Investing for retirement takes patience. When stocks get caught up in a bear market like they are right now, you might think investing in a company with a falling stock price is a waste of time and resources. But long-term investors know that if you hold onto stocks from quality companies through these down cycles, your purchase can eventually pay off with huge rewards as compounding growth works its magic. The only hard part is finding the right quality companies to buy stock in and hold.

To help you in your search, here are two stocks that are worthy of buy-and-hold consideration. Each is a great candidate that can help you fund your retirement.

1. Electronic Arts

Electronic Arts (EA 0.36%) is one of the world's largest video game publishers, mainly producing franchise games for consoles and PCs. The company has a lock on the sports gaming market through its FIFA Soccer and Madden NFL games, among other titles. Besides sports gaming, EA publishes titles from beloved franchises like Battlefield, Apex Legends, and The Sims.

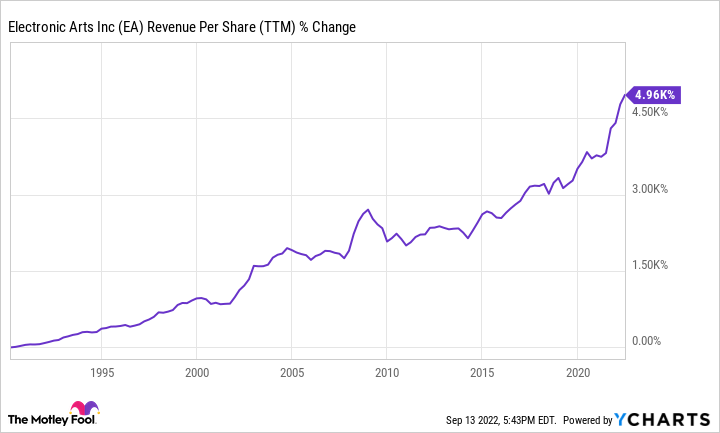

This diversification of revenue streams helped EA ride a steady video game market tailwind over the past few decades. And it's a tailwind that shows no sign of stopping. Since going public, EA's revenue per share is up almost 5,000%. With the video games market expected to grow even larger this decade, investors should expect EA's revenue to continue this upward trajectory.

Profitability is not an issue with EA, either. Over the last 10 years, free cash flow per share grew by almost 500%. Some of this is due to continued top-line growth, but EA also greatly expanded its margins by selling games digitally and growing in-game spending among its player base. The company's trailing free cash flow per share of $6.20 gives the stock a price-to-free cash flow (P/FCF) multiple of 20.5, which is right around the market average.

All this cash allows EA management to return money to shareholders in the form of share repurchases and dividends. The dividend yield is a somewhat low 0.6% but there is plenty of room for growth. Also, management spent approximately $1.3 billion repurchasing shares over the last 12 months. Combined with steady top-line growth, this capital returns program makes EA stock a viable buy-and-hold candidate for investors looking to save for retirement.

EA Revenue Per Share (TTM) data by YCharts

2. Spotify

Spotify (SPOT 0.94%) is the leading audio streaming service around the world (not including China). With 433 million total monthly active users (MAUs) and 188 million paying premium subscribers, Spotify is one of the largest internet platforms and subscription services globally.

The company is growing its user base as the world transitions to digitally streamed music, similar to the transition that is taking place in the TV and video market. Revenue per share is up 127% since Spotify went public a few years back, driven by continued growth in MAUs and paying subscribers. Globally, industry experts expect the music streaming market to grow at approximately 15% annually from now through 2030. As long as Spotify keeps its spot as the market leader, it should easily be able to ride this industry tailwind.

Along with music streaming, Spotify is exploring other audio opportunities for its platform, like podcasts. Management invested heavily into podcasts in the last few years, buying up studios and signing exclusive deals with top shows like The Joe Rogan Experience. Spotify now has 4.4 million podcasts on its platform, up significantly from just a few years ago. To monetize these offerings, the company set up a dynamic advertising marketplace, similar to how YouTube works. While still early days, podcasting is driving strong growth in Spotify's advertising segment, which grew revenue by 31% year over year in the second quarter. Investors should watch for this category to grow and become a much larger part of Spotify's consolidated financials in the coming years.

High-growth stocks like Spotify took a beating this market cycle. Share prices fell 56% year to date, even though the business continues to show promise. At a current market cap under $20 billion, investors have a chance to buy shares of Spotify on the cheap. If the company becomes the leader in music streaming, podcasting, and eventually other audio offerings, Spotify should be worth much more than $20 billion a decade or two from now.