The e-commerce space has been growing rapidly in recent years, and the pandemic accelerated the trend. However, there is still substantial room left for growth. According to some estimates, the market will be worth $17.53 trillion by 2030, registering a compound annual growth rate of 15.1% through then.

The opportunity is enormous, and while plenty of stocks are battling in this lucrative sector, several stand out. Let's look at three of them: Amazon (AMZN 1.30%), MercadoLibre (MELI 1.96%), and Etsy (ETSY 2.86%).

1. Amazon

Amazon leads the retail e-commerce segment in the U.S., with an estimated 37.8% share of the market as of June. That's well ahead of second-place Walmart, which held a 6.3% share.

Amazon's valuable brand name allows it to attract customers who often stay for the perks. The company offers free one-day or two-day shipping on thousands of items that are typically cheaper than what customers can find on other platforms. Amazon has ranked as the cheapest online retailer for five years in a row, according to a yearly study conducted by the research company Profitero.

Like many e-commerce specialists, Amazon benefits from the network effect as the value of its platform grows with more users. Online merchants seeking a broad customer base will gravitate toward the largest platforms, and Amazon is one of them. And as the number of merchants on its website increases, it attracts more customers.

Amazon will benefit from the increased adoption of e-commerce thanks to the solid lead it has already built. And those who invest in this company are getting more than just its e-commerce business. Amazon's high-margin cloud computing unit is firing on all cylinders. The company leads the cloud industry, too, a market that is on a solid growth trajectory.

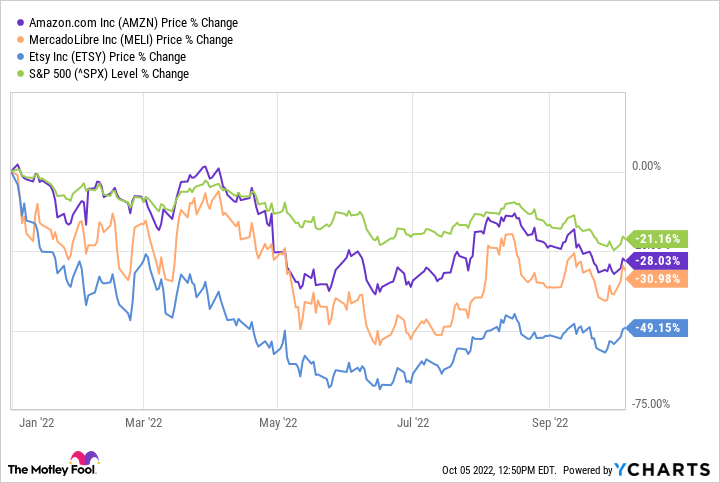

Amazon hasn't escaped the recent downturn unscathed. Its e-commerce unit has been hit particularly hard. But with a leadership in two major industries ripe for growth, the tech giant can turn things around and return to its market-beating ways, making it an excellent stock to buy and hold for a while, especially at current levels.

2. MercadoLibre

MercadoLibre has earned its nickname of "the Amazon of Latin America" by becoming the biggest player in e-commerce in the region. It leads all online marketplaces that operate in Latin America in terms of monthly visits. And just like the original Amazon, MercadoLibre also benefits from a network effect -- one major reason it should remain atop the pecking order where it operates.

Newcomers looking to challenge MercadoLibre will have to pour in substantial up-front investments. Offering perks such as one-day shipping requires building or acquiring the infrastructure necessary to do so in various countries. That takes both time and money. MercadoLibre has already done that -- and continues to do so.

Further, MercadoLibre offers an entire ecosystem of services. The company runs a fintech platform known as MercadoPago, a service that allows sellers to ship their orders throughout Latin America known as Mercado Envios, and Mercado Shops, which allows merchants to create online storefronts.

All these complimentary services allow MercadoLibre to offer merchants and sellers all they need to be successful, making it hard for them to jump ship. In other words, the tech giant also benefits from high switching costs. MercadoLibre will profit as e-commerce penetration increases in Latin America, where it is lower than in other countries, such as the U.S. and China.

The company has years of growth left ahead. Don't focus on the past year, during which it has struggled on the market.

3. Etsy

Etsy's business slightly differs from that of its competitors in that the company's platform primarily focuses on vintage and handmade goods. On the one hand, that can be seen as a bad thing, since the pool of items sold on the platform is much smaller than it otherwise would be -- only so many items are handmade.

However, Etsy's focus on this small niche is actually a strength. The company has become the go-to platform for buyers and sellers in this category, granting it a network effect with those interested in handmade items.

Etsy has suffered this year as revenue growth rates have dropped, a familiar story on Wall Street with companies that excelled during the early days of the pandemic. The good news is that Etsy still has plenty of white space within its target market. The company estimates a total addressable market of $2 trillion, of which it has grabbed a minuscule 2.6% market share.

Etsy isn't the only company in this space, and it won't be the only one profiting from this large, growing market. However, it is one of the most important players in it, and thanks to the competitive edge it has built, it is well-positioned to make steady progress as it grows its revenue and earnings. Etsy's stock price will follow suit.