Investing in stocks is not for the faint of heart. Unlike other asset classes like real estate where investors rarely experience extreme volatility, the stock market has a tendency to test the emotional fortitude of its participants.

And 2022 is just the latest episode in the saga.

With the S&P 500 declining as much as 23% year to date and its tech-heavy cousin, the Nasdaq Composite, down even worse, there are investors who will likely leave the market for good in the coming weeks (if they haven't already). In fact, a recent survey by Allianz Life found that 43% of investors are too nervous to buy stocks at current levels.

But if the goal is to buy low and sell high, why would investors be hesitant to buy when stocks are cheap?

This is the investor's dilemma. We all say we are going to buy when the market is down, and yet when the opportunity presents itself, we find it difficult to pull the trigger. Here are three reminders to help you stay the course so your portfolio can come out of this bear market on top.

Image source: Getty Images.

Net buyers of stocks win long term

One of the simplest reminders to calm one's nerves during a bear market is that the market has never failed to recover from past crashes.

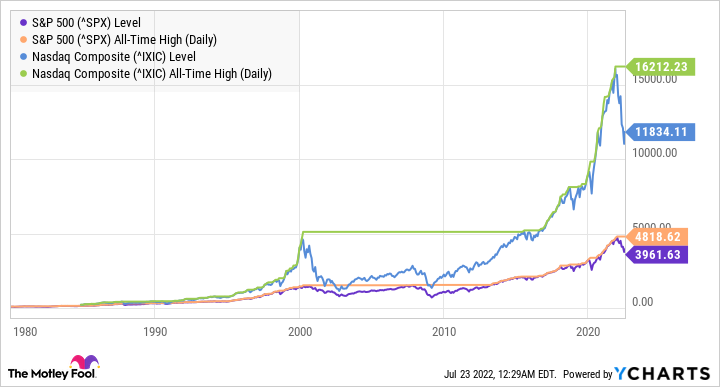

Consider the chart below that tracks the overall returns of the S&P 500 and Nasdaq as well as their all-time highs over the past several decades.

Data by YCharts.

This chart might be a bit confusing at first glance, but it's actually pretty simple. The straight horizontal lines represent the period of time between all-time highs in both indices.

There are two important takeaways:

- Both indices have recovered from every crash to reclaim their all-time highs and surge even higher.

- There have been extended periods of time for both indices before those all-time highs were recovered.

The second takeaway is not as uplifting, but it should actually be the bigger motivator to keep investing through bear markets. If you are planning to wait until the market recovers to begin investing, just know you could be waiting over seven years based on the S&P 500's longest recovery.

Even worse, the tech investors who exited the market after the dot-com bubble missed out on nearly 300% of Nasdaq gains over the next 15 years:

Data by YCharts.

Finally, here are a couple more stats to support remaining a net buyer of stocks today:

- Half of the market's best trading days take place during bear markets.

- Midterm election years tend to be brutal for stocks, but the average gain in the S&P 500 the following year is 32% (according to LPL Research).

Buying what you know gives you an edge

When the market gets me down, I often turn to the words of legendary mutual fund manager Peter Lynch.

He said the following about using your unique edge when buying stocks:

People have incredible edges and they throw them away [...] If you'd worked in the auto industry -- let's, say you have been an auto dealer for the last 10 years -- you would have seen Chrysler, come up with the minivan. If you were a Buick dealer, a Toyota dealer, a Honda dealer, you would have seen the Chrysler dealership packed with people. You could have made 10 times your money on Chrysler a year after the minivan came out.

Lynch's point is instead of chasing hot stocks, look for companies in your area of expertise.

People are more than willing to pile money into industries they know nothing about because the rest of the market is doing so, even when there are huge opportunities in their own fields of expertise.

So, if you're feeling frightened about putting money in the market right now, consider looking at stocks where you have a unique advantage. To be honest, this is good advice in any market cycle, but it can give you the conviction you need to keep investing during bearish periods.

Put on your contrarian hat

To succeed in investing, it can pay off looking at the market in a contrarian way. And in a bear market, there are tremendous opportunities to be a contrarian.

Right now, many investors are throwing out pretty much all technology companies. The market is collectively saying that because inflation is higher and interest rates are on the rise, technological growth will stall for the foreseeable future.

Much of this is muscle memory from the dot-com crash when hundreds of companies went public with weak to nonexistent underlying business models. But many of the technology companies that have sold off the past year are highly profitable and driving society forward in the digital world.

I doubt rising interest rates will significantly deter this advancement, and investors buying up quality growth companies at cheap prices will likely reap the rewards in the future.