Data specialist Palantir Technologies (PLTR -1.04%) is a unique company. It requires top-notch talent to build complicated software solutions for some of the world's most complex tasks, including working with the most secretive parts of the U.S. government.

The story is fantastic, but sometimes it doesn't translate well to investment returns. The stock is sitting at $10 per share, the same price it went public at in late 2020. A bear market that was especially hard on tech stocks certainly deserves some blame, but there is a deeper issue that investors should know about.

Palantir's stock-based compensation strategy

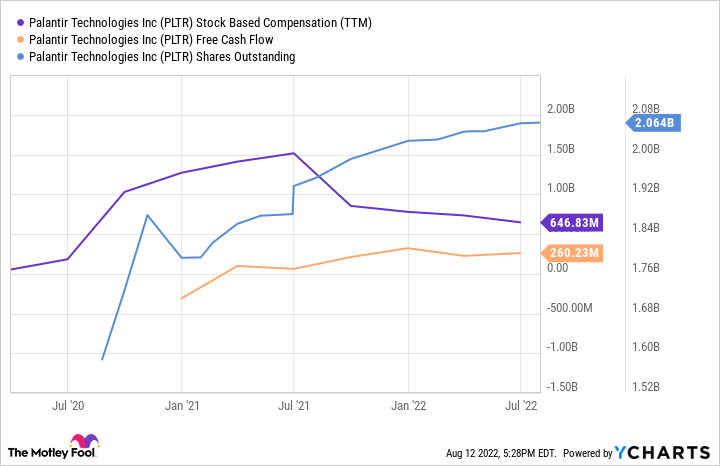

Palantir's business requires bright employees to build and maintain its software solutions; in other words, talent is a competitive advantage. Good help isn't cheap, and Palantir has chosen a strategy of luring talent with significant stock-based compensation instead of large cash salaries.

This is a double-edged sword. On the one hand, stock-based compensation is a non-cash expense, which preserves cash and has helped Palantir operate with positive free cash flow:

PLTR Stock-Based Compensation (TTM) data by YCharts.

But the downside is a share count that is continually expanding. Shares lose value when you add more because they represent a smaller slice of the company. The business must grow fast enough to overcome this loss of share value, called dilution.

But it's canceling out the company's growth

Unfortunately, that doesn't appear to be the case. Most investors look at an earnings report and see the top-line growth. For example, Palantir's revenue grew 26% year over year in Q2. Trailing-12-month revenue has hit $1.7 billion, a 94% increase since coming public in 2020.

PLTR Revenue (TTM) data by YCharts.

But almost nobody looks past that to see what dilution is doing to Palantir's shareholders. The above chart shows that revenue per share is virtually flat, wiping out all of that revenue growth on a per-share basis.

Meanwhile, growth isn't cutting it

This wouldn't be a huge deal if Palantir's growth were accelerating. Its software platforms, Gotham and Foundry, could play an essential role in how government and businesses operate in the years to come. Additionally, Palantir has just 304 customers; there is a lot of room for the company to grow.

However, Palantir's growth is slowing down, not speeding up. You can see below that the quarterly revenue growth rate has slowed from more than 48% to 26% in the most recent quarter (Q2):

PLTR Revenue (Quarterly YoY Growth) data by YCharts.

The problem is that Palantir could need to bring on more talent as it grows larger. The company's employee count increased 20% over the past year. There has to be some point where the scales tip and Palantir's business can grow faster than its share count.

It's not too late for Palantir to change its trajectory. Many companies have noted fears about a looming recession, and enterprises could be hesitant to spend money in the short term. In that light, maybe cutting Palantir some slack is fair. But this trend needs to turn around at some point. Otherwise, Palantir might end up being a cool company but a mediocre investment.