If you've got $5,000 you can afford to invest right now, you should strongly consider doing so. Although the markets aren't in great shape this year, that doesn't mean that all stocks are bad buys or that they will struggle.

A couple of stocks that are doing exceptionally well this year are Veru (VERU 22.41%) and Chevron (CVX 0.75%). Here's a look at why they've been great buys thus far and whether you should consider adding them to your portfolio.

1. Veru

Pharmaceutical company Veru has been among the hottest stocks to own this year, having more than doubled in value while the S&P 500 is firmly in negative territory, down 13%. The main catalyst behind the business has been its COVID-19 drug, sabizabulin. The company and its investors are hoping that the Food and Drug Administration (FDA) grants it Emergency Use Authorization (EUA) as phase 3 trials have shown it is effective in reducing the risk of death among hospitalized patients.

There's some risk with Veru because if the authorization doesn't come in (the company submitted an application for EUA in June), the stock could quickly give back much of the gains it has generated this year. And so the key question to ask yourself before buying the stock is whether you're comfortable with that level of risk. If you are, Veru could make for promising growth stock to own.

And unlike other companies hanging their hats on a COVID vaccine or treatment, Veru does have a product that already generates revenue for its business today. Through the six-month period ended March 31, the company's key product, the FC2 Female Condom, brought in more than $27 million in revenue. Unfortunately, the company's research and development costs of nearly $26 million over the same period almost wipe out that revenue all on their own.

Veru isn't a profitable business today, incurring losses of more than $20 million over the past two quarters. So if you're risk-averse, this may not be the growth stock for you, but Veru does have plenty of upside should it obtain EUA for sabizabulin.

2. Chevron

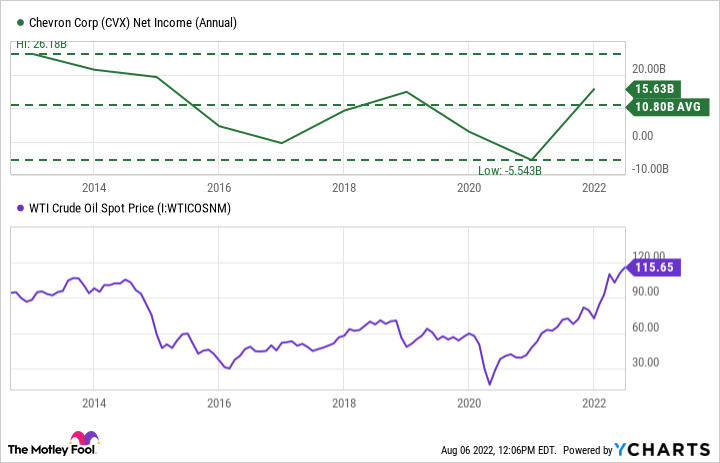

A safer option for investors is oil and gas giant Chevron. Although its business can be volatile, it generates much more revenue than Veru and it has posted a profit in three of the past four years (the lone exception being 2020, when oil prices were struggling so badly they briefly dipped into negative territory).

Nowadays, with people traveling again and the war in Ukraine still ongoing, oil prices are much higher, with West Texas Intermediate (WTI), a key benchmark for the industry, at around $89 per barrel. That's down from highs of more than $120 that it reached earlier this year. However, those were likely unsustainable levels to begin with as prior to this year, oil prices had been falling due to a supply glut.

It's likely that over the long term, prices will decline as oil production increases and demand stabilizes. But the positive for investors is that even during those years when the price of oil was low, Chevron was still profitable.

CVX Net Income (Annual) data by YCharts

Although there's no mistaking the impact that oil prices have on the energy company, Chevron has proven to be resilient for the most part. The oil and gas producer is coming off an exceptional quarter last month, when it reported earnings of $11.6 billion for the period ended June 30 -- nearly four times the $3.1 billion it posted in the prior-year period.

Another reason to consider putting $5,000 into the stock is that it pays a dividend yield of 3.7%. That equates to $185 in annual dividend income that can pad your total returns from the stock. Up 30% this year, Chevron could still continue to climb higher. Airlines are struggling to handle pent-up demand, which suggests demand for oil may still not be at its peak.

Investing in Chevron, at worst, is a good hedge against inflation this year. And at best, it turns out to be a terrific long-term buy if the price of WTI remains elevated (e.g., above $60 per barrel, which is about where it was at before the pandemic).