What happened

Shares of Match Group (MTCH -0.68%) were down 22.9% in August, according to data provided by S&P Global Market Intelligence. The company reported financial results for the second quarter of 2022 on Aug. 2, which left the market wanting more, leading to the outsized stock-price drop.

So what

In Q2, Match Group generated revenue of $795 million, up 12% year over year on an as-reported basis. Keep in mind, though, that roughly half of the company's revenue comes from outside of the U.S., and foreign currency exchange rates impact the financials. Adjusting for this, Match Group's revenue was up 19% year over year.

Match Group's top-line growth rate was respectable. But other issues during the quarter weighed the stock down. Specifically, the company's Tinder platform is struggling. And Tinder is a big deal -- it had Q2 revenue of $449 million, which was over half of overall revenue.

Match Group brought in new CEO Bernard Kim earlier this year. And Tinder is his top priority. With the Q2 financial release, the company announced that Tinder's CEO Renate Nyborg is gone. Kim has hand-picked the executives leading Tinder right now and the team is reporting to him while he searches for Nyborg's replacement.

According to The Fly, Deutsche Bank analyst Benjamin Black said that Match Group is hitting the "reset button" under its new leadership. And this is partly why he reset his price target from $100 per share to $85 per share.

With Tinder's problems, some price-target reductions were far more extreme than Black's. For example, Truist analyst Youssef Squali lowered his price target for Match stock by 52% to $68 per share and simultaneously downgraded it from buy to hold, also according to The Fly.

Now what

The market also reacted negatively to Match Group's guidance. For the third quarter, management expects to generate revenue of $790 million to $800 million, which is a slight decrease from the $802 million the company generated in the third quarter of 2021. Most analyst estimates had expected double-digit growth, not a decline.

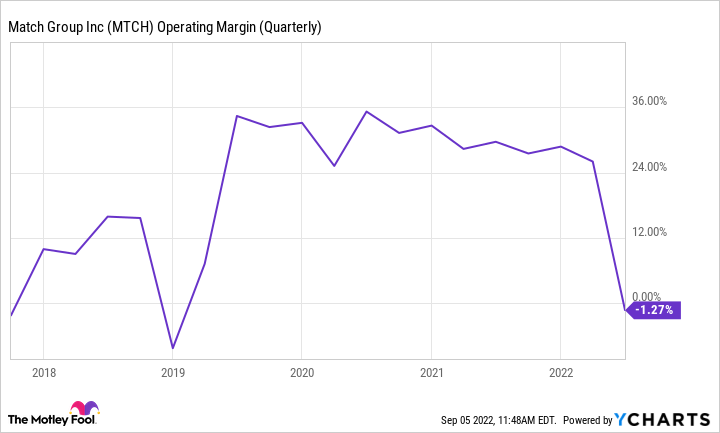

While Match Group's slumping growth is disappointing, there's more to the story than this. The company's profitability was hammered in Q2 because of a $217 million impairment charge from its $1.7 billion acquisition of South Korea's Hyperconnect platform in 2021.

However, the good news is its slumping profitability isn't a structural problem -- Match is still built for profits. Looking ahead to the third quarter, management expects to generate $255 million to $260 million in adjusted operating income, implying a roughly 32% margin. This margin profile is world-class.

MTCH Operating Margin (Quarterly) data by YCharts

With its ongoing profitability, Match's management is looking to grow shareholder value by continuing what it often does: make acquisitions. Management says it's identified some interesting opportunities. But in the meantime, it's repurchasing shares at what it believes are discount levels.

Match Group is struggling right now. But its profits are still good and provide opportunity for management to reward shareholders. In short, August was bad, but I'd expect better days ahead.