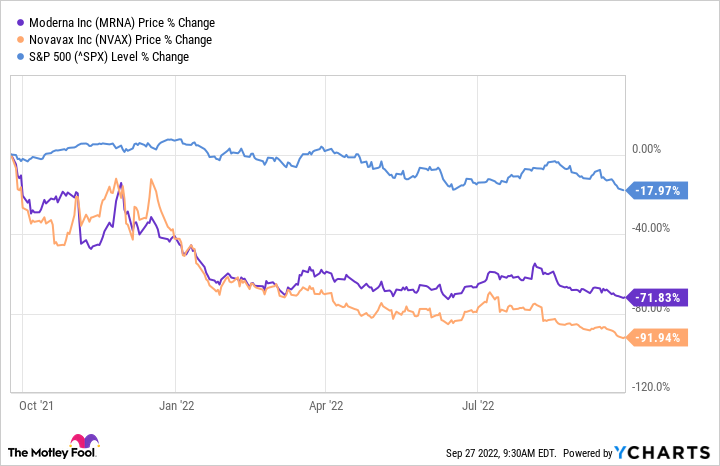

In the past two years, biotech companies Moderna (MRNA -0.07%) and Novavax (NVAX -3.15%) rose to fame thanks to their successful attempts to develop vaccines for COVID-19 and help us end the outbreak. The pandemic isn't over yet, but Moderna and Novavax have given up substantial chunks of their value in the past year.

There's a simple reason. The market is forward-looking, and right now, it sees the end of the pandemic -- or at least the phase of the pandemic during which there is a dire need for vaccines -- in sight. Where does that leave Moderna and Novavax? Let's examine whether these biotechs are still worth investing in today.

1. Moderna

Moderna managed to become a leader in the COVID-19 vaccine market thanks to its Spikevax being one of the first to earn authorization in the U.S. The company generated $22.3 billion in revenue and $14.1 billion in net income over the trailing 12-month period. Moderna is still developing various candidates targeting specific variants of the coronavirus.

Even if the demand for vaccines drops, the biotech is betting that millions of patients, especially those at high risk of severe disease or complications, will continue to seek to get inoculated every year. The long-term booster market could represent a somewhat lucrative opportunity for Moderna, although it probably won't generate $22 billion in annual sales for the company.

Thankfully, Moderna's recent success has allowed it to make solid progress with its pipeline. The company looks likely to rack up important clinical wins in the next two years, and regulatory approvals should follow not too long after that. Consider Moderna's late-stage pipeline, which features potential vaccines against the cytomegalovirus (CMV), the respiratory syncytial virus (RSV), and the influenza virus.

Flu vaccines already exist, but they are inadequate as they typically confer only 40% to 60% protection. Moderna seeks to address this shortcoming with its mRNA approach. Meanwhile, there are no approved vaccines for CMV or RSV in the U.S, although several biotechs are now working on candidates that target these viruses; Moderna is one of them.

If even one of these three products earns approval, it would likely help Moderna generate hundreds of millions of dollars annually. That's before we look at the company's products in earlier stages, of which there are more than a dozen. Again, even at a 33% success rate, Moderna will almost certainly enlarge its lineup over the next five years. Does that make the company's stock a buy at current levels? In my view, the answer is yes.

However, investors will have to be patient as the company will continue to be under pressure in the near term due to the potential end of its coronavirus-related tailwind.

2. Novavax

Novavax is a bit of a latecomer in the coronavirus vaccine market, especially in the U.S. The company's Nuvaxovid earned emergency use authorization as a primary vaccination option in the country in July. Novavax had a plan: To attract those who were hesitant to get the jab as a result of skepticism regarding the relatively new mRNA technology that is the basis of some of the vaccine leaders.

Novavax's Nuvaxovid is a protein-based vaccine manufactured in traditional ways. The biotech hoped this factor would help it capture a niche of the vaccine-hesitant crowd. While not much time has elapsed since Nuvaxovid has earned approval in the U.S., Novavax's plan does not seem to be working. In fairness, Novavax's COVID-19 vaccine is approved in dozens of other countries.

But while the company is recording decent revenue -- especially considering it was a clinical-stage biotech just two years ago -- Novavax isn't consistently profitable yet. The company has generated $1.1 billion in revenue over the trailing 12 months and a net loss of $1.5 billion. One of the factors slowing down Novavax in the U.S. is the fact that Nuvaxovid is only approved for primary vaccination.

The company is seeking the nod to offer it as a booster option, which should substantially improve its prospects. After all, 79.5% of the population has already received at least one dose of a vaccine, while 67.8% are fully vaccinated. Novavax has also applied to earn authorization for Nuvaxovid as a booster in the U.K.

The company is currently waiting for the green light. It recently announced that it had made one million doses of its product available in the country. Novavax is working on several other candidates, including NanoFlu, an investigational influenza vaccine for adults aged 65 and older. Seniors are more likely to suffer from severe flu cases, be hospitalized, and succumb to the disease.

NanoFlu is currently undergoing a late-stage study, although, importantly, it has already demonstrated safety and efficacy in another phase 3 clinical trial. Novavax is also targeting vaccines against RSV, as well as another one against Malaria. The biotech plans on starting a phase 3 trial for a promising combined COVID/flu vaccine next year. Novavax hasn't been able to be as successful as some of its peers in the COVID-19 vaccine.

But the market seems to be undervaluing its potential. Novavax's current market cap is $1.5 billion, which is slightly higher than its revenue over the past 12 months. Novavax may encounter many more headwinds in the short run, and investing in this biotech stock will also be a bit of a waiting game. However, patient investors could be rewarded down the road.