With the S&P 500 index making new lows in 2022, it is crucial investors stay the course and continue adding high-quality businesses to their portfolios -- through dollar-cost averaging, if possible. While everyone's description of a high-quality business varies, three stocks today offer multi-bagger potential over the next 10 years in unique ways.

Shopify (SHOP -2.37%) is currently light on profits yet is vital to the burgeoning U.S. e-commerce industry. Adyen (ADYE.Y 0.53%) and InMode (INMD -0.06%) offer the beautiful pairing of high sales growth and strong free cash flow (FCF) creation and profitability.

Shopify continues empowering entrepreneurs

In just 15 years, Shopify has rapidly become a force in e-commerce, boasting over 2 million merchants on its platform. By enabling entrepreneurs to go from product idea to first sale in an unfathomably easy manner, the business's platform quickly grew to account for an impressive 10% share of United States e-commerce gross merchandise volume (GMV).

Thanks to its support of entrepreneurial visions everywhere, Shopify became a growth stock darling before the current bear market (and the company's premium valuation) guided its shares down 80% year to date.

Making matters worse for Shopify investors, the business continued to invest heavily in its logistical network and saw its operating margin drop to negative 15%, returning to recent lows.

SHOP Operating Margin (Quarterly) data by YCharts

However, despite this seemingly perpetual reinvestment in its operations keeping profitability at bay, Shopify's long-term potential is still quite enticing.

Posting 47% growth in offline GMV year over year during the second quarter -- compared to 8% online -- the company continues to prove that it is capable of much more than merely enabling e-commerce sales. Although traditionally labeled an e-commerce stock, Shopify's suite of offerings includes point-of-sale systems, access to capital, shipping fulfillment, and perhaps its most significant growth driver yet: localized selling in international markets.

Despite only being rolled out in the first quarter of 2022, Shopify Markets -- its localized shopping experience for international markets -- already has 100,000 merchants signed up and looking to expand abroad.

While Shopify still has to prove that it can profitably compete with the major retailers, it seems that its importance to the U.S. economy (and maybe soon the global economy) is much higher than its current market capitalization of $37 billion.

Moreover, with $7 billion in cash Shopify is well-positioned to continue building out its unique omnichannel capabilities -- now potentially on a global scale.

Wildly cheap growth potential with InMode

Founder-led InMode creates minimally invasive aesthetic products that use proprietary radio frequency technologies for various skin rejuvenation procedures. InMode aims to bridge the "treatment gap" between outdated laser-based methods and intimidating plastic surgery options through its innovative product line.

After its initial public offering (IPO) in 2019, the company's share price rocketed skyward from $10 to nearly $100 as its revenue grew from $100 million to over $300 million in just three years. However, despite this incredible top-line growth, InMode was cast aside in 2022 amid the growth stock sell-off, dropping over 70% year to date.

As alarming as this drop may seem, the company's underlying operations remain incredibly sound. Overall revenue grew 30% year over year in the second quarter, and its international operations -- covering 78 countries -- posted a slightly faster growth rate of 33% over that same time.

Best yet for investors, InMode isn't your typical growth stock, sacrificing profits in the name of rapid top-line expansion -- it has incredible free cash flow generation.

INMD Revenue (TTM) data by YCharts

Following its precipitous drop in 2022, InMode only trades at 14 times its free cash flow. Anytime a stock's growth rate is higher than its price-to-free cash flow ratio, it catches my attention as it highlights growth at an intriguing, potentially discounted price.

As InMode continues to grow its installed base of products globally, look for its consumable sales (these are the items that users need to replace from time to time) to also continue expanding -- all of which should reward investors over the next decade.

Adyen looks to revolutionize payments for merchants

Netherlands-based Adyen is unique in that it operates using a fully integrated payments system. This means that the company helps its clients -- merchants of all sizes -- connect to their customers across the entire payment process. From payment gateway, processing, and acquiring, to risk, issuing, and authentication, Adyen's offerings run the gamut -- all on the global level.

Thanks to this comprehensive coverage of the payments process, the company can record high conversion rates for its clients, all while providing valuable customer data. Highlighting Adyen's rapid uptake and popularity within the financial sector is its 96th-place ranking in Kantar Brandz Top 100 Most Valuable Brands report.

Following its 2019 IPO, Adyen saw its share price quadruple by 2021 as revenue more than doubled over the same time. However, much like Shopify and InMode, Adyen was crushed in 2022, seeing its price fall by more than 60%.

Despite this drop, Adyen recorded a 60% gross payment volume increase in the first half of 2022 versus the year prior while also growing net revenue and net income by 37% and 36% over the same time.

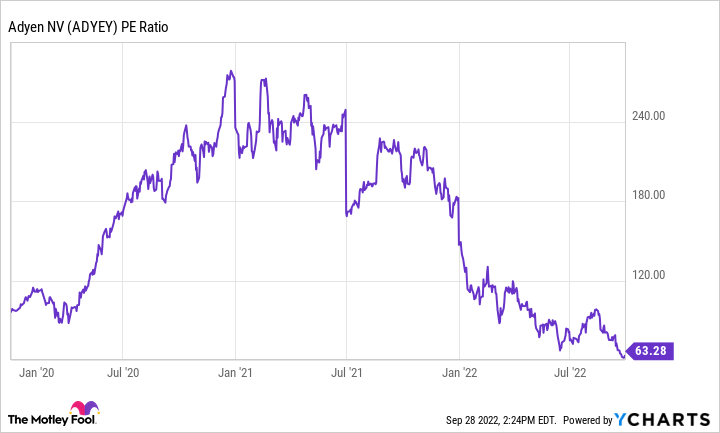

While Adyen's P/E ratio of 63 is still somewhat intimidating, it has returned from the stratospheric levels it was trading at over the last two years.

ADYEY PE Ratio data by YCharts

Despite its premium valuation persisting, Adyen is cheaper now than it was at its IPO and could be profitable for investors as it looks to continue its rapid growth alongside its merchants and their global ambitions.