The answer is $170,000. That's how much you'd have now if you'd invested $10,000 in Deere (DE 0.25%) 20 years ago. It's a super return for a large-cap company, as elephants aren't supposed to be able to gallop. Moreover, what's remarkable about Deere's stock performance is its tripling over the last five years. The company has been doing something right, because its returns dwarf those of the S&P 500 and its peers like AGCO and CNH Industrial. Here's a look at what makes the agricultural machinery company so unique.

Why Deere's stock has outperformed

There are a few key reasons why Deere has outperformed in recent years:

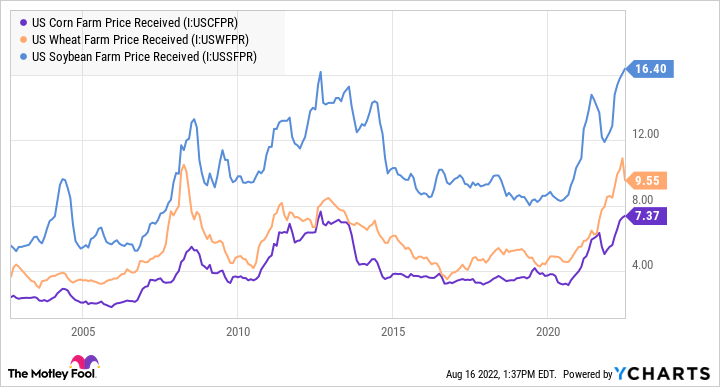

- After half a decade in the doldrums, the prices of key crop commodities like soybeans, corn, and wheat have increased significantly over the last few years (see chart below).

- The company's leadership in smart farming solutions has added a significant amount of value to its equipment and kept farmers loyal to Deere's equipment.

- Management's acquisition policy has been excellent in building its precision agriculture (smart farming) business and diversifying its end markets by acquiring a major road construction equipment maker, Wirtgen, in 2017.

As noted above, crop commodity prices have risen to historical highs recently, which is excellent news for crop farmers. It's also great news for Deere because it encourages farmers to replace aging equipment. It's also timely because it coincides with a period when Deere is aggressively rolling out its precision agriculture solutions -- more on that in a moment.

Data by YCharts.

Great acquisition history

Deere is best known for its large and small agriculture equipment, but it also has a construction and forestry segment which contributes handily to profitability. For example, the segment contributed $1.5 billion to operating profit in 2021, compared to $2 billion for small ag and turf and $3.3 billion for production and precision ag.

In addition, the $5.2 billion acquisition of Wirtgen bolstered Deere's position in road construction machinery and helped diversify its income stream. That's a major plus for investors and the company because it ensures a level of earnings and cash flow. That's important because Deere will need cash to invest in its business, even when its core agriculture machinery business is experiencing weak conditions.

Precision agriculture

Deere's acquisition strategy is an instrumental part of its precision ag strategy. Precision ag solutions use real-time data gathered from internet-enabled devices to help farmers make the right decisions in an industry fraught with uncertainty. For example, preparing the soil, planting, nurturing, and harvesting are critical decisions that hugely affect crop yield.

Deere's technology solutions are deeply embedded in its hardware. For example, it has the technology to control spraying and monitor and control fertilizer application, and solutions that use data to guide planting, spraying, and harvesting. It's a set of solutions Deere built up through organic investment and acquisitions, such as the 2017 acquisition of Blue River Technology , creators of "see and spray" technology to spray herbicide precisely.

Harvest Profit, a provider of farm profitability software, was bought in 2020, and Bear Flag Robotics was purchased in 2021. The latter is a developer of autonomous driving technology that can be retrofitted to existing tractors.

Looking ahead

Deere's leadership in precision ag has encouraged peers to follow in its steps and make acquisitions in the space. It combines the right technology at the right time (as crop prices recovered), and Deere is reaping the rewards. Whether $10,000 invested in Deere now will lead you to $170,000 in 20 years is debatable. However, no one will argue that Deere isn't the market leader in an industry (precision ag) that is only getting started in improving global crop yields. As such, investors can look forward to more earnings growth in the future.