When a company faces economic uncertainty, advertising is often the first expense that gets cut. It is a discretionary spending -- something the business can do without -- and it's the easiest to stop. And the return on advertising is notoriously hard to calculate.

Most who follow Alphabet (GOOG -0.68%) (GOOGL -0.79%) understand that its success is highly dependent on companies' willingness to spend on digital ads. They may even know that it's more insulated than many others in the industry. What they probably don't know is how much a downturn is likely to affect the share price.

A big piece of the pie

The advertising industry is much different from a generation ago. Late last year, a report by advertising conglomerate GroupM predicted digital would make up nearly 65% of all ad spending in 2021. The same report went on to estimate that between 80% and 90% of that amount would flow to Alphabet and Meta Platforms (META -2.62%). That dominance has been cemented over time.

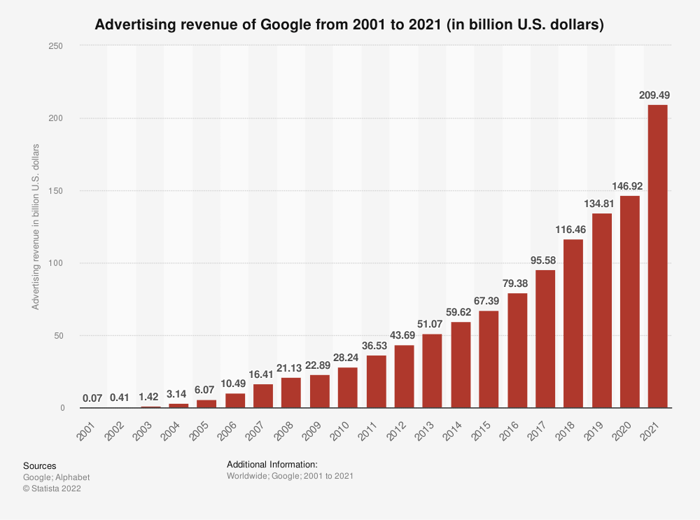

A glance at Google's annual ad revenue shows 2021 was far from the norm. After annual growth of about 19% in the three years leading up to the pandemic, ad revenue jumped 43% in 2021. That spending party was destined to lead to a hangover. And it has.

Image source: Getty Images.

So far, through the first two quarters of 2022, the company has brought in $111 billion in ad revenue. That's up almost 17% from the same period last year. It's respectable growth. But it's slower than Wall Street expected. Second-quarter growth was even worse, coming in less than 12% higher than 2021.

Insulation isn't the same as immunity

The slowdown has contributed to a stock-price drop of more than 30% from the all-time high. It trades at one of the cheapest multiples of gross profit since a tussle with European regulators in 2012. But that doesn't mean shares can't fall further.

Fundamental Chart data by YCharts

During the 2008 recession, spending on advertising dropped 13%. Although the drop was only 2% for online ads, it's unlikely investors would pay even the current multiple in a similar scenario. In fact, a couple of quarters with that paltry growth at the lowest multiple experienced during March 2020 could drive Alphabet shares as low as $85.

Management is already preparing in case a recession does arrive. In last quarter's earnings call, CEO Sundar Pichai highlighted Alphabet's newfound discipline. First, the company is slowing hiring -- focusing on key technical talent. It's also emphasizing productivity. That's a big change for a company famous for giving its employees 20% of their time to experiment. The shift should show up in profit margins. That would soften the impact if ad sales slow further.

Compensated for the risk

Despite the uncertainty, the U.S. economy still appears to be chugging along. Overall ad spending is expected to grow about 10% this year. And the retail and travel categories are helping digital ad spending remain strong. Estimates are for 17% growth in 2022.

That should mean Alphabet's growth will normalize and the noisy numbers of the past few years will fade. Once that starts to happen and Wall Street catches on, the stock is likely to return to its historical valuation. In that case, it's not unrealistic to think shares could double over the next few years. That would make the return from today's price well worth the downside risk.