It's no exaggeration to say that Altria (MO 1.91%) might be the best dividend stock in history.

The domestic tobacco company has raised its dividend 57 times in the last 53 years, most recently hiking the quarterly payout by 4.4% in August to $0.94 a share.

In fact, for much of the last 50 years, Altria was the best stock you could own largely due to its rising dividend payments. According to Wharton professor Jeremy Siegel, $1 invested in Altria in 1968 turned into $6,638 by 2015 with dividends reinvested.

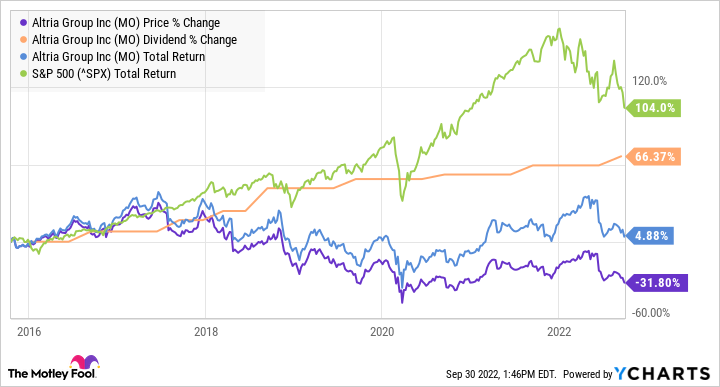

However, if you expected Altria to deliver those kinds of returns in the years that followed 2015, you would've been disappointed. As the chart below shows, the stock price is down 31% since then, and even with dividends factored in, the total return is just 5%, well below the S&P 500's at 104%. That weak performance comes even as Altria's dividend has increased by 66% over the past seven years.

Altria's stock price peaked in 2017 and has fallen by roughly 50% since then due to concerns about declining cigarette consumption and its bad bets on JUUL Labs and Cronos Group. In spite of those headwinds, the Marlboro parent's revenue and profits have continued to grow, thanks largely to price increases.

MO Operating Income (TTM) data by YCharts.

As the stock price has fallen, the dividend yield has grown, and with the exception of a brief spike during the pandemic-influenced market crash in March 2020, the yield at 9% is now the highest it's been since the company split from Philip Morris in 2008.

MO Dividend Yield data by YCharts.

At the current price, is Altria a value stock or a value trap? Let's take a look at both sides of the argument.

The case for Altria as a value stock

According to conventional valuation metrics, the bona fides for Altria as a value stock are clear. It offers a 9% dividend yield, making it one of the top-yielding large-cap stocks on the market. The company's track record of dividend hikes and growing profits should also give investors confidence that its dividend is well funded. The company targets a dividend payout ratio of 80%, meaning 80% of the company's profits go directly to shareholders, and it's held closely to that target for years.

Tobacco is a recession-proof industry, and given the company's commitment to dividend growth, investors should expect the quarterly payout to rise, at least for the foreseeable future. Altria's share buybacks should also grow its dividend as buybacks can increase earnings per share without an increase in net income.

Aside from the dividend, the tobacco stock looks cheap at the current price. Its price-to-earnings (P/E) ratio is just 8.7, less than half that of the S&P 500's P/E ratio at 18.3.

With a 9% dividend yield, even if the stock just sustains its current dividend payout, that would be enough to deliver value for investors, especially in today's uncertain macroeconomic environment. Continued dividend increases would help put a floor on the stock price and attract more income investors into the stock, rewarding current shareholders.

Why Altria stock is a value trap

It's no secret why Altria stock is so cheap. The company competes in a declining industry. Tobacco use peaked in the U.S. in the mid-1960s when over 40% of adults smoked. In 1963, 523 billion cigarettes were sold in the U.S. By 2020, that number had dropped to just over 200 billion, and per-capita smoking rates had fallen by 75%.

There's little doubt that smoking rates will continue to decline. Restrictions on smoking continue to get tougher, with the age of consumption now 21, and excise taxes have forced sharp increases in cigarette prices in some states. Altria isn't fighting the decline of smoking. Its own vision statement is to "responsibly lead the transition of adult smokers to a smoke-free future."

In other words, it's betting on its core product to disappear, and it's been aggressive in diversifying away from cigarettes with multibillion-dollar investments in JUUL Labs and Cronos Group, though those have led to billions of dollars in losses. It's written down its investment in JUUL several times as the leading vape brand has faced a harsh crackdown from regulators, and Cronos is now worth about a quarter of what it was when Altria paid $1.8 billion for a 45% stake in the company. Philip Morris's IQOS heat-not-burn product, which Altria had also been banking on to help transition away from cigarettes, was taken off the U.S. market a year ago and has not yet returned.

With cigarette sales continuing to decline and Altria's attempts to diversify away from cigarettes having fallen flat, the business simply doesn't look sustainable over the long term. Eventually, the consumption decline will impact the bottom line.

Image source: Getty Images.

The best way to play Altria stock

Both of the above arguments can be true at the same time, depending on your time horizon. Altria is a reliable dividend payer and has demonstrated its ability to pass along price increases to customers. After all, cigarettes are an addictive product, so its dividend looks safe over at least the near term.

However, price increases have been shown to decrease cigarette consumption, especially among young people as teen smoking rates in the U.S. fell from near 23% in 2000 to just 2.3% in 2021.

Therefore, the long-term picture looks much murkier for Altria, and without a product to replace cigarettes, its revenue and profits will eventually peak as long as overall cigarette sales continue to decline.

If you're an income investor with a short time horizon, Altria looks like a reliable dividend stock, and its 9% yield is certain to be appealing. Better yet, the company is recession-proof, and rising interest rates will benefit stocks with strong current cash flows like Altria as opposed to unprofitable growth stocks since rising interest rates make distant profits worth less.

However, Altria isn't a stock you can set and forget, and it's likely a bad pick for investors with a longer-term horizon as regulators seem just as skeptical of vaping as they are of cigarettes, making the chances slim that Altria can achieve a highly profitable pivot away from cigarettes.

Despite the business's overall success, there's a reason why the stock price is down 50% over the last five years and its P/E ratio is in the single digits.