The Dow Jones Industrial Average has been up and down over the past few days, falling into bear territory before regaining much of its lost value. It's an escalation of the volatility that has plagued the markets for the past year as governments launch policies and programs to stem inflation. Many investors are hurting. If you have the ability to wait out challenging market conditions and some money available to invest after paying off debts, you can find deals not seen in years on powerhouse stocks that dominate their industries. Home Depot (HD -1.44%), Nike (NKE 1.20%), and Visa (V -1.70%) are top Dow stocks that are unbelievably cheap right now.

1. Building on top of pandemic growth

Many companies are struggling. Companies that demonstrated robust growth amid the pandemic are having trouble keeping up the pace, and on top of that, they now have too much inventory and an enlarged infrastructure they no longer need.

Not Home Depot. This powerhouse company continues to grow comparable sales (comps) and post profits despite tough year-over-year comps, inflation, and a drooping housing market.

How has it achieved this? There are several elements to its successful formula. It's the largest home improvement chain in the U.S., and it scaled faster than competitors over the past few decades, giving it an edge. It heavily invested across its business over the past few years, starting with an overhaul of its digital channels prior to the pandemic. That positioned it for top performance when people were staying home and focusing on home improvement projects, and the synergies among physical stores, a powerful digital platform, and a robust distribution network worked together to provide services.

These continue to fuel growth in this market. Home Depot has upgraded its multiple channels through improved digital features and store redesigns, with a focus on the professional segment. Despite some softness in seasonal items in the second quarter, other categories were so strong, specifically big-ticket items, that comps exceeded expectations.

Current economic conditions may yet wear Home Depot down, and management is expecting the second half of 2022 to be more challenging than the first half. But despite whatever happens in the near future, Home Depot is a stellar company with huge long-term potential.

Home Depot stock is down 32% this year, and shares are trading at their cheapest price-to-earnings ratio in over a decade outside of the 2020 downturn.

HD PE Ratio data by YCharts

2. Turning activewear into casual wear

Fashion has never been so athletic. That's in part thanks to Nike, which has become the premier activewear brand and so successful at attracting loyalty that its footwear and apparel are practically a uniform for millennials seeking stylish sportswear.

Nike grew to be the largest sporting wear company in the world, with more trailing-12-month revenue than Adidas, Under Armour, Lululemon Athletica, and Skechers combined.

NKE Revenue (TTM) data by YCharts

That gives it tremendous leverage as it tries to grow amid world economic pressure. Revenue was down 1% in the 2022 fiscal fourth quarter (ended May 31), but up 3% on a currency-neutral basis. Strength was in the Nike Direct channel, which encompasses its direct-to-consumer (DTC) networks, with a 7% sales increase, while wholesale sales were down. That's become a pattern, with Nike Direct continuing to be a strong piece of the company's operating model. It has fed into that by building up its digital DTC services and severing some wholesale channels.

Nike first let investors know of coming challenges over a year ago, and it has struggled this year with increased costs and inventory. But Nike is well positioned to stay strong and jump forward when economic pressure eases. There are many overall tailwinds that should boost its business in the future.

On the Q4 earnings call, CEO John Donahoe mentioned what he called the "expanded definition of sport" in addition to shifts toward health, wellness, and comfort. That, combined with Nike's digital strength, size, and powerful brand portfolio give it an edge in any market.

Nike stock is down 41% this year, and shares trade at 26 times trailing-12-month earnings, their cheapest valuation in almost five years.

3. More than an indicator of the economy

There are two overarching reasons that Visa is a solid stock to own. One is that it broadly follows the economy. When the economy is going well, Visa performs well. When the economy is down, Visa's performance typically suffers. That's good for Visa and its shareholders because the economy does well the vast majority of the time. The flip side is that when spending goes down, Visa feels the pinch.

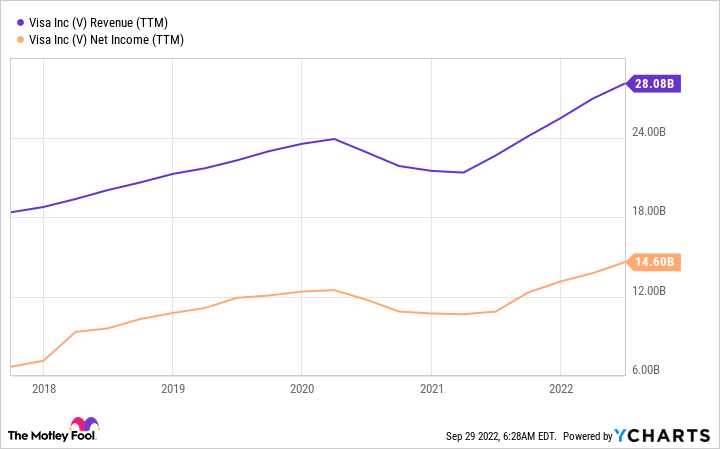

However, despite macroeconomic uncertainty, Visa's business has been flourishing since it rebounded from the pandemic. It's still feeling the rebound, with strong spending outpacing inflation and adding to Visa's revenue and income.

V Revenue (TTM) data by YCharts

The second reason Visa is a compelling stock to own is that it's highly profitable. It's an asset-light business with wide margins, so there aren't too many worries about this company staying viable. It has a very simple operating model in processing credit card transactions, and its network is so large as to provide a strong moat for its business. However, it isn't sitting still and relying on that. It has developed a huge fintech backbone, buying out or partnering with many companies to offer digital services and features and turning itself into a competitive player in digital.

Visa stock is down 17% this year, and shares are trading at 26 times trailing-12-month earnings, the stock's cheapest valuation in more than five years outside of the 2020 dip.