What happened

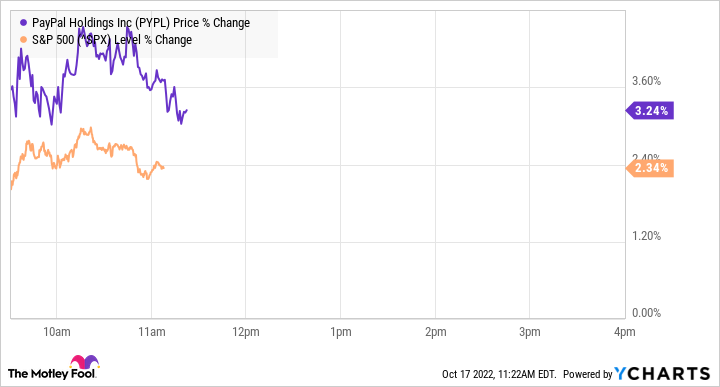

Shares of PayPal Holdings (PYPL 1.41%) were up 4% at 10:41 a.m. ET on Monday, outpacing the S&P 500 index. The stock got a boost as investors digested a strong earnings report from Bank of America. PayPal also announced PayPal Rewards, a new app feature that combines cash-back rewards and merchant offers in a single shopping experience.

Slowing growth and increasing competition from Apple have contributed to PayPal's 73% decline since reaching an all-time high in 2021. Can it claw its way back?

So what

PayPal says the rewards feature is designed to help consumers save money this holiday season, which could be useful to its 429 million active accounts during a time of high inflation. But the announcement is also a response to Apple Pay, which continues to take market share in transaction value from Mastercard and Visa.

Apple has a massive built-in base of users, and it has been applying more pressure to PayPal with new features this year. Last week, Apple unveiled a new high-yield savings account coming to Apple Card users in the next few months. Earlier this year, Apple also launched a Pay Later option.

Meanwhile, PayPal has seen active account growth slow to 6% in the second quarter, down from 16% in the same quarter in 2021.

Now what

The market remains bullish on PayPal, despite the fall in stock price this year. Analysts expect the payments provider to post 10% growth in revenue for the full year before accelerating to 14% next year. The stock trades at a forward price-to-earnings ratio of 21.2 on top of a five-year earnings growth estimate of about 13% annualized.

Competition may have contributed to PayPal's lower growth, but it still has a large base of active users. This is reflected in the 12% increase in transactions per account last quarter.

There are still healthy indicators that suggest PayPal is still a force to reckon with, which explains why the stock is rising as part of a broader market rally today.