future. Roblox's bookings have also turned negative, as the chart shows.

Data Source: Roblox. Chart by author.

Can Roblox become profitable with slowing growth and falling bookings? Anything is possible. However, the company lost more money from operations each successive year from 2019 to 2021 and lost more money again in Q1 2022 than in Q1 2021.

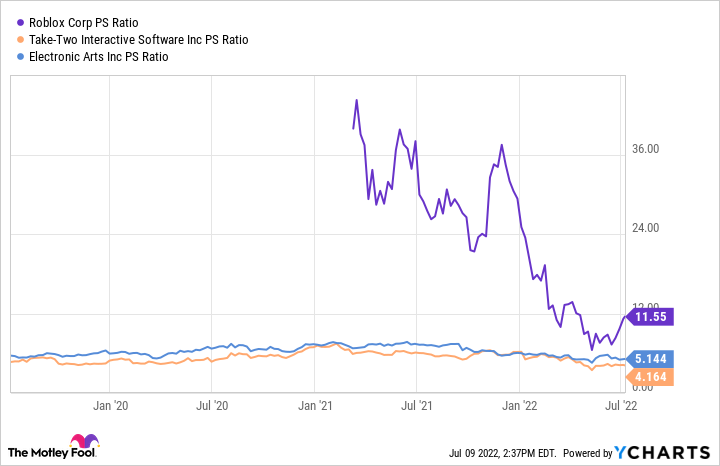

Roblox is still valued as a growth company

Roblox's stock may still be too expensive even after its 70% haircut. As shown in the chart, other gaming companies that are more mature and already profitable are valued at much lower price-to-sales (P/S) ratios.

RBLX PS Ratio data by YCharts

Roblox is an exciting company, and the metaverse is a compelling new technology. However, that doesn't mean that the stock is a terrific investment. The metrics above suggest further downside potential.