One of the first things dividend investors look at, invariably, is dividend yield. That makes sense, but yield alone doesn't always tell the entire story. And sometimes large dividend yields can lure you into an investment that isn't a good fit for your actual income needs. A review of what happened to $10,000 invested in AGNC Investment (AGNC -1.86%) over the past decade is a warning you need to keep in mind.

What a difference!

Ten years ago AGNC's dividend yield was hovering around 15%. That compared very favorably to the low-single-digit yield on offer from an S&P 500 index fund. Over the following decade, mortgage real estate investment trust (REIT) AGNC's yield bounced around a little, but it was always fairly large. The lowest point came in 2021 when the yield dropped into the 8% range. Most of that span, however, it was in the 10%-plus range. If you are an income-focused investor, AGNC's huge yield very likely put this stock on your radar screen.

AGNC Dividend Yield data by YCharts

But mortgage REITs (m-REITs) are a unique category. Unlike traditional REITs, which own physical assets, mortgage REITs create portfolios of mortgages. Generally that means buying groups of mortgages that have been turned into something like a bond, known as a collateralized mortgage obligation (or CMO). To boost returns, m-REITs often use leverage, with the value of their portfolios acting as collateral.

One big problem with this scenario is that the value of CMOs fluctuates and, thus, leverage can turn into a major burden when CMO values are falling. And that's on top of the unique nature of mortgages, which tend to turn over more quickly when rates are falling (reducing the income CMOs generate as refinanced mortgages end up being removed from the CMO's mortgage pool) and very slowly when rates are rising (few want to replace a low-rate mortgage with a higher-rate mortgage). But when rates are rising, delinquencies can become a problem, particularly if there is a recession, and mortgage volume overall can drop as the cost to carry a mortgage increases. This is a high-level overview of what is a complicated niche of the REIT sector that's generally not appropriate for most conservative dividend investors.

A painful dividend trend

The dividend trends at AGNC show exactly why this is. Note above that the yield remained elevated throughout the last decade. But if you look at the dividends that investors collected, well, they fall throughout the entire span.

AGNC Dividend Per Share (Quarterly) data by YCharts

Dividend yield and share price move in opposite directions. In order for AGNC's dividend yield to remain as high as it did, the stock had to fall. It's simple math: Dividend / Share Price = Dividend Yield. And the price of AGNC declined in a very material way, effectively tracking the huge declines in the dividend.

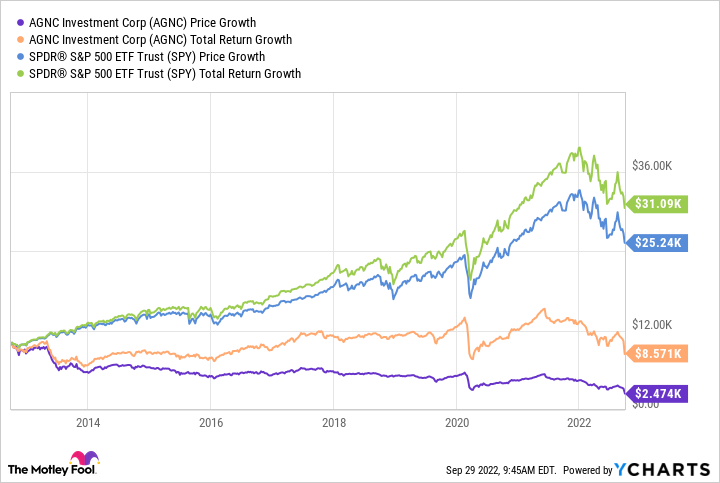

Over that 10-year span, $10,000 invested in AGNC turned into about $2,500. To be fair, that's based only on the stock price movement. If you were to have reinvested the dividends, thus considering total return, the same investment in AGNC would have left you with $8,600 or so. That's much better, but certainly not good. For comparison, the S&P 500 index over that span turned $10,000 into about $25,000 based on stock appreciation alone, and on a total return front, reinvesting dividends, the value grew to $31,000.

But remember, the entire time included AGNC sporting a huge dividend on both the absolute level and relative to the S&P 500 index. If you didn't understand what you were getting into, that huge yield could have been very tempting and, ultimately, very costly.

You need to know more

This isn't to suggest that AGNC Investment is a terrible company in any way, but more to highlight that yield alone doesn't tell you enough about an investment to make an informed decision. Mortgage REITs are very complex and unique compared to other REITs and areas of the finance sector. Focusing only on yield and not looking at the full picture, as seen with AGNC over the past decade, is always a material investment mistake.