Dividends are a popular wealth-building tool, but let's face it: A dividend is only as helpful as it is reliable. Chasing stocks because they have high dividend yields is a dangerous game; sometimes, a high yield reflects the market's concern that a company can't afford its payout.

Healthcare conglomerate Johnson & Johnson (JNJ -0.69%) could be your stock if dependability is your goal. You should keep tabs on every investment, but here is why Johnson & Johnson could be as close to a stock you can "buy and forget" as they come.

The company is a cash cow

Healthcare is arguably one of the best industries you can invest in; it's a priority in society and it's massive. Worldwide healthcare spending is worth as much as $10 trillion today, a nearly endless market Johnson & Johnson can grow into.

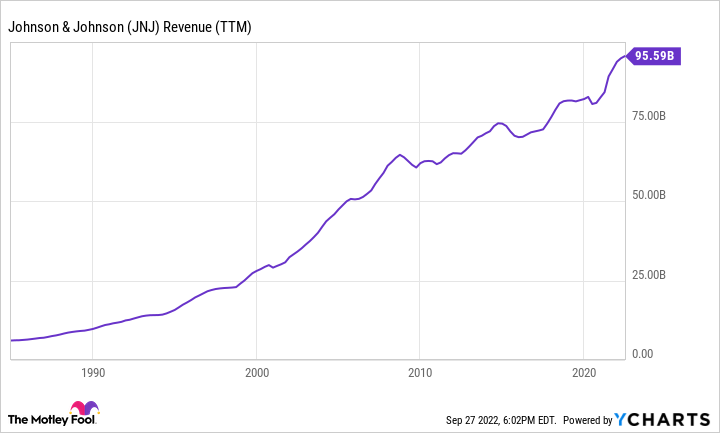

It is a healthcare conglomerate consisting of three segments: consumer products like over-the-counter medicines and personal care items, medical devices, and pharmaceutical drugs. These total more than $95 billion in annual revenue, and you can see below how consistent growth has been over the years; you don't see many spikes or drops, just reliable growth for decades.

JNJ revenue (TTM). Data by YCharts. TTM = trailing 12 months.

Notably, Johnson & Johnson is a very profitable company, converting 21% of its revenue into free cash flow -- cash profits that management can discretionally spend on dividends or stack on the balance sheet as cash. A steady and growing business is perfect for supporting a dividend that increases a little bit each year.

Strong financials behind the dividend

But every company faces a challenge now and then, so Johnson & Johnson must have healthy financials supporting its legendary dividend. If a company spends all (or most) of its cash profits on the dividend, an event that causes the business to slump could put it in a tough spot in deciding between using debt to pay the dividend or cutting it instead.

JNJ cash dividend payout ratio. Data by YCharts.

Johnson & Johnson has raised its dividend for a whopping 60 years in a row but has still managed to keep its dividend payout ratio below 60% of its cash profits. Its free cash flow has grown 58% over the past decade, which helps it raise the dividend without significantly affecting the payout ratio. Sure, it might fluctuate a little bit, but you can see that the payout ratio a decade ago versus today is virtually the same.

The secret sauce behind the dividend

Imagine a hypothetical doomsday scenario that hits Johnson & Johnson: The business craters and free cash flow declines 50% overnight. Even in this situation, management could turn to the company's balance sheet, its secret weapon as a dividend stock.

The company has $32 billion in cash and the same in total debt. In other words, Johnson & Johnson, a company generating almost $100 billion in revenue and worth over $400 billion in market cap, is debt-free on a net cash basis.

JNJ cash and short-term investments (quarterly). Data by YCharts.

It's one of only two public companies (the other being Microsoft) with an AAA rating from the major credit bureaus, higher than that of the United States government, which can literally create money! The U.S. going bankrupt would be a disaster far beyond the stock market, so it says something when a private-sector business gets a better rating than that.

Johnson & Johnson won't make you rich overnight, but it's a steady compounder with arguably the most reliable dividend you'll find. You can buy and hold this Dividend King with the utmost confidence that its checks will keep clearing.