Latin America's fintech environment differs significantly from that of the U.S. That part of the world is primarily a cash-based society, and large portions of the population hold neither a bank account nor a credit card. Hence, bringing these consumers into a fintech ecosystem requires a different approach.

A few fintech companies are making strong efforts to develop the right approach and potentially benefit from a large, mostly untapped market. Their efforts caught the attention of famed investor Warren Buffett and his Berkshire Hathaway holding company. Buffett's liked what he's seen so far and (through Berkshire) made investments in Stoneco (STNE 0.32%) and Nu Holdings (NU -1.37%).

Given both companies' strong growth potential, both Buffett and the investors who follow him are exercising some patience in the hopes of earning considerable gains. Let's take a closer look at these two potential superchargers and see if it's worth following Buffett's lead.

1. Stoneco

Stoneco operates in Latin America's largest market, Brazil. It provides technology solutions for small and medium-sized businesses (SMEs) in the South American country.

Stoneco offers and integrates different solutions that handle payments, e-commerce, and sales management tools. However, its customer service stands out in Brazil's competitive fintech market. It prides itself on a "no bureaucracy" approach. This can bring customer service personnel close to customers, and those reps have the autonomy to resolve client issues quickly.

Stoneco's business model attracted Berkshire to buy 14.2 million shares before its IPO in late 2018. Buffett's team sold about 3.5 million shares in the first quarter of 2021 when the stock was trading near its peak. That ended up being a wise move. Headwinds such as COVID-19, rising inflation, a presidential election, and changes in policy from Brazil's central bank hammered Stoneco's loan portfolio and slowed its sales growth for a time. Consequently, Stoneco's stock price has fallen nearly 90% from its early 2021 high.

Stoneco has since recovered somewhat and revenue for the first half of 2022 of 4.4 billion reais ($830 million) was up 195% compared with the same period in 2021. Adjusted net income increased by 302% to 128 million reais ($24 million) during that period. Analysts forecast 90% revenue growth for the year, which should serve as a tailwind for the fintech stock.

Moreover, Stoneco's price-to-sales (P/S) ratio of 2 is near an all-time low. That could be partially indicative of the political and economic uncertainty that remains in its home country. But considering its growth, Stoneco stock likely prices in its challenges.

2. Nu Holdings

Nu Holdings operates a fintech-oriented bank, NuBank. It seeks to leverage technology and groundbreaking business practices to offer financial solutions to both individuals and small to medium-sized businesses.

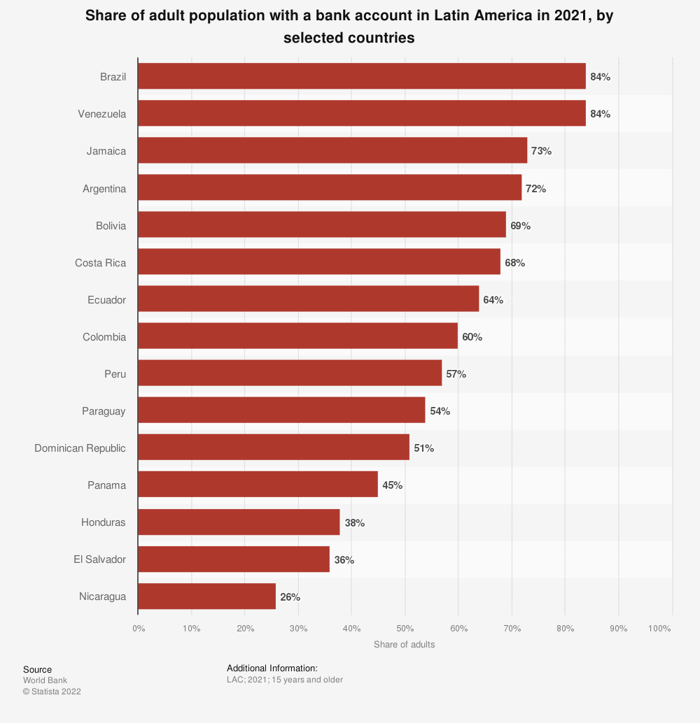

This is important because, in Latin America, a few banks have traditionally dominated the industry. That situation left much of Latin America's population unbanked. Now, thanks to Nu Holdings, citizens and small businesses previously frozen out of the banking system now have access to bank accounts and credit cards.

Data source: World Bank.

NuBank's approach helped the client base grow to more than 70 million customers spread across Brazil, Mexico, and Colombia. More than 5 million of those customers received their first credit card or bank account through NuBank.

Like Stoneco, Buffett invested in this company before its IPO (this one in December 2021), buying more than 107 million shares of the Brazilian bank. Admittedly, Buffett is likely exercising patience on this one, as the stock price has fallen by about two-thirds since peaking soon after its IPO, a factor that seems to contradict at least one of the vital rules Warren Buffett follows.

Despite that decline, revenue for the first two quarters of 2022 came in at just over $2 billion, 250% higher than the same period in 2021. And though losses appear modest, rising expenses and taxes meant losses rose 16% to $75 million for the period.

But Nu's P/S ratio, which now stands at 10, is an 80% discount to its sales multiple at the time of the IPO. Considering the valuation and the transformative potential of Nu Holdings, one can see why Buffett's team took an interest.