Shares of online gambling stocks were all the rage in 2020 and 2021 as sports betting spread across the U.S. and growth seemed to be unstoppable. DraftKings (DKNG -1.35%) and Rush Street Interactive (RSI -2.84%) went public with much fanfare, and companies like Penn National (PENN -0.74%) surged on online gambling speculation as well.

But online sports betting and iGaming have been much harder to make money at than investors thought. Looking back, this wasn't a very good business to invest in and there are some things we can learn from these poor-performing stocks.

The growth at any cost

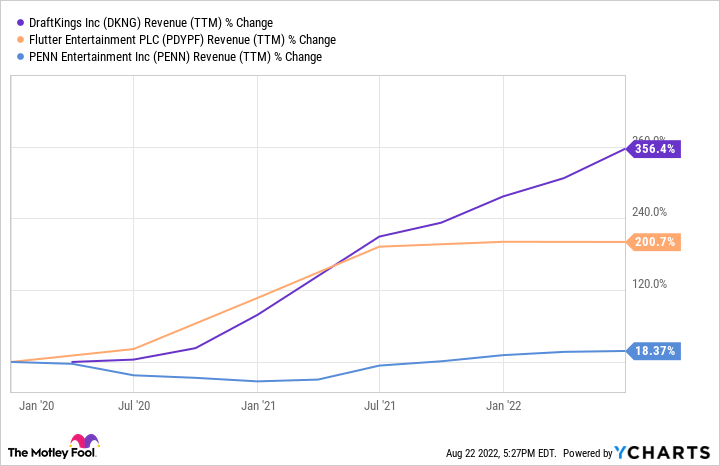

Online gambling was supposed to be a growth business for everyone involved. In some limited respects, it's lived up to that potential. You can see below that DraftKings revenue has been growing, as has Flutter. Rush Street Interactive grew 19% in the first half of 2022 after going public at the end of 2020.

DKNG Revenue (TTM) data by YCharts

Growth is great, but the cost of growth matters, especially with rising interest rates and a down stock market. You can see below that each of these three companies are reporting heavy losses as they grow. This is because they're not only spending money to build out their systems, but because they're spending hundreds of millions of dollars on advertising to attract customers. The idea is that spending on customers will pay off eventually, but that hasn't proven to be the case yet and it's not clear when the payoff will come.

DKNG Net Income (TTM) data by YCharts

There's no easy fix to this problem. MGM said it costs $250 to acquire a single customer and the company said its EBITDA (earnings before interest, taxes, depreciation and amortization -- a proxy for cash flow in gaming) won't reach breakeven until 2023 at best. Companies could cut spending on customer acquisition. The likely result, though, would be slowing revenue growth, which could create a downward spiral as stocks fall, market share drops, and competitors scoop up customers.

Where there's opportunity in online gambling

To make the online gambling investment story worse, shares of these stocks trade at a huge premium to competitors on the basis of price-to-cash from operations. You can see below that DraftKings doesn't even show up because it doesn't have positive cash flow, while the cheapest companies are MGM Resorts (MGM 0.02%) and Penn National, which have a large presence in the physical world.

DKNG Price to CFO Per Share (TTM) data by YCharts

MGM and Penn National are both investing heavily in online gambling as well. Penn National is spending $548.2 million to buy Barstool Sports and build both in-person and online betting platforms across the country. MGM Resorts recently said total investment in BetMGM would be $1.1 billion between 2018 and the end of 2022, which it splits with 50/50 partner Entain.

Both companies have a solid cash flow business in the physical world to fund long-term growth in the digital world. Online-only companies that need to generate profit now are at risk of diluting shareholders or even going bankrupt at the current rate of cash burn. The risk profiles are different and right now it seems like physical casino companies with an online arm are winning.

Consumer spending is shifting

As all of this is happening, consumer spending is shifting. People are spending more on gambling in Las Vegas than ever and online gaming that ballooned during the pandemic is showing signs of slowing. It makes sense that growth in online sports betting and iGaming would suffer as people spend more in person.

I don't think this is going to change, either. Online gambling may have a bright future a decade from now, but it's not a rocket ship. The companies that are burning cash right now may only be suited to periods of high growth, not times of slow or no growth.

Where to invest in online gambling today

The good news for investors is there's an option for them that isn't all that crazy. MGM Resorts owns half of BetMGM with Entain and is still generating billions in cash flow from existing properties. Any cash from online gambling is a bonus at this point. The same can be said for Caesars Resorts, which owns its own online gambling business along with casinos across the country.

MGM or Caesars will give investors exposure to growth in online gambling without the risk of going bankrupt if the market stops growing. I think that's a much better bet than any online gambling stock today.