Alphabet (GOOG 1.43%) (GOOGL 1.42%) and Amazon (AMZN 1.49%) are two of the most influential technology companies in the world. On the heels of turbulence for the market, and growth stocks in particular this year, each company's valuation is also down significantly from its previous high.

With these industry leaders potentially on track for big rebounds, investors could wonder which stock looks like the better buy at today's prices. Read on to see why two Motley Fool contributors have different views on which company will be a better performer for your portfolio.

The case for Amazon

Keith Noonan: When it comes to innovation, Amazon has an absolutely incredible track record. The company built an online bookstore into the leading overall online retail platform, and it continues to shape the direction of the e-commerce world. The tech giant also spearheaded the evolution of cloud-infrastructure services with Amazon Web Services, and the technologies it provides are at the heart of the modern internet and the evolution of cloud-based software.

Amazon also has a fast-growing digital advertising business that has plenty of room for long-term expansion. Because the company controls the leading online-retail marketplace, it has some natural advantages in the ads space, and it's still in the early stages of leveraging these strengths to build on its position in the category.

The company is also a leader in smart speakers and voice-based operating systems, and its move to acquire iRobot should bolster its position in the consumer devices category and augment broader strategic initiatives. Between its various products and services for consumers and businesses, Amazon has access to an incredible amount of data, and this should help the company take advantage of opportunities in artificial intelligence and continue mapping out new growth strategies and ways to capitalize on synergies between its businesses.

Amazon's cloud segment is highly profitable and continues to grow at an impressive clip, and advancements in automation and robotics could ultimately make its market-leading e-commerce business much more profitable. With big opportunities in its two core businesses, growth potential in other categories, and a penchant for market-defining innovation, Amazon looks like a great buy today.

The case for Alphabet

Parkev Tatevosian: The factors that help make Alphabet an excellent stock to buy are that it holds a dominant position in a massive industry and sells at a relatively inexpensive valuation. Indeed, Alphabet is home to Google, the most powerful search engine worldwide. That's a critically important business to dominate because so many purchase decisions start with an internet search.

It can partly explain how Alphabet has expanded its revenue from $46 billion in 2012 to $258 billion in 2021. More importantly, it helped boost operating income from $13.8 billion to $78.7 billion in that same time. Businesses with less dominant positions frequently grapple with competitors, which works toward lower profits. Alphabet's search engine makes money through advertising. Companies pay Alphabet to have their websites listed near the top of search engine queries.

It's estimated that advertisers will spend $838 billion globally in 2022, an 8.4% increase from the year before. That massive figure allowed Alphabet to expand beyond its $258 billion revenue in 2021. If it operated in a smaller market, it could approach a ceiling much faster, making an investment less lucrative.

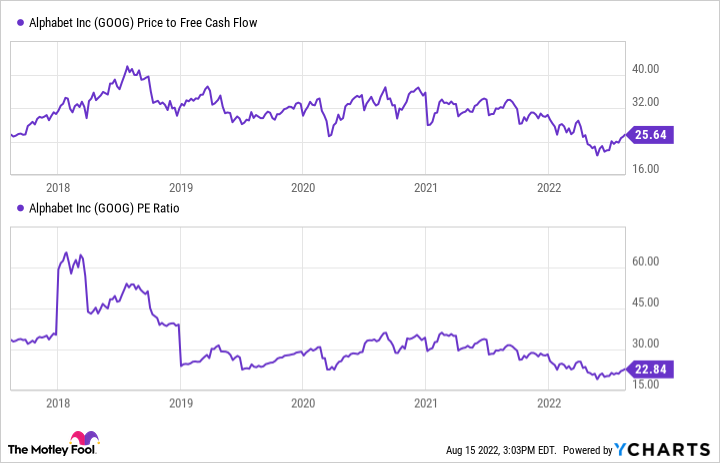

GOOG Price to Free Cash Flow data by YCharts.

Despite these excellent prospects, Alphabet is trading relatively inexpensively at a price-to-free-cash-flow ratio of 25.6 and a price-to-earnings ratio of 22.8. These are below its historical averages through the last five years.

Which big tech stock should you buy today?

Unless you're only interested in owning one of these big tech companies in your portfolio, this is a case where buying both stocks could be the right move. Alphabet's top positions in search, digital advertising, and mobile give it clear avenues to long-term expansion. Meanwhile, Amazon's market-leading e-commerce and cloud computing businesses give it a strong growth engine, and the company has proven it can successfully branch into new categories. Both of these technology leaders look poised to tap into secular growth trends, and each stock stands a good chance of being a long-term winner.