The last few months have been tough for investors. The S&P 500 is down more than 17% since the beginning of the year, and many people are concerned that a market crash is on the horizon.

If you're feeling pessimistic about the future of the market, you're not alone. But a bull market is coming, and right now is the perfect time to take advantage of it. Here's how.

Image source: Getty Images.

When will the stock market recover?

The bad news is that the stock market can be unpredictable, and nobody knows exactly how it will perform over the short term. There's a chance that stock prices could fall in the coming weeks or months, and a market crash is a possibility.

The good news, though, is that every single bear market in history has eventually given way to a bull market. In other words, no matter how bad the market gets, it will recover and go on to see positive average returns over time.

While that may not be too reassuring at the moment, it does mean that the stock market is safer than it may seem. Investing is a long-term strategy. While nobody knows exactly how long this slump will last, it's almost guaranteed that the market will thrive over time.

How to increase your earnings despite volatility

When stock prices are falling, it can be tempting to stop investing or pull your money out of the market. However, to take full advantage of the inevitable bull market, investing right now is key.

The best way to maximize your earnings in the stock market is to invest when prices are at their lowest, then hold your investments until the market inevitably recovers. If you only invest when the market is thriving, you're paying a premium for your investments and spending far more than necessary.

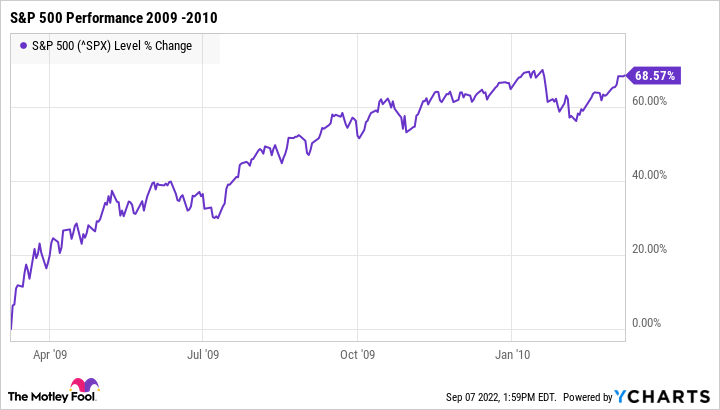

It can be intimidating to invest during downturns, but it can pay off big time. For instance, near the tail end of the Great Recession, the market hit its lowest point in March 2009. But in the year that followed, the S&P 500 surged by nearly 70%.

If you had stopped investing throughout the recession, you would have missed out on those gains. But the more you invest during market slumps, the more you can potentially earn when prices eventually rebound.

The secret to maximizing your returns

Not all investments are created equal, and some stocks will have a harder time recovering from downturns than others. The more research you put into your investments, the better your chances of surviving a slump.

The strongest stocks are the ones from companies with solid underlying business fundamentals. These stocks won't make you a millionaire overnight, but they're far more likely to see long-term growth despite market volatility. The more of these stocks you have in your portfolio, the more you can potentially earn over time.