E-commerce giant Amazon (AMZN -1.64%) completed a 20-for-1 stock split in June, its first split since 1999. Stock splits don't change a stock's fundamental valuation, but a lower share price can make it easier for retail investors to build a position in a company.

Splits often get a lot of investor attention, sometimes leading to buying frenzies for a stock. Now that a couple of months have passed since this split, it's an opportune time to revisit Amazon as a potential investment. Here are three things you should know before making a decision about whether to add it to your portfolio.

1. The stock is attractively valued

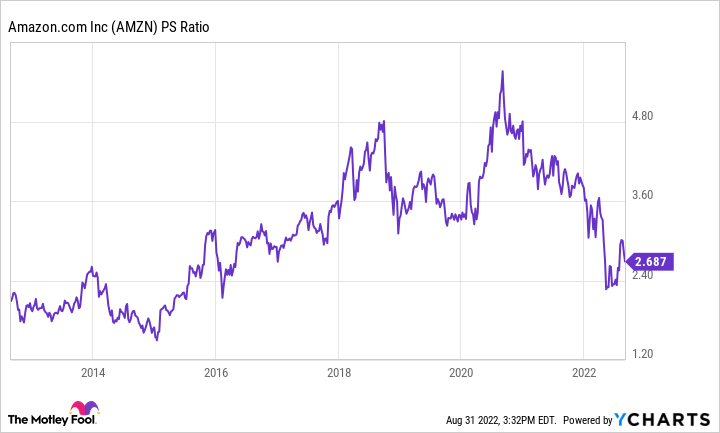

Most investors know that 2022 has been a tough year for the stock market, and Amazon hasn't escaped that fact. Its shares are down roughly 28% since the beginning of the year, but the decline has let some steam out of its valuation. The company's price-to-sales ratio (P/S) ballooned to more than five at the height of the pandemic. At its current P/S multiple of 2.7, its valuation is near its lowest level since early 2016.

AMZN PS Ratio data by YCharts

But context matters. When a stock's valuation rises or falls significantly, investors need to understand whether something has changed in the company to explain why.

In Amazon's case, revenue growth has slowed this year, primarily because it's being compared to 2021, which was a tough act to follow. For example, Amazon's Q2 revenue growth in 2021 was 27%. Fast-forward to Q2 2022 when its year over year top-line growth slowed to just 7%. This could help explain why the stock declined. But Amazon's growth could pick back up again as it will be going up against these more modest 2022 growth figures next year -- and so the bar may be easier to clear.

2. Inflation is a real challenge

High inflation has been a major economic storyline this year, and it has had a significant impact on Amazon, which operates an extremely price-competitive business that spends a lot on wages and logistics. Consider how Amazon's operating margins started to plunge as inflation accelerated.

AMZN Operating Margin (TTM) data by YCharts

Falling profit margins aren't good, but remember that inflation is hitting the entire economy, including all of Amazon's competitors. Most of them don't have anything close to Amazon's size and breadth of operations, which likely means they are struggling too.

The current high inflation conditions will likely abate eventually. Meanwhile, Amazon has a massive balance sheet with $60 billion in cash, which should allow it to endure the pain of inflation better than most. Investors should maintain a long-term mindset here as it doesn't seem that inflation will impact Amazon's competitive position over the long term.

3. Profitable business segments are growing

E-commerce is notoriously tough to make money in, but it's a great way to get a foot in the door with consumers. The Amazon Prime membership program is a great tool to bring users into Amazon's ecosystem, where its other businesses are flourishing. Amazon Web Services, its public cloud platform, has done $72 billion in revenue over the past four quarters; it was also responsible for all of the company's operating income in Q2. That segment grew 33% in Q2, which could eventually further move the profitability needle.

Additionally, Amazon is wading further into advertising and is investing heavily in Prime Video, including securing broadcasting rights to the NFL's Thursday Night Football games in 2022. Amazon's ad revenue hit nearly $34 billion over the past four quarters. That business could significantly contribute to the company's performance down the road. Investors will want to keep an eye on the non-retail pieces of Amazon; they could play significant roles in how the company performs over the coming years.

Is Amazon a buy?

Amazon faces some short-term challenges due to issues outside of its control, and Wall Street hasn't been in the mood to give it a pass. But it seems like these headwinds will eventually dissipate. Meanwhile, Amazon remains the runaway market share leader for U.S. e-commerce at 38%, and its secondary businesses like AWS and advertising continue to grow.

Amazon is one of the world's largest companies, and its stock is probably too big to take you from rags to riches. However, the company remains as dominant as ever, and it doesn't seem like a reach to expect that investors buying its shares today will be pleased with their returns years from now.