What happened

The Inflation Reduction Act officially passed the Senate yesterday, causing a bounce in alternative energy stocks today. After Sen. Joe Manchin and Sen. Chuck Schumer reached a deal a couple of weeks ago, some holdouts and sticking points were cleared yesterday. Now, the bill goes to the House of Representatives, where Democrats have a majority and an easier path to passing the bill.

Westport Fuel Systems (WPRT -0.62%) was up as much as 21.2% today, Blink Charging (BLNK -2.54%) jumped 6.3%, and Lordstown Motors (RIDE) was up 8.3%. Shares were up 10.6%, 4%, and 2.4% respectively at 1 p.m. ET.

So what

Today's move wasn't so much company specific as it was a boon for the entire alternative energy space. The nearly $370 billion package will add tax benefits for building alternative energy assets and installing them.

The electric vehicle tax credit will remain at $7,500 for new vehicles and won't expire as companies ramp up sales, as was previously in place. There's also a $4,000 credit for buying a used electric vehicle, which is new.

There are also tax benefits for alternative energy manufacturing in the U.S., including solar panels. The bill hasn't passed the House of Representatives, but it's expected to pass by the end of the week.

Companies like Westport, Blink, and Lordstown, may not directly feel the benefits, but there will be benefits to customers or adjacent industries that should increase demand.

Now what

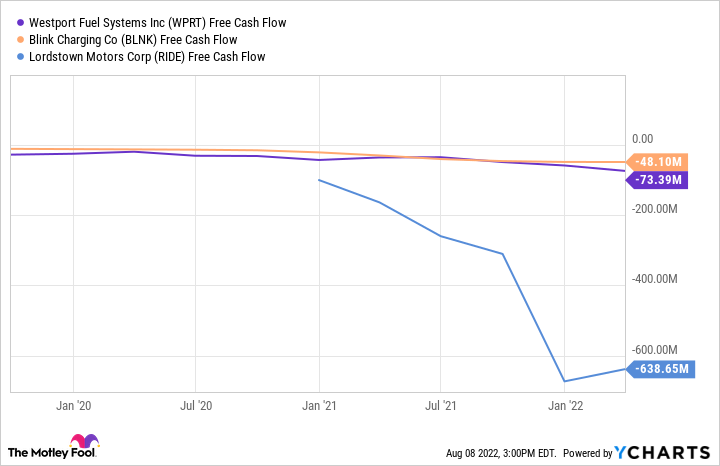

This is a major piece of legislation related to climate change, but it doesn't fundamentally change the outlook for any of these companies. Cash burn is still high at a time when the industry is maturing and companies are starting to generate stable profits.

WPRT Free Cash Flow data by YCharts

Historically, subsidies haven't significantly changed the trajectory of energy companies and in the case of these companies, there may not be as much direct money for them as investors are expecting.

I think there are better ways to play the new subsidies like leading electric vehicle manufacturers or solar installers, which already have scale and will directly feel the subsidy benefit.

The reality is that not all technologies will survive or thrive long-term. Chargers, for example, don't have a clear path to profitability or a way to build a differentiated business model. It's a commodity that can be built by anyone, which will squeeze profits.

As a result, I'm not buying this bounce today. I'm bullish on alternative energy, but I want to see how subsidies benefit the industry before investing more in speculative companies.