What happened

Shares of FuboTV (FUBO 7.46%) popped over 20% this week, according to data from S&P Global Market Intelligence. The live-TV streaming platform released its second-quarter earnings report after the market closed on Aug. 4, driving shares up over 20% in after-hours trading. On top of a resurgence of meme and growth stocks this week, that has sent Fubo's shares into the stratosphere.

So what

On Aug. 4, Fubo released its Q2 earnings report. Revenue grew 70% year over year to $222 million in the period, with subscribers in North America up 47% to 947k. Clearly, investors are excited about the growth numbers Fubo is putting up, with the stock soaring in after-hours trading the day of the report.

Fubo also benefited from broad market movements this week. Even before its earnings announcement, shares were up as much as 19.5% since last Friday's close. Why? It is hard to pinpoint an exact reason, but it is likely that Fubo stock is trading higher because of a resurgence of the 2021 meme stocks this week. For example, Gamestop, one of the most famous meme stocks from last year, is up 13.4% this week. While it may seem silly, after 2021, it shouldn't be surprising that stocks can fluctuate this wildly in such a short time period.

But don't get too excited about Fubo's prospects. The company is hemorrhaging money because of all the licensing/royalty payments it has to make to essentially bring the cable bundle to connected television (CTV). It has a net income margin of -52.4% and has burned $218 million in operating cash flow through the first six months of this year. The balance sheet only has $373 million in cash and equivalents right now. Fubo needs to reach profitability -- and fast -- or it is going to have to raise more money from investors, potentially at a discounted stock price.

Now what

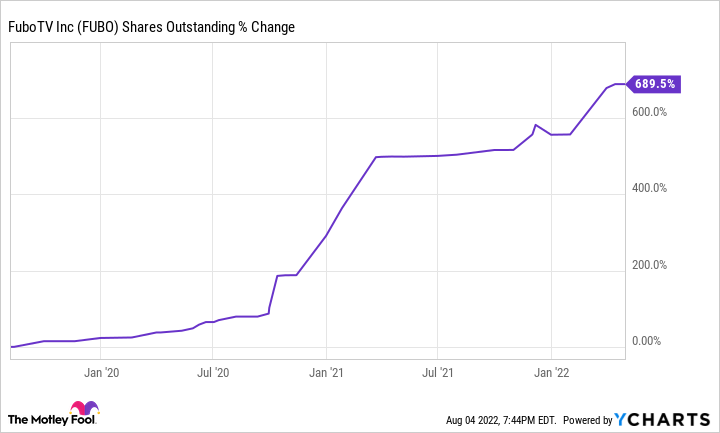

Investors should stay far away from Fubo stock because of how unprofitable the business is and the hypercompetitiveness of the streaming video industry. However, its history of share dilution should also frighten you. Over the last three years, shares outstanding are up 690%, heavily diluting any shareholders who have held over that time frame.

FUBO Shares Outstanding data by YCharts.

As long as Fubo remains heavily unprofitable, it will have to continue diluting stockholders through share offerings. Unless that changes, investors should avoid buying the stock.