While shopping for stocks trading at a discount makes sense for people who subscribe to the "buy low, sell high" model of investing, it can actually be a risky strategy at times. Many businesses that are trading at cheap-looking valuations may be down for valid reasons. It's important to pay attention to what factors the market may be pricing into a company's shares.

However, with the S&P 500 Index in bear market territory, many high-quality stocks look attractive due to the increasing levels of fear about the direction of the economy. But in the wake of this year's sell-off, FedEx (FDX -0.44%), Old Dominion Freight Lines (ODFL 0.10%), and Lowe's (LOW -0.56%) look like great discounted options for long-term dividend investors.

FedEx: A well-covered dividend at a discounted price

Down nearly 40% year to date and off by more than 20% in the last month alone, shipping juggernaut FedEx has been under increased pressure since it delivered its fiscal 2023 first-quarter report.

For the period, which ended Aug. 31, FedEx reported year-over-year declines in volume of 11% and 3% from its Express and Ground operations, respectively, but it still grew revenue by 6%, thanks partly to higher fuel surcharges.

However, these surcharges did not keep pace with the weakening macroeconomic conditions and ballooning fuel costs facing FedEx. The company's earnings per share (EPS) dropped 19% from the prior-year period.

So what makes FedEx interesting right now?

First, despite the economic slowdown, the company's dividend, which at the current share price yields 2.4%, looks safe. And with its low payout ratio of 25%, management has ample room to grow that dividend.

Similarly, FedEx generated nearly $2.9 billion in free cash flow over the last 12 months while paying out roughly $900 million in dividends, so in terms of both earnings and cash generation, it easily covers its dividend. While investors will have to wait and see if the company will increase its payout again in fiscal 2023, there's no immediate reason to fear a dividend cut.

Second, while the company's price-to-earnings (P/E) ratio is historically volatile, based on its price-to-sales (P/S) ratio, it's trading at an attractive valuation.

FDX PS Ratio data by YCharts

Taking this low P/S, investors can look at the company's average profit margin over the same time and develop a less volatile P/E ratio.

FDX Profit Margin data by YCharts

By dividing FedEx's P/S of 0.433 by its average profit margin of 4.25% over the last 10 years, we can find that the company trades at only 10 times earnings should it continue generating these margins. Moreover, with CEO Raj Subramaniam expecting at least $2.2 billion in cost savings in 2023 ($1 billion of which will be permanent), FedEx looks poised to maintain this average profit margin.

Compared to the S&P 500 Index's median P/E of 22, the company's cost-cutting efforts, dividend strength, and ongoing turnaround look tempting at today's prices.

Old Dominion Freight Lines: A future Dividend Aristocrat

While less-than-truckload (LTL) freight carriers may not sound like the most exciting investment options, Old Dominion Freight Line's 1,300% total return over the last decade shows that such stocks can provide some thrilling results to your portfolio.

Old Dominion has become the best-in-class performer in its industry thanks to its 99% on-time delivery rate and its 0.1% cargo claims ratio. These impressive metrics have led to it receiving the Mastio Quality Award for No. 1 Shipper for 12 straight years. The company has positioned itself as the ever-reliable (and premium-priced) LTL option. Due to this premium offering, the company has posted annualized sales growth of 12% since 2002, well outpacing the broader LTL industry, which grew by just shy of 5% annually over that period.

Best yet for income-focused investors, Old Dominion began paying a dividend in 2017, which it has more than tripled since.

ODFL Dividends Paid (TTM) data by YCharts

Despite this rapid dividend growth, its payout ratio is a tiny 9%, while its yield of 0.41% is close to its all-time high.

ODFL Dividend Yield data by YCharts

While this yield may not sound like much, the company's willingness to continue boosting payouts rapidly and its small payout ratio give it excellent long-term dividend growth potential.

On top of that, Old Dominion trades at a P/E ratio of only 25, a level it has not seen since the stock market's March 2020 plunge.

ODFL PE Ratio data by YCharts

In the second quarter, the company's revenue and EPS grew by 26% and 43%, respectively, which indicates that this excellent operator should remain a fantastic holding for the long haul.

Lowe's: A discount on stability

Anytime the share price of a Dividend Aristocrat drops by more than 20%, it should catch investors' attention -- and that's precisely what has happened to Lowe's in 2022.

Its sales dropped slightly -- by just 0.3% -- in Q2, and the market continued to worry over the home-improvement retailer's operations. However, despite the top line being stagnant, Lowe's posted a 10% increase in EPS from the prior-year period.

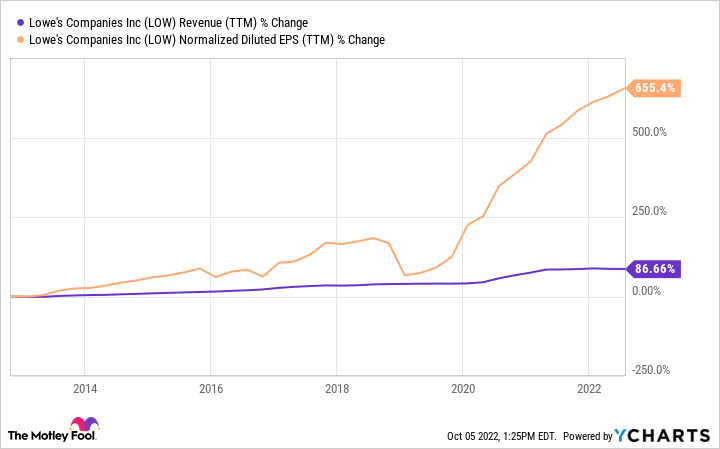

Notably, though its revenue only rose by 87% over the last decade, its EPS increased more than sevenfold over that time.

LOW Revenue (TTM) data by YCharts

While its slow and steady profit margin expansion juiced that EPS growth, Lowe's declining share count has also been a significant factor.

LOW Shares Outstanding data by YCharts

The company's methodical share repurchases have enabled it to continue posting earnings growth that has led to market-beating returns over the long haul. These buybacks and Lowe's 58-year streak of dividend increases have generated cash returns to shareholders that are rivaled by only a handful of companies.

Best yet, its dividend yield is above its 10-year average, so future payouts are available at a discounted price.

LOW Dividend Yield data by YCharts

Anytime a Dividend Aristocrat's yield moves above its recent averages, it highlights the potential for investors to benefit from a discounted passive income stream. That's especially appealing when the company in question is as stable as Lowe's.